WHAT IS GST?

GST is called as Goods and Service Tax which is an indirect tax and passed in the parliament on 29th March 2017 and came into force on 1st July 2017. This is an indirect tax which has replaced many indirect taxes such as VAT, excise duty etc.

As the name suggest the GST is imposed on supply of goods and services. It is the destination based tax. It was introduced to reduce the cascading effect on tax. It is the single domestic indirect tax law in India. The tax is imposed at every stage of supply.

Let us understand the meaning of destination based tax by giving one example: so let’s consider that the goods are being manufacture in Maharashtra and is going to supply in Gujarat, so basically the consumption is in the Gujarat the tax will be levied in Gujarat and not in Maharashtra.

JOURNEY OF GST

It took 17 years to pass the GST law in India. The journey of GST started in the year of 2000 when a committee drafted law. Lok Sabha and Rajya Sabha passed the GST Bill in the year of 2017. And finally on 1st July 2017 the GST was came into force.

OBJECTIVE OF GST

1. To reach the idea of 'One Nation One Tax'

GST has replaced many indirect taxes and now the GST is only tax which is being followed by all the states and it is the advantage as all the state follows the same rate of tax. It became easier for the Central Government to decide the rate and policies.

2. To reduces the cascading effect

It is the very first objective of GST that is to reduce the cascading effect. Before GST there was many indirect taxes in which the taxpayer was not able to set off the credits. If we understand this by giving an example then, the excise duties paid during the manufacturing of goods will not be set off against the VAT payable during sale.

3. To expand the taxpayer base

Before GST there was different limits for registration based on turnover. As GST is imposed on both goods and services, it has risen the registered businesses. So the GST is helped in extended the tax in India.

ADVANTAGE OF GST

- Eliminate the cascading effect;

- Higher the limit for registration of GST;

- Small business can also opt for composition scheme;

- Making more simple online facilities for compliance of GST;

- GST has relatively lesser compliances;

- GST has also defined the treatment for E-Commerce activities;

- It extended the efficiency in logistics;

- It also regulates the unorganized sectors.

COMPONENTS OF GST

There are three taxes which is applicable under GST which is:

- CGST: It is the tax which is collected by the Central Government, and it is imposed on intra state supplies. For e.g. transaction which happens in Maharashtra.

- For e.g. transaction which happens between two states.

