please help what to fill in tabs given for reason of disagrrement in the picture enclosed.

ihave income from salary in form 16 and interest from bank form 16a.

please help what to fill in tabs given for reason of disagrrement in the picture enclosed.

ihave income from salary in form 16 and interest from bank form 16a.

I called CPC helpline as well as e-filling helpline and both gave same response that no need to reply to intimation 143(1)(a) till any further notice come to your registered email id.CPC is re-evaluating the return and if they find any discrepancy then new intimation will be send. They didn't provided any time line for new notice nor did they provided any response if both positive or negative finding during reassesment will be shared and that too withing 30 days. In summary just igonre the intimation till you get any new intimation.

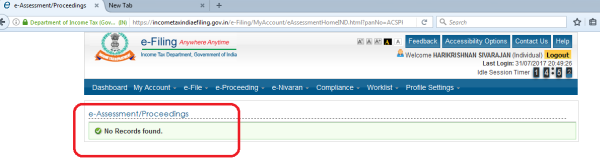

The link under "eAssesment/Proceeding" has been activated quoting the same value in the 143(1)a notice. The values are not matching with my Form 16. I called the helpline and asked about the source of values. They said that we should not suppose to take any action and will be notified again through email. I insisted that 31st is the last date and my eAssessment link is activated and if any additional amount to be paid in that I will have to pay the penality but still they said that don't take any action.

Please update if anyone of you got the same answer after activation of eAssessment link.

Hi Rajesh/Osden,

Even I got the same response from CPC helpline. They said they are verifying it and I do not need to take any action till further notice. When I pushed for detailed understanding, he told that if you know the cause of difference in numbers, or if you have a correction in income, you can file revised return. We will verify that return instead of original one.

I am also got that message. But "E-Proceeding" section is not enabled/visible.

Please see the image. Anyone have any idea?

Hello friends,

Thanks a lot for useful advice on the notice. I will continue to wait for a few days (say a week) till I receive further communication from IT else I will have to file a revised return.

Can someone throw light on the below queries:

My apologies if my queries are too basic as I am not CA but I have learnt a few things by filing my own return since last 6 years.

Thanks in advance!

Manoj

I have contributed to Armed Forces Flag Day Fund via Cheque. Now that I have received "Communication u/s 143(1)(a)" from Income tax. When I try to disagree with e-proceeding, it is asking for TAN no. I tried to contact Kendriya Saink Board authority body for requesting TAN No. of Armed Forces Flag Day Fund (AFFDF); didnt get any response. Any ways I could get the TAN No? or is TAN no. really nesscesary?

| Originally posted by : Francis | ||

|

I have contributed to Armed Forces Flag Day Fund via Cheque. Now that I have received "Communication u/s 143(1)(a)" from Income tax. When I try to disagree with e-proceeding, it is asking for TAN no. I tried to contact Kendriya Saink Board authority body for requesting TAN No. of Armed Forces Flag Day Fund (AFFDF); didnt get any response. Any ways I could get the TAN No? or is TAN no. really nesscesary? |

|

TAN no is not required or is irrrelevant in this case. Simply attach copy of receipt, showing your contribution.

I have a mismatch of Rs 10000 because deduction under 80TTA is not considered by CPC. I tried today to disagree selecting the option "Deductions claimed in the return but not in Form 16" with an explanation, but it is asking for TAN. I received the communication from CPC on 23rd July. No second communication yet. Frustrating ![]() .

.

Could now see TAN No. is mandatory to Disagree with e-proceedings. Also I dont have the receipt of contribution. Would my account statement showing credited amount to AFFDF be suffice?

without TAN you cannot submit response.it is mandatory. if you are a salaried person quote TAN of employer and fill relevent fields as per your form 16

Your are not logged in . Please login to post replies

Click here to Login / Register

CAclubindia

CAclubindia

India's largest network for

finance professionals