How to score good marks in Indirect Taxes—5 Simple Pointers to success

%20(Custom).jpg)

Pointer 1: Choose a good reference book

Obviously, many students have expressed dissatisfaction on the standard of ICAI study material. There is some truth to it because most of the content needs updating and also user-friendliness. The soporific effect (sleep-inducing) which this study material is capable of doing unless the student is really Gung-ho about it, is unparalleled by even the best sedatives your Medical doctor might advice you!

So, an arduous task now comes for selection of a proper book.

V.S.Datey takes the cake here for being the best and most comprehensive book on this subject. This is again a Taxmann’s publication. The subject has been very professionally presented and thus is a pleasure to read. However, this is similar to V.K.Singhania book for Direct Taxes and thus quite Voluminous. Some students debate the merits of studying this book vis-à-vis time availability (rather paucity).

So, ENTER à: Guides and other easy to read books.

I would suggest here Bangar as the next best book which can be safely relied upon (but for a few printing errors here and there and an occasional conceptual blooper).The student is advised to study this book thoroughly (cover-to-cover if possible) along with the Compiler which they publish (Aadhya’s publications)

There are other books (when I say books, I use the authors’ names to appellate the books) too like Ajay Jain, N.S.Govindan, Vaitheeswaran, etc which can be replied upon. The list I have given is just Illustrative.

Since ICAI compiler is not good (as it is not updated. If something is not updated in Indirect taxes, it is mere claptrap the student studies and would definitely be ‘missing the bus’ in the exam).

One good reference book with the Bare Acts and Compiler would do for this subject. One need not break one’s head on this aspect. Any book is fine. Students seem to waste half the time in even deciding which book to study. So much of choice exist these days that it becomes a despondent state of affairs for an average student to decide which book to follow. One should note one thing here: MANY STUDENTS HAVE CLEARED BY FOLLOWING JUST ONE BOOK MENTIONED ABOVE. So, the moment one fails, one should not shift the blame to the author or the book but one must review what one has done and where one needs improvement. Else, it just betrays an escapist attitude on the part of a student. Always the other side of the road looks good. So, it seems some students have easily passed with yet another book. One must try to resist these useless feelings.

Ultimately, the power lies within you, not the printed papyrus which you hold as a book!

Pointer 2: ABCD analysis.

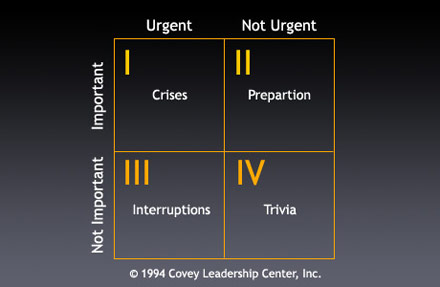

ABCD analysis(also called ABC analysis) means to divide the subject into 4 objective quadrants and prioritize and study as per importance of chapters(vis-a-vis the relevant attempt). Naive students who over-enthusiastically say (but secretly follow their plan within the 4 walls!) that such an ABCD analysis will not work, are actually highly erroneous and need some reality-check!

Trends exist for any exam in this world. And trends do exist even for CA.

So, this is an exercise in time-management and not an excuse for not studying some chapters. One must study all chapters but one must know which areas are important. For this subject too one can do an ABCD analysis and chalk out a systematic plan to work it out.

Pointer 3: Revision

Revision of this subject is of utmost importance. Revision for this subject would mean 3 times minimum to be able to write well in the exam. Anything below this number is taking a chance. Some say, “I can clear this subject by just reading once”. I have no arguments with such over-confident blubbers or Me-too-Einstein-types. I’m talking of people who are of average intelligence and who have the capacity and the inclination to work hard

Revision makes this subject really very easy! This subject can get you high marks in the exam. Many students even clear Gr-2 or the whole CA exam with this single subject. So keep this in the front of your mind (not back!) when you read this subject.

If ICAI wants to screw students it can do so even in this subject (apart from Strategic Management/MAFA)but for some strange reason, it is giving some concession here. Except for a few attempts this subject has been fairly an easy one to answer for a well prepared student and well-preparedness includes a good revision plan.

Pointer 4: Case Laws

I’m not going to harp on conceptual understanding for this subject. This goes without saying that conceptual understanding is necessary for any legal subject (see my article “5 Tenets for Direct Taxes preparation”) but I would definitely say that Case laws are important for this exam. Some feel that one need not quote case-laws or the like. But I would not side with them. The examiner would be mighty pleased if he sees relevant Case-laws quoted in the exam with a good presentation, of course.

In fact, most of the nascent law has been moulded into the current Act with a lot of legal Cases galore! Many concepts were revealed and closed, omitted and recommitted, inserted and amended, explained and done away with mainly from these Legal cases.

In fact, when this subject is taken like a fun-puzzle to solve with the Cases, it takes an interesting turn to learn the subject well.

Pointer 5: Prepare for the exam!

Yes, this advice sounds childish. But I beg to differ. Many students I see seem to prepare for fighting cases in courts! They dig too deep!

Man, you need to give me a break here!

You are still a student, so read like one, oriented for clearing the exams(Act smart here only at your peril). Get basic concepts ok. Do not fear or fret that one is going to be tested too deep in this subject. You have 2 major Acts, not to mention Service Tax and VAT. There are more chapters to cover and this has to be done fast but steadily.

Once the 3 minimum revision rule (mentioned above) is adhered. Then one can go easy and dig a little deeper for certain issues, check the legal intent behind the Act, question the whys and wherefores of Indirect Taxes.

So, there you go, I have given you all 5 simple pointers for this subject renegading any other hubris on this subject to the backseat.

Too much of anything is bad (“ Mitham Hitham” they say in Sanskrit) and this applies for advices too.

I don’t normally go beyond 7 or 8 tips for any subject and normally restrict myself to just 5 tips. Rest is all just embellishment and fluff narrated by some smart dudes around! I just go to the core and give you the pith of the matter, time being a scarce commodity for both you and me.

Best Wishes,

Mythreya

(Originally posted in articles section: https://www.caclubindia.com/articles/how-to-score-good-marks-in-indirect-taxes-5-simple-pointers--4461.asp )

CAclubindia

CAclubindia