Chartered Accountant

1375 Points

Joined August 2012

Hey...

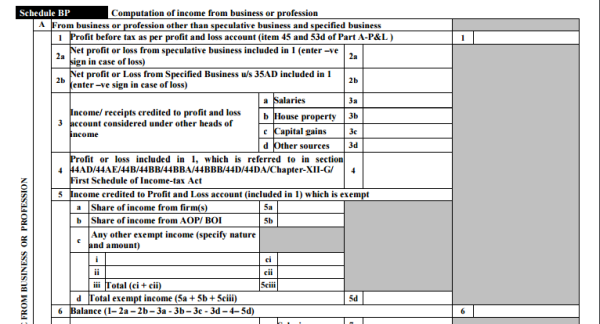

Firstly, In the schedule BP, maybe the 'Interest from PPF' has been shown under clause 3. This has to come under Clause 5(c) and parallely under Schedule EI.

Secondly, cross-check the figures deducted under clause 3 & 5 in Schedule BP with those shown under the respective heads. If the amount shown in the respective heads are lesser than the figures shown under Sch. BP, in some instances, it might be treated as defective.