Chartered Accountant

1572 Points

Joined August 2008

Invoicing forms a crucial function when it comes to the execution of a transaction. The invoice becomes a basic document for recording the sale/purchase in books of accounts.

The government has notified rules of invoicing under GST along with a template of invoice(GST INV-01) covering the elements such as supplier’s details, GST tax rates etc that need to be presented. Let us understand these in detail.

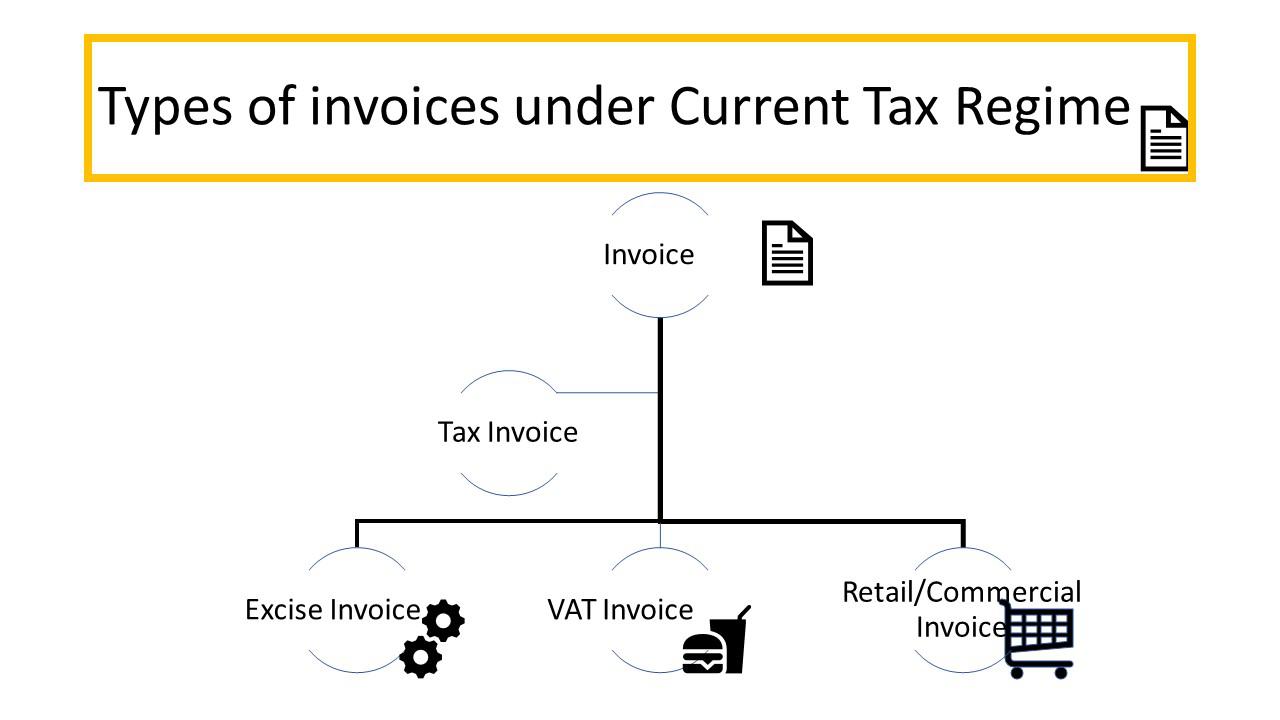

Invoicing in the current tax regime

In the current tax regime, two types of invoices are issued:

1. Tax Invoice:

1. Tax Invoice:

This invoice is issued to registered dealers. It includes particulars of the product, details about the supplier (TIN) & the recipient along with tax charged. A registered purchaser can use this to claim tax credit called as input tax credit.

a. Excise Invoice(as per Rule 11 of Central Exercise)

The excise invoice is signed by the owner of the factory (where it is manufactured) or his authorized agent. This invoice is issued to highlight all the particulars of goods along with details of duty paid to let the recipient know how much tax has been charged and how much CENVAT input he can claim on the purchase of the goods.

b. Vat Invoice

The VAT invoice is issued by registered VAT dealers in the manner as prescribed by the State Vat laws of the respective state of the supplier. Eg. for a dealer doing business in Maharashtra, he will be required to quote his VAT TIN no.(Tax Identification Number under MVAT)/ CST no.

2. Retail or commercial invoice

This is issued to an unregistered dealer or retail customer. The VAT charged in the bill is shown separately but as it is issued to the ultimate consumer who has the final liability to pay the tax, tax credit is not to be passed on and hence tax credit can’t be claimed on this invoice.

