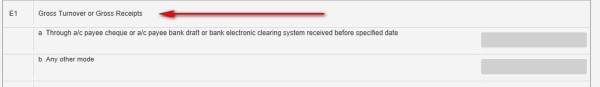

When calculating total gross turnover income do we have to deduct the non taxable income (250000) from the total or should we show the complete income without deducting the non taxable income?

For example

gross turnover income - non taxable income = total income

400000 - 250000 = 150000 (total taxable income after reduction )

Or should i show complete 400000 in itr 4?

Also when i tried the calculation in the itr form it was deducting 250000 from the taxable total income field and then showing the tax payable amount.

So do i have to deduct the non taxable income ( 250000 ) when calculation the total or the software will do it afterwards?

CAclubindia

CAclubindia