My turnover is less than 1Cr for FY 2020-21 .

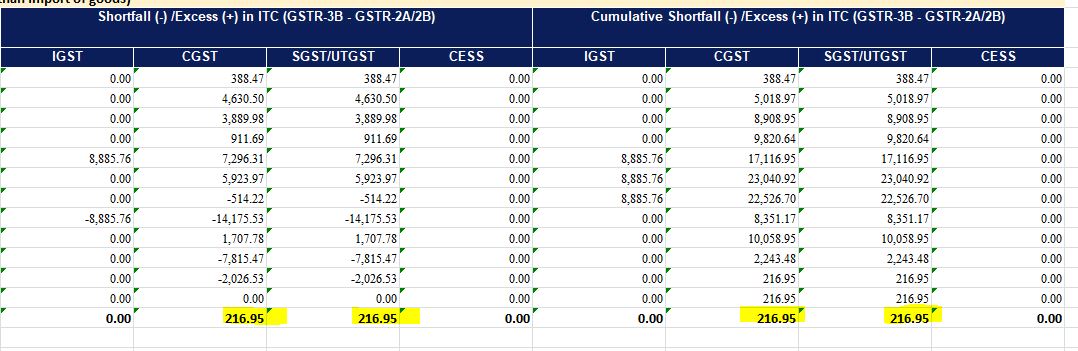

1. I have claimed extra ITC of total of Rs.434 (217+217) (in pic below )

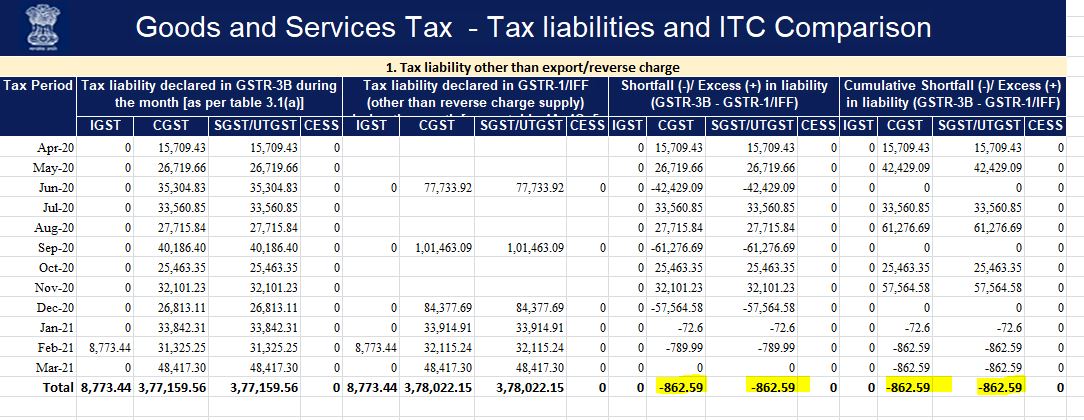

2. Also I issued debit notes to supplier which I uploaded in GSTR1 but failed to adjust the same in my GSTR3B due to which I am also getting difference in tax liability of Rs.1725 (862.59+826.59 )

To correct this mistake should I file GSTR9 or not ?Or can these mistakes be ignored ?

CAclubindia

CAclubindia