Menu

Forum Search

GSTR-1 Last date extended

Narendra Prasad

Link to the orginial notification: https://www.cbec.gov.in/htdocs-cbec/gst/notfctn-71-central-tax-english.pdf

[To be published in the Gazette of India, Extraordinary, Part-II, Section 3, Sub-section(i)]

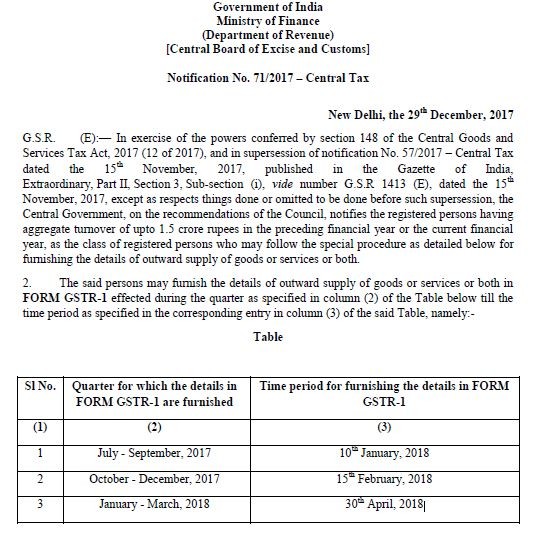

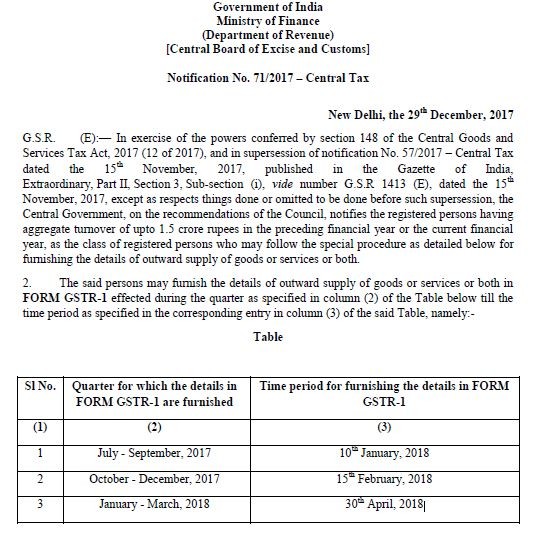

Government of India

Ministry of Finance

(Department of Revenue)

[Central Board of Excise and Customs]

Notification No. 71/2017–Central Tax

New Delhi, the 29th December 2017

G.S.R. (E):— In exercise of the powers conferred by section 148 of the Central Goods and Services Tax Act, 2017 (12 of 2017), and in super session of notification No. 57/2017– Central Tax dated the 15th November, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section(i), vide number G.S.R 1413(E), dated the 15th November,2017, except as respects things done or omitted to be done before such super session the Central Government, on the recommendations of the Council, notifies the registered persons having aggregate turnover of upto 1.5 crore rupees in the preceding financial year or the current financial year, as the class of registered persons who shall follow the special procedure as detailed below for furnishing the details of outward supply of goods or services or both.

2. The said persons may furnish the details of outward supply of goods or services or both in FORM GSTR-1 effected during the quarter as specified in column (2) of the Table below till the time period as specified in the corresponding entry in column (3) of the said Table, namely:-

Table

| Sl No. | Quarter for which the details in FORM GSTR-1 are furnished | Time period for furnishing the details in FORM GSTR-1 |

| (1) | (2) | (3) |

| 1 | July- September, 2017 | 10th January, 2018 |

| 2 | October- December, 2017 | 15th February, 2018 |

| 3 | January- March, 2018 | 30th April, 2018 |

3. The special procedure or extension of the time limit for furnishing the details or return, as the case may be, under sub-section(2) of section 38 and sub-section (1) of section 39 of the Act, for the months of July,2017 to March, 2018 shall be subsequently notified in the Official Gazette.

[F.No.349/58/2017-GST(Pt.)]

(Dr. Sreeparvathy S.L.)

Under Secretary to the Government of India

Rahul K Dey

Second is also available.

