First of all, I would like to thank this forum for helping me with my queries. I appreciate your support.

My aunt is retired and pensioner. Since she is not employed, we have selected category as ‘Other / Pensioner’ in the ITR1 personal info screens. She however got medical insurance as bank’s ex staff pensioner and has paid the premium in FY-20-21.

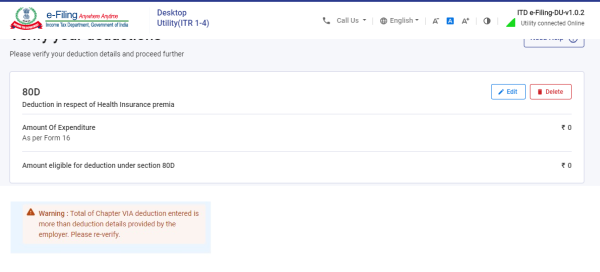

We are trying to claim that amount in 80D but it says ‘As per form 16’ See the screenshot and the issue is there’s no Form 16 applicable. after we enter the data and proceed, it warns that there’s a mismatch between ITR and Form 16 instantly then and there. Same message appended in the screenshot.

I was wondering if this deduction is only applicable for salaried? If not, the constraint of checking against form 16 should not have been there for retired people who have only ‘Other’ source of income.

Any advice would be great. If IT dept is still checking against form 16 which does not exist she will unnecessarily get intimation to validate the submitted data and it’s a long process of getting all certificates from the concerned banks / insurance company etc to prove the deduction.

CAclubindia

CAclubindia