The S&P 500 is touching new Highs but it hides the pain of the U.S economy through the Mag7 stocks and mostly through the Nvidia. Inflation might never come down in straight line rather it will remain as a challenge until U.S takes the whole world into a plunge. Highly unbelievable but the burden of interest expenses on US federal debt has reached staggering levels, surpassing spending on critical sectors like national defence, Medicare, and Medicaid.

The net interest expense amounted to a massive $514 billion in the first seven months of Fiscal Year 2024 alone, exceeding previous years by a significant margin. Moreover, a substantial portion of small-cap stocks' debt, totalling $620 billion, is due for refinancing over the next five years, posing significant challenges amid rising interest rates.

Its not only the citizens who are struggling but so as the small companies struggling for survival. 42% of small caps are unprofitable, higher than the 41% during the Dot Com Bubble The behavioural aspect of investors is changing dramatically.

American Cry

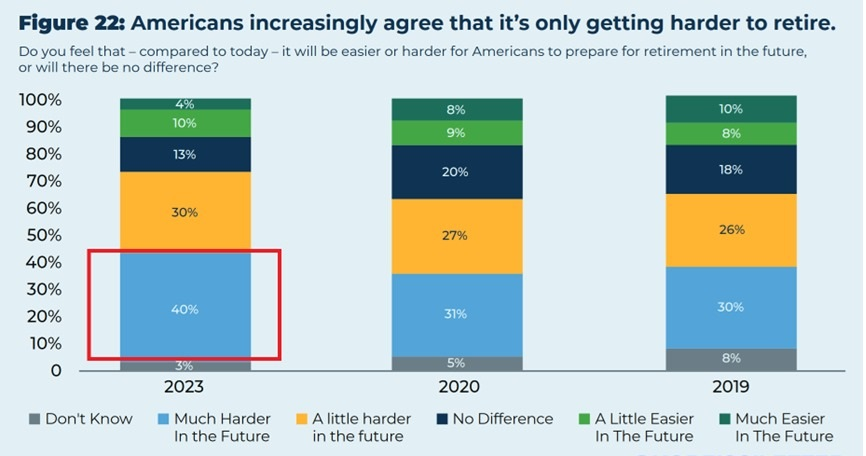

Concerns about retirement are also mounting, with 40% of Americans expressing that it's becoming increasingly difficult to retire. Factors such as high inflation, escalating healthcare costs, and market volatility are cited as major obstacles to retirement readiness. Moreover, alarming statistics reveal the financial strain faced by many Americans, with a significant portion unable to cover emergency expenses or manage credit card debt effectively.

Despite positive GDP growth and stock market performance, there exists a stark disconnect between economic data and public perception. 56% of Americans currently believe we are in a recession, according to a Harris poll conducted for the Guardian. Currently, 55% of Americans believe the economy is shrinking and 49% believe that the S&P 500 is down for the year. The poll says that 49% of Americans believe unemployment is at a 50-year high, though the rate has been under 4%, a near 50-year low. 58% of Americans blame the president for the state of the economy, according to the poll.

