I had filed my last GSTR 3B on 31st Oct . due date was 25th Oct .

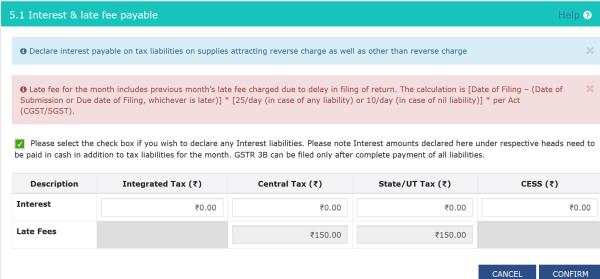

when I wanted to file GSTR-3B for current tax period , it is showing Rs.150 as late fee . total 300 rupees.

How this is calculated ? how they get figure Rs.150 as late fee charge ?

I do not have any intra state supply , I only file one invoice i.e a Interstate supply to a registered person.

CAclubindia

CAclubindia