I don't think that's correct, CAPM should not be confused with APT, basically APT is 'like' CAPM with more than 1 factor - there is a simple linear relationship.

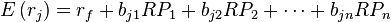

The APT states that if asset returns follow a factor structure then the following relation exists between expected returns and the factor sensitivities:

-

Rf is already given in the question and RP = Actual Value - Expected Value

CAclubindia

CAclubindia