Menu

Computation of salary income received outside india

Hi,

I need help on salary income received outside India. Assessee went outside India in September 2014 and started receiving income in foreign currency from november 2014 till June 2016.

1. Whether ITR need to file for FY 2015-16.

2. How we will compute income in case of below particulars of foreign salary:

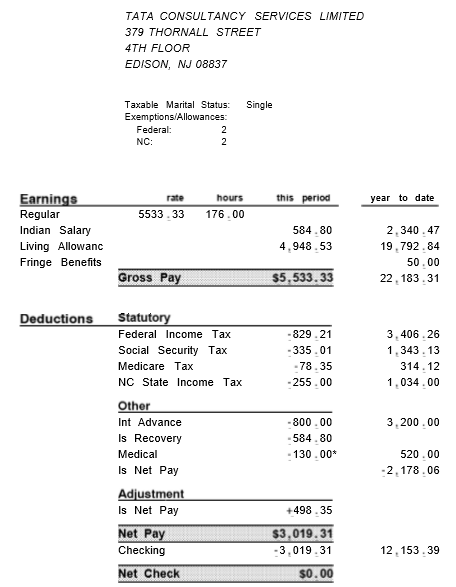

Gross Pay

Deduction statutory

Federal Income Tax

Social Security Tax

Medicare Tax

NC State Income Tax

Other

Int Advance

Is Recovery

Adjustment in net pay

Net pay

Replies (4)

Recent Threads

- Form 26QB – Section 194-IA: TDS on Full Cons

- Indexation Benefit available or not on Calculation

- Documents for return exhibition material

- Can I set off equity losses(both short term loss a

- Input tax credit on rent to rent

- Family Pension Army

- Waste Management services

- Seeking Clarity: New Transport Allowance Limits (D

- Query regarding Consolidated Gift Deed for Bank Tr

- TDS u/s194IB - Joint Ownership

Related Threads

CAclubindia

CAclubindia