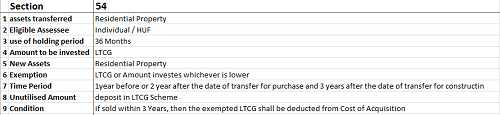

If a person sells his house to buy a new appartment as a residential property and the dealer promises to hand over the possession after 4 year (being the construction period), can the assessee avail exemtption u/s 54 (sal of one residential property to purchase another one and investing the total proceeds along with capital gain therein).?

Menu

Exemption u/s 54

Replies (2)

Recent Threads

- GST on business receipts pre -registration

- A Restaurant registered under the Composition Sche

- GST RATE OF OUT DOOR CATERING

- Non resident taxation & income tax in India

- GST Rate for oral Hygiene Combo Pack

- GST registration - Address error

- TDS on property pu

- Import of goods IMS action related

- Incometax Survey - Updated Return Filing after the

- TCS under 206C(1F)

Related Threads

CAclubindia

CAclubindia