CA Dip IFR (ACCA UK)

3229 Points

Joined June 2009

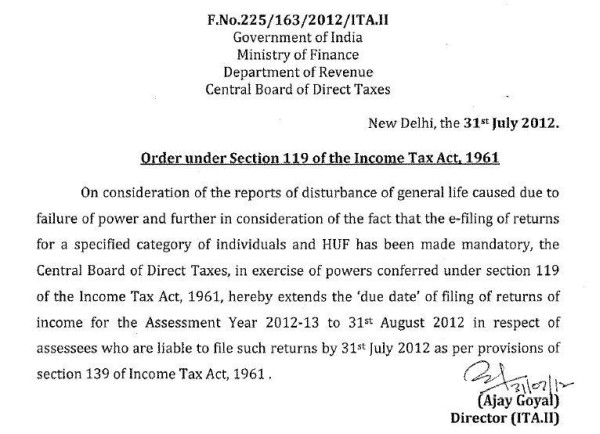

CBDT’s Press Release On Extension Of Due Date Of Filing Of ROI

The CBDT has issued the follwoing Press Release dated 01.08.2012

PRESS RELEASE [No. 402/92/2006-MC (20 of 2012)], dated 1-8-2012

A section of Media has reported that the Central Board of Direct Taxes has extended ‘due date’ of filing of returns to 31st August, 2012 in respect of only those returns which were to be e-filed by 31st July, 2012. It is clarified that the notification issued by the Board on 31st July, 2012 has extended the ‘due date’ of filing of all returns for the Assessment Year 2012-13 which were due to be filed by 31st July, 2012 to 31st August, 2012.

CAclubindia

CAclubindia