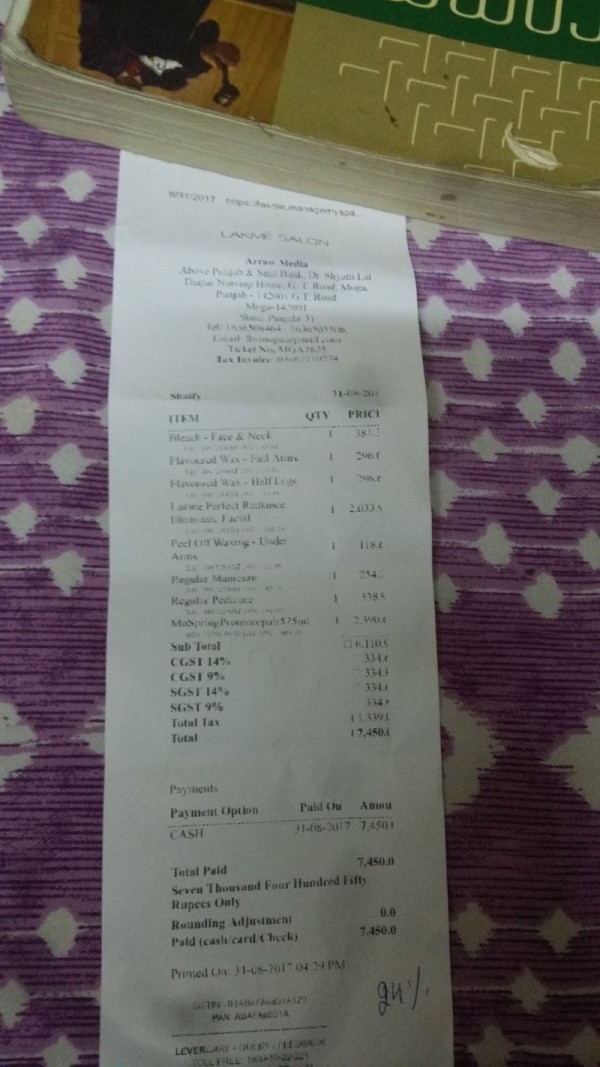

Q.On beauty parlour services the GST rate is 18% , as per my knowledge. I am not able to understand the CGST & SGST @ 14% each mentioned in the bill as to this rate is on which service and where in law the rate 24% (i.e. 14+14%). Please help to find out. i have attached the image of the bill.

Q.On beauty parlour services the GST rate is 18% , as per my knowledge. I am not able to understand the CGST & SGST @ 14% each mentioned in the bill as to this rate is on which service and where in law the rate 24% (i.e. 14+14%). Please help to find out. i have attached the image of the bill.

Menu

Calculation of tax

Replies (5)

Recent Threads

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

- SAC code and GST rate transport services for anima

- Section 44AB is Gone — How Different is Tax

Related Threads

CAclubindia

CAclubindia