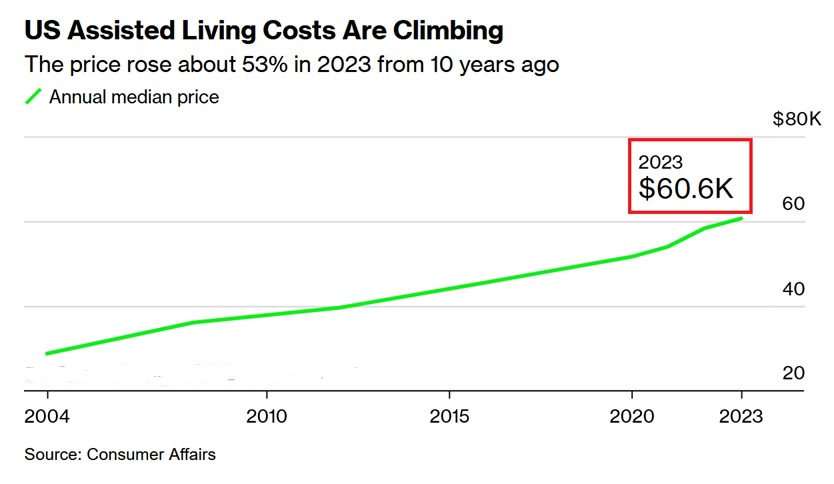

US assisted living costs are up 53% over the last 10 years to a new all time high. Over the last 3 years, the annual median prices of assisted living services surged by 17% from $51,600 to $60,600. This has been largely driven by skyrocketing commercial property insurance premiums nationwide, especially in Florida.

Over the last 5 years, insurance premiums in Florida spiked by a MASSIVE 125%. At the same time, in Florida, 146 nursing homes or assisted-living facilities have been shut down each year on average.

