Hi,

I work for a private firm and my total annual income (with out any deduction or excemption) is 8.32 Lacs.

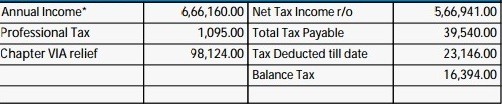

Below is my 'Projected Annual Tax Information'

* Annual Income in below Table is after considering all exemption.

So the total tax payable is 39,540/-Year after considering all excemption.

Below are my current investment details

1. 63, 200 = 53,000(LIC)+ 10,200 (Payroll) in 80C

2.19,780 in 80D

So my questions are below

1) How can I legally avoid paying above tax projected?

2) I know I'm eligible for an investment of another 86,800 (1,50,000 - 63, 200) as per 80C. Can anyone suggest me the best investment options available here?

I'm paying almost 36,000 as income tax since last 3 years.So desperately looking for a solution :-(

CAclubindia

CAclubindia