Hello,

I have been filing GST Returns for Few Months and I have this Doubt.

There is a seperate Table for "Nil Rated, Exempted and Non-GST Supplies",

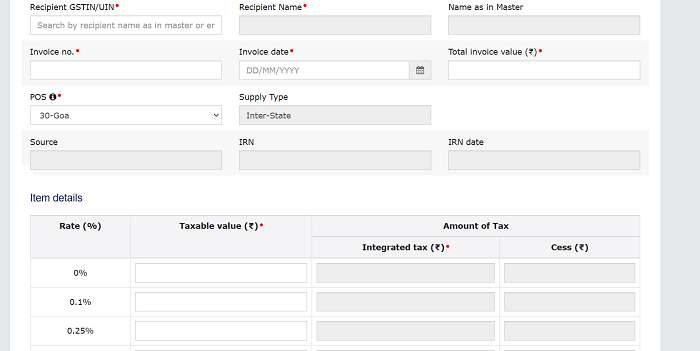

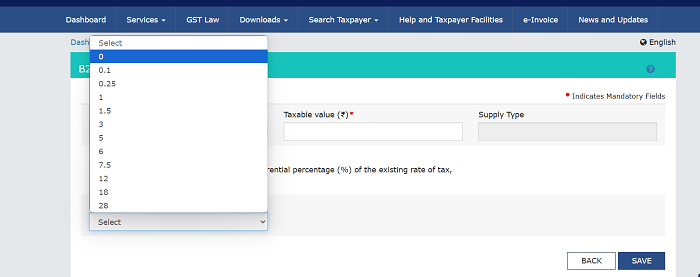

In the Table

1)"4A, 4B, 6B, 6C - B2B, SEZ, DE Invoices" And

2) "7 - B2C (Others)"

There is an option for entering 0% Sales.

In Which Situvation we will fill this coloumn,

Why they are providing this when we have seperate table for "Nil Rated, Exempted and Non-GST Supplies".

In "4A, 4B, 6B, 6C - B2B, SEZ, DE Invoices" Table.

In "7 - B2C (Others)" Table.

CAclubindia

CAclubindia