American Credit Card Saga

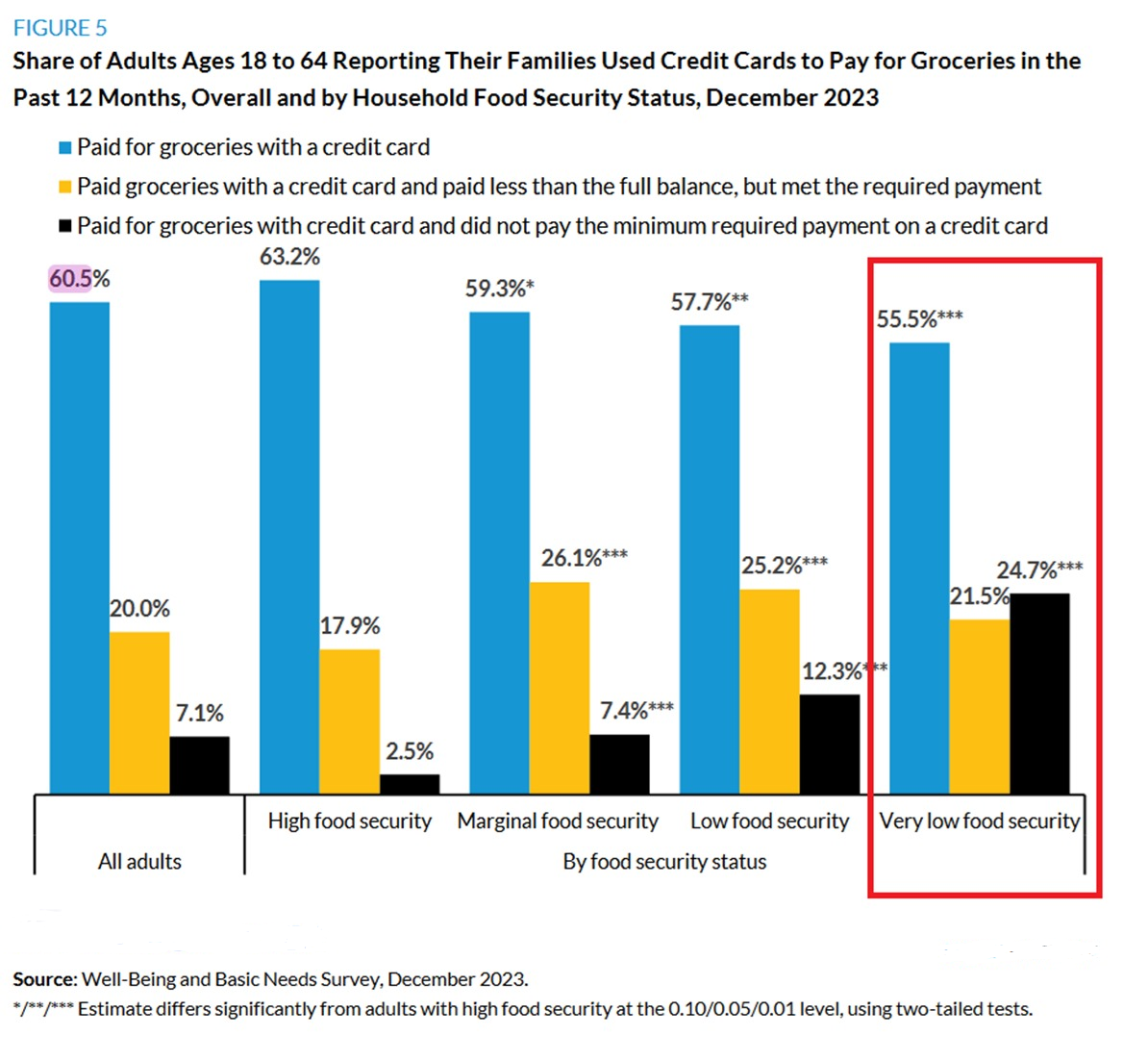

Assisted living in the US is now a luxury. The average American now has $6,500 in credit card debt. Meanwhile, the median American FAMILY has less than $8,000 in savings. We are witnessing a credit card debt crisis with interest rates at 25%+. Recent stats about credit card debt: 61% of Americans aged 18-64 paid for their groceries with a credit card in 2023. 19% of adults in the US used savings not intended for routine living expenses and 3.5% exploited the Buy Now, Pay Later option. 20% of adults who used credit cards did not pay the full balance but met the required payment. However, 25% of those with very low food security did not even pay the minimum required payment on their credit cards. Record levels of credit card debt can barely cover living expenses for many Americans.

Cost Living is beyond the Roof

While CPI inflation is at 3.4%, inflation is much higher in many basic necessities: 1) Car Insurance Inflation: 22.6% 2) Transportation Inflation: 11.2% 3) Hospital Services Inflation: 7.7% 4) Car Repair Inflation: 7.6% 5) Homeowner Inflation: 5.8% 6) Rent Inflation: 5.4% 7) Electricity Inflation: 5.1% 8) Food Away From Home Inflation: 4.1% . Do keep in mind, inflation has been above 3% for over 3 years now. This means that these inflation numbers are building on multiple years of already inflated prices. Further student loans owned by US households are near the all-time high of $1.60 trillion.

Fast Food is drying down

Over 50% of Americans believe we are in a recession 5. Lowest mortgage demand in over 30 years . A record $17.7 trillion in total household debt. 78% of US consumers view fast food as a luxury due to high prices, according to a LendingTree survey. 75% of Americans eat fast food at least once a week but 62% claim rising prices constrain them to eat it less often. 50% of respondents consider fast food a luxury because they struggle financially. This is most evident among households that make less than $30,000 a year. Meanwhile, a family fast food meal currently costs $60-$70.

Student Loan the Burden and Balloon

Federal student loan interest rates for the 2024-25 academic year will now rise to the highest levels in at least 12 years. Student loan rates for undergraduate and graduate students will be now 6.5% and 8.1%, respectively, up from 5.5% and 7.1% in 2023. Direct plus graduate loan rates will surge to 9.1% from the current 8.1%. Since 2020, loan rates have skyrocketed with undergrad rates more than DOUBLING in 4 years. Whoever assumes office after November's election will be greeted by the formidable challenge of inflation. Despite more than two years of the Federal Reserve's efforts to curb a pandemic-induced price surge through interest rate hikes, the core consumer price index remains stubbornly above the central bank's target.

Wealth Inequality

Wealth inequality remains a pressing concern, with the top 0.1% holding a disproportionate share of wealth compared to the bottom 50% of Americans. Addressing poverty and reducing wealth disparities are imperative for fostering economic stability and social cohesion.

In conclusion, while the S&P 500 may be reaching new highs, it is essential to recognize the underlying economic challenges that persist. Tackling these challenges will require concerted efforts from policymakers, businesses, and individuals to ensure a more inclusive and resilient economy.

CAclubindia

CAclubindia