Hi CA Experts

I am trying to file tax returns online, but I got stuck at the Taxes Paid and Verification tab.

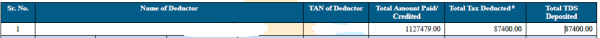

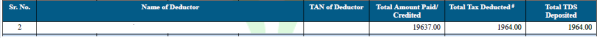

Below image contains my Deductors summary as in Form 26-AS

Deductor 1 (Employer)

Deductor 2 (A Bank)

From the above summary I think the total TDS deducted for me in this FY 2018-19 = 87400 + 1964 = 89364

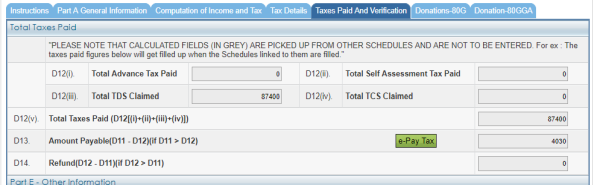

But, while I am at the tab Taxes Paid and Verification tab it shows the total TDS claimed as only 87400 as shown in the below image.

The Bank TDS is not updated I think.

Please correct me if I am wrong, What should I do now if there is discrepancy? How to proceed?

CAclubindia

CAclubindia