Tata companies keep the employee's PF in the Tata Provident Fund instead of keeping it in the EPFO.

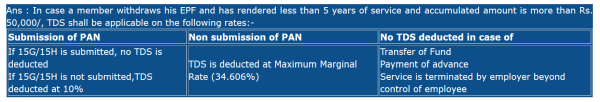

So if an employee works at a Tata company (company 1) for 6.9 years, resigns to join another non-Tata company (company 2), where company 2 creates a new account for her at the EPFO and are having difficulty transferring the PF from Tata Provident Fund to the new account and even after 1.5 years of trying they are unable to transfer it, and then if the employee resigns from company 2 and chooses to withdraw the entire amount from her Tata Provident Fund to fund her education, and company 1 agrees and transfers the entire amount to the employee's bank account, then is the amount exempt from tax?

The employee uses part of the amount to fund her education and the remaining is invested in debt funds and tax saving funds.

CAclubindia

CAclubindia