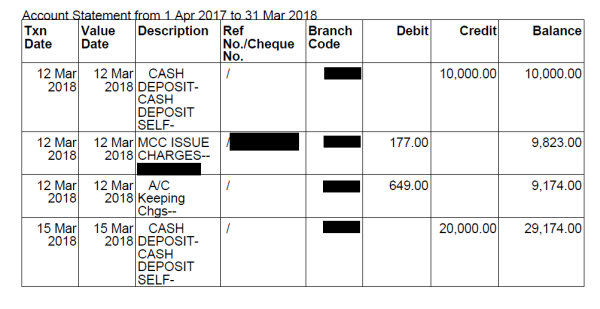

I incorporated LLp in December 2017 and open bank account in march 2018. CA filed ITR 4 for my LLP (FY 2017-18) NIL RETURN. Filing ITR 4 for LLP is correct? or ITR 5 should file. Bank statement attached. Please help.

Partners Contribution - 10,000

Loan from A Partner - 20,000

CA filed NIL Return all information 0 NIL in ITR 4, is it correct?

Thanks for Help.

CAclubindia

CAclubindia