Hello,

In this FY, I fully redeemed my very old UTI ULIP units (debt scheme)

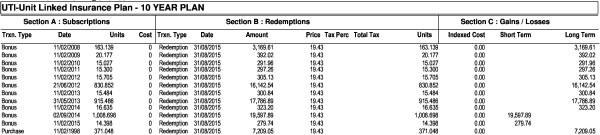

Just now I obtained Capital gain statement from Karvy.

To my shock it showed Long term capital gains (after indexation) of 80000Rs

Which mean tax liability of Rs.16000. (20%)

I was surprised and tried to figure out how they came to this huge figure.

UTI declares BONUS units every year. I noticed that Karvy is taking "cost of acquisition" of bonus units as ZERO.

SEE image below:

OR see here: https://i.imgur.com/uPCLBkZ.jpg

This means that "FULL SELL" value is considered as a Long term capital gain. Which to me seems VERY WRONG.

Shouldn't they consider NAV of that day as cost of acquisition for bonus units?

Please shed some light.

Thank you very much in advance.

CAclubindia

CAclubindia