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

(Department of Revenue)

[Central Board of Excise and Customs]

Notification No. 72/2017-Central Tax

New Delhi, the 29th December, 2017

G.S.R. (E):- In exercise of the powers conferred by the second proviso to sub-section (1) of section 37 read with section 168 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereinafter in this notification referred to as the Act) and in super session of notification No. 58/2017-Central Tax dated the 15th November, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), videnumber G.S.R 1414 (E), dated the 15th November, 2017, except as respects things done or omitted to be done before such super session, the Commissioner, on the recommendations of the Council, hereby extends the time limit for furnishing the details of outward supplies in FORM GSTR-1 under sub-section (1) of section 37 of the Act for the months as specified in column (2) of the Table, by such class of registered persons having aggregate turnover of more than 1.5 crore rupees in the preceding financial year or the current financial year, till the time period as specified in the corresponding entry in column (3) of the said Table, namely:-

Table

| SI No. | Months for which the details in FORM GSTR-1 are furnished | Time period for furnishing the details in FORM GSTR-1 |

| (1) | (2) | (3) |

| 1 | July- November, 2017 | 10th January, 2018 |

| 2 | December, 2017 | 10th February, 2018 |

| 3 | January, 2018 | 10th March, 2018 |

| 4 | February, 2018 | 10th April, 2018 |

| 5 | March, 2018 | 10th May, 2018 |

2. The extension of the time limit for furnishing the details or return, as the case may be, under sub-section (2) of section 38 and sub-section (1) of section 39 of the Act, for the months of July, 2017 to March, 2018 shall be subsequently notified in the Official Gazette.

[F. No. 349/58/2017-GST(Pt.)]

(Dr.Sreeparvathy S.L.)

Under Secretary to the Government of India

Second is also available.

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

(Department of Revenue)

[Central Board of Excise and Customs]

Notification No. 72/2017-Central Tax

New Delhi, the 29th December, 2017

G.S.R. (E):- In exercise of the powers conferred by the second proviso to sub-section (1) of section 37 read with section 168 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereinafter in this notification referred to as the Act) and in super session of notification No. 58/2017-Central Tax dated the 15th November, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), videnumber G.S.R 1414 (E), dated the 15th November, 2017, except as respects things done or omitted to be done before such super session, the Commissioner, on the recommendations of the Council, hereby extends the time limit for furnishing the details of outward supplies in FORM GSTR-1 under sub-section (1) of section 37 of the Act for the months as specified in column (2) of the Table, by such class of registered persons having aggregate turnover of more than 1.5 crore rupees in the preceding financial year or the current financial year, till the time period as specified in the corresponding entry in column (3) of the said Table, namely:-

Table

| SI No. | Months for which the details in FORM GSTR-1 are furnished | Time period for furnishing the details in FORM GSTR-1 |

| (1) | (2) | (3) |

| 1 | July- November, 2017 | 10th January, 2018 |

| 2 | December, 2017 | 10th February, 2018 |

| 3 | January, 2018 | 10th March, 2018 |

| 4 | February, 2018 | 10th April, 2018 |

| 5 | March, 2018 | 10th May, 2018 |

2. The extension of the time limit for furnishing the details or return, as the case may be, under sub-section (2) of section 38 and sub-section (1) of section 39 of the Act, for the months of July, 2017 to March, 2018 shall be subsequently notified in the Official Gazette.

[F. No. 349/58/2017-GST(Pt.)]

(Dr.Sreeparvathy S.L.)

Under Secretary to the Government of India

Sandip Verma

Shreepad Joshi

GSTR 1 Press release by CBEC link "https://cbec.gov.in/htdocs-cbec/press-release/press-release-new"

Quarterly return for registered persons with aggregate turnover up to Rs. 1.50 crores

GSTR-1 (Jul-Sep, 2017) - Jan 10th, 2018

GSTR-1 (Oct-Dec, 2017) - Feb 15th, 2018

Monthly return for registered persons with aggregate turnover of more than Rs. 1.50 crores

GSTR-1 (Jul-Nov, 2017) - Jan 10th, 2018

GSTR-1 (Dec, 2017) - Feb 10th, 2018

Leave a Reply

Your are not logged in . Please login to post replies

Click here to Login / Register

Recent Threads

- Transfer of equity shares to original owner

- Login credentials and payment acknowledgement not

- Export sales not realised payment not received fro

- Capital gain account amount utilisation

- Form 26QB – Section 194-IA: TDS on Full Cons

- Indexation Benefit available or not on Calculation

- Documents for return exhibition material

- Can I set off equity losses(both short term loss a

- Input tax credit on rent to rent

- Family Pension Army

Related Threads

CAclubindia

CAclubindia