Cases of some of the defaulted companies

- 60 Listed companies disclosed debt default of Rs 75,000 Cr

- 49 Listed companies disclosed debt default of Rs 69,140 Cr

- 8 Listed companies have defaulted for 50.93 US$ Billion equal into Rs.4.32 Lakh Cr

- 2263 Listed companies have defaulted for Rs 1.96 Lakh Cr

- 50 wilful defaulted companies owe Rs 87,925 Cr to Banks

- 88 Listed companies have been referred for liquidation as per NSE website.

- The list of wilful defaulters as of 30th June 2024 spans 1517 pages

TYPES OF DEFAULTING COMPANIES

1.Wilful Defaulters-Intentionally defaulted

Banks sanction working capital loans to support the regular operations of a company, with the condition that the sanctioned limits must be strictly used for their intended purpose. These funds should not be diverted to unrelated investments. The company, upon receiving the sanction letter, acknowledges and agrees to these terms and conditions.

However, some companies, driven by greed, violate these terms by diverting the loan towards unrelated activities such as investments in the capital market, subsidiary companies, or the purchase of fixed assets. Such fund diversion disrupts the company's core operations, hampers its ability to service debt, and may ultimately lead to bankruptcy and liquidation. As a result, the loan account turns into a Non-Performing Asset (NPA), causing significant losses to both banks and investors, who stand to lose their hard-earned money.

This ongoing issue has been eroding the net worth of banks and investor confidence for decades. Despite its seriousness, there remains a lack of effective preventive measures to curb these fraudulent practices of fund diversion by defaulters

2. Section 186(2) of Companies Act

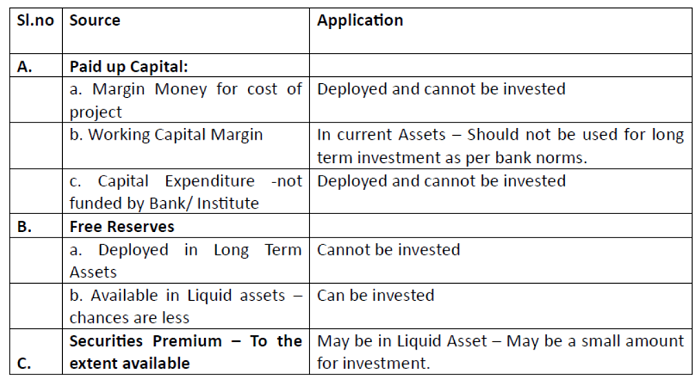

As per Section 186(2) of the Companies Act, 2013, a company can invest in/give a loan to other company up to 60% of net worth or 100% of free reserves plus securities premium whichever is higher.

The Act is silent on source of funding and hence the implications of the application of section 186(2) is as follows:

MISUSE OF SECTION 186(2) - IMPLICATIONS

- Section 186(2) of the Companies Act, 2013 prescribes limits on loans, guarantees, and investments that a company can make. However, the section is silent on the source of funding for such investments or loans. Due to this gap, managements of certain companies, facing liquidity constraints, resort to using readily available liquid funds of working capital loans sanctioned by banks, to invest in or lend to other companies.

The Concern

- Working capital loans are typically sanctioned by banks for the specific purpose of meeting the company's short-term operational needs, such as funding inventory and receivables.

- Diverting these funds for long-term investments or lending to other entities violates the terms and conditions outlined in the sanction letters of banks.

The Lapes

- While Section 186(2) regulates the quantum of loans and investments a company can make, it does not specify the funding source, leaving room for potential misuse. This oversight can be exploited by company managements, knowingly or unknowingly, leading to financial imprudence and systemic risks.

- This misuse of borrowed funds weakens financial health, leading to companies becoming sick and eventually defaulting.

- The ultimate burden falls on investors and banks, causing financial losses amounting to lakhs of cores of rupees.

- Investments or loans to other companies should protect, not erode, the hard earned wealth of investors and the net worth of banks.

The List of defaulted listed companies given in the beginning is an indication for misuse of Section 186(2) of the Companies Act, 2013

THE NEED FOR REFORMS

Given that there is possible misuse of Section 186, the Government may act decisively –

1. Amend the Act to restrict companies from using working capital loans for intercorporate investments or loans.

2. Introduce stringent monitoring mechanisms to track the source of funds used for investments or loans to other companies.

DISCLAIMER: The information presented in this article reflects my personal opinion and is intended to help safeguard investors and banks by identifying and mitigating risks associated with defaulting companies. All data referenced in the article, where applicable, has been sourced from publicly available information on Google.

Any decisions made based on the content of this article are entirely at the reader’s discretion and risk. The author shall not be held responsible for any losses or damages arising from the use of this information.

CAclubindia

CAclubindia