Invoicing under GST

In the GST regime, two types of invoices will be issued:

-

Tax invoice

-

Bill of supply

1. Tax Invoice

When a registered taxable person supplies taxable goods or services, a tax invoice is issued. Based on the rules regarding details required in a tax invoice, a sample tax invoice has been shown below.

The new Format for Invoices to be issued for supply of goods under GST

2. Bill of Supply

Tax invoice is generally issued to charge the tax and pass on the credit. In GST there are some instances where the supplier is not allowed to charge any tax and hence a Tax invoice can’t be issued instead another document called Bill of Supply is issued.

Cases where a registered supplier needs to issue bill of supply:

- Supply of exempted goods or services

- Supplier is paying tax under composition scheme

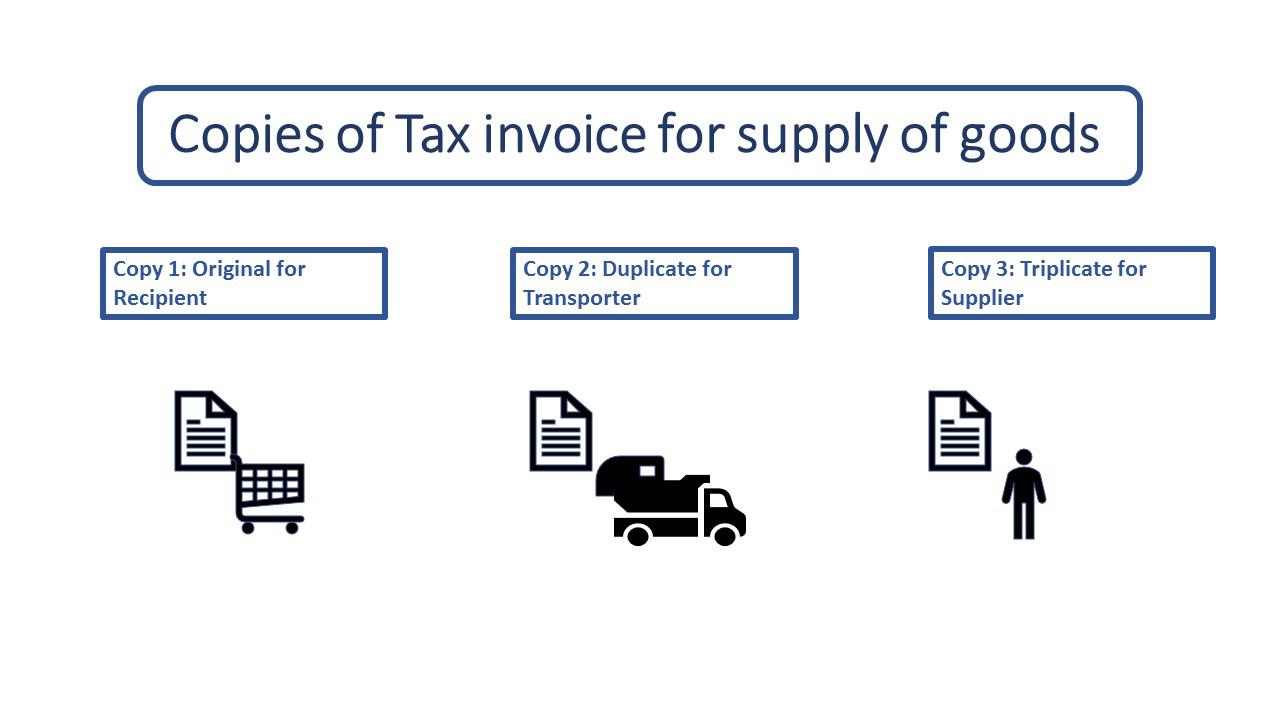

How many copies of Tax Invoices are to be issued?

When goods are supplied, the supplier is required to issue three copies of the invoice– Original, Duplicate, and Triplicate.

Original invoice: When a buyer makes the purchase he gets the first copy of invoice, marked as ‘Original for recipient’.

Duplicate copy: The duplicate copy is issued to the transporter( carrier of goods) to present as evidence as and when required, and is marked as ‘Duplicate for transporter’. The transporter doesn’t need to carry the invoice if the supplier has obtained an invoice reference number.

Note: How to generate “Invoice Reference Number”?

The supplier can obtain an Invoice reference number from the common portal (GSTN) by uploading a tax invoice issued by him. The invoice reference number will be valid for 30 days from the date of uploading.

Triplicate copy: This copy is retained by the supplier for his own record.