Hi CA Experts

I have filed income tax online for FY 2016-17, AY 2017-18. Yesterday, I have received a notice from Income tax.

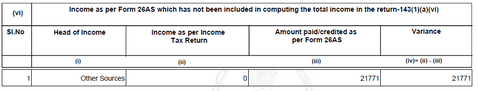

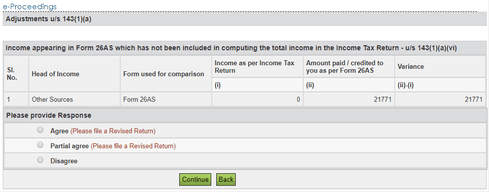

Below is the screenshot from the notice.

Income as per Form 26AS which has not been included in computing the total income in the return-143(1)(a)(vi)

I tried to cross check with what I have submitted while filing. Below is the Detailed info with screenshots.

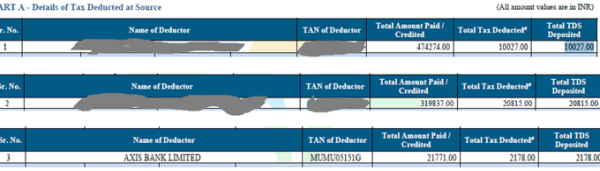

Here is the details of my FORM 26AS

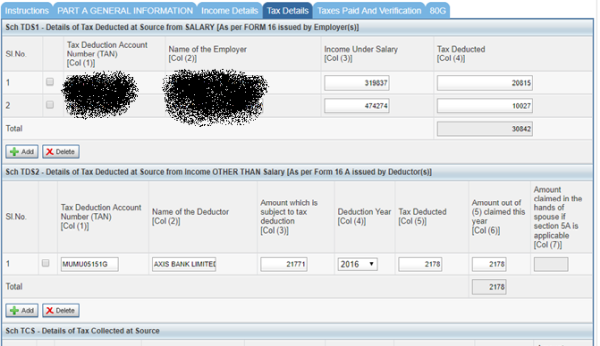

Tax Details tab exactly same as FORM 26AS that is shown above.

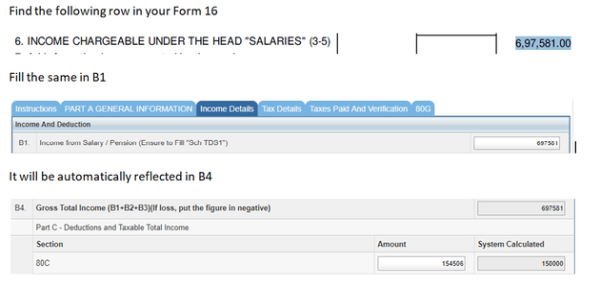

I guess something is wrong with data that I have entered in Income Details tab as shown below.

As shown above, I didn't declare B3(Income from other sources) with INR 21771.

So, this is what is mentioned in the notice right?

Request for Questions/Clarifications

1. May be I think I haven't decalred the Income details info properly, but Tax Details I have declared correctly, isn't it so, correct me if I am wrong here?

2. If yes, can I go ahead and Submit my response, selecting Agree and Filing a revised return?

3. If yes, in revised return form income details sections, maybe I have to add B3(Income from other sources) section with INR 21771 as per FORM 26AS

Thanks in advance. Kindly advice and clarify.

CAclubindia

CAclubindia