User Guide before logging in GST Portal

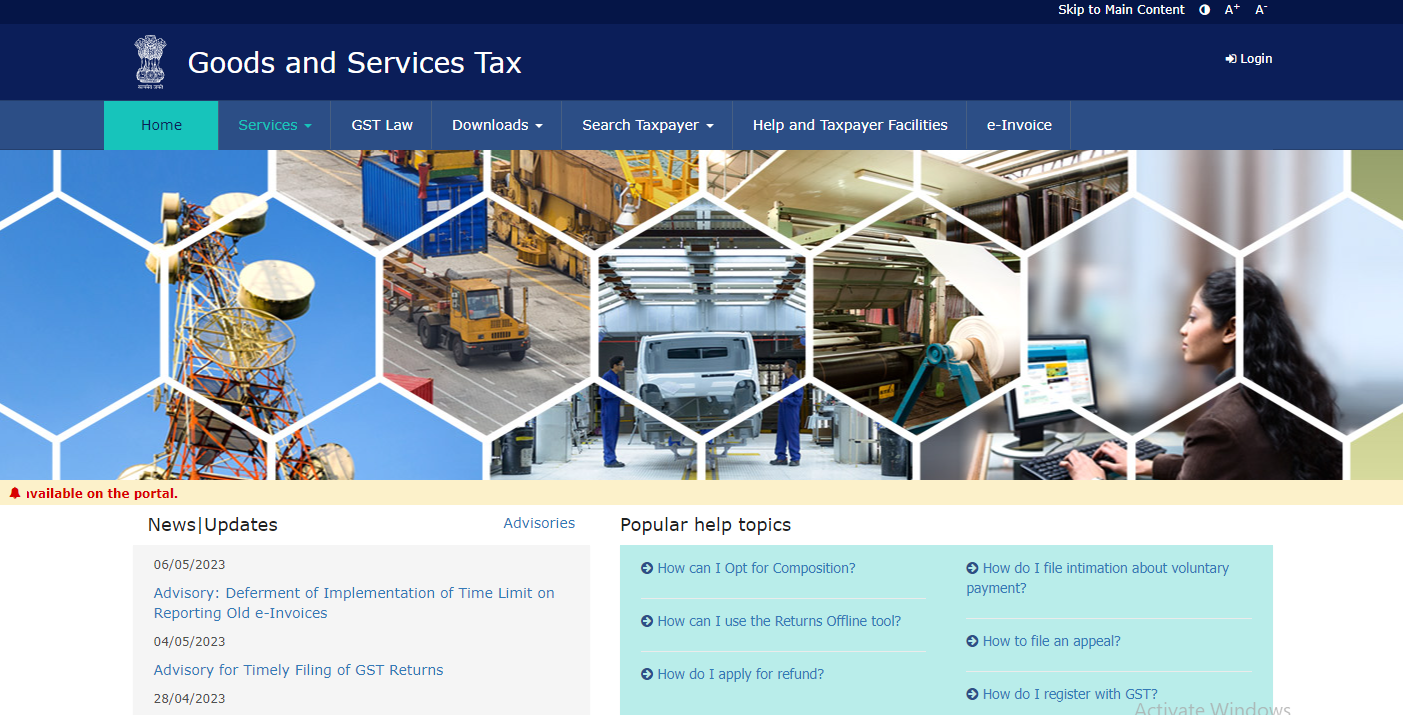

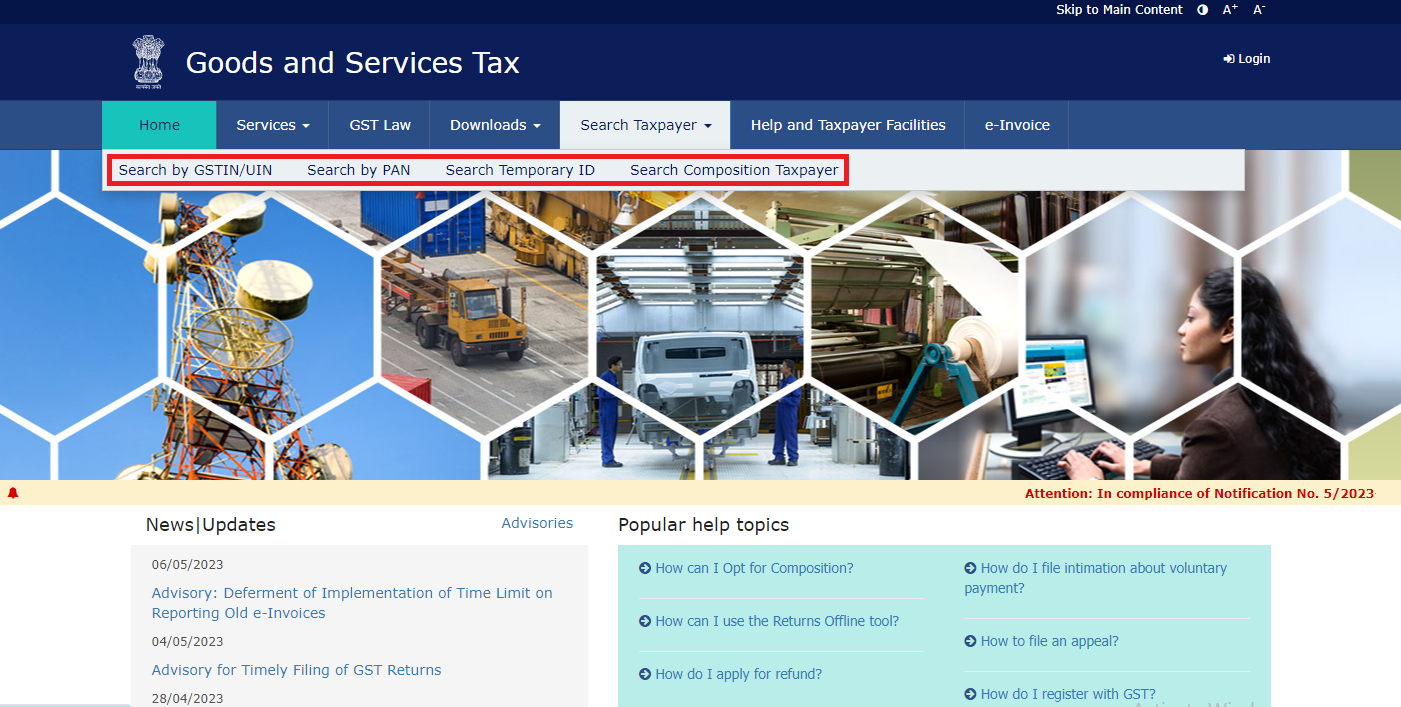

To use the GST (Goods and Services Tax) portal at gst.gov.in before logging in, you can follow these steps:

- Open your web browser and go to the GST portal website: gst.gov.in.

- On the homepage, you will find various options and menus. Before logging in, you can access a few important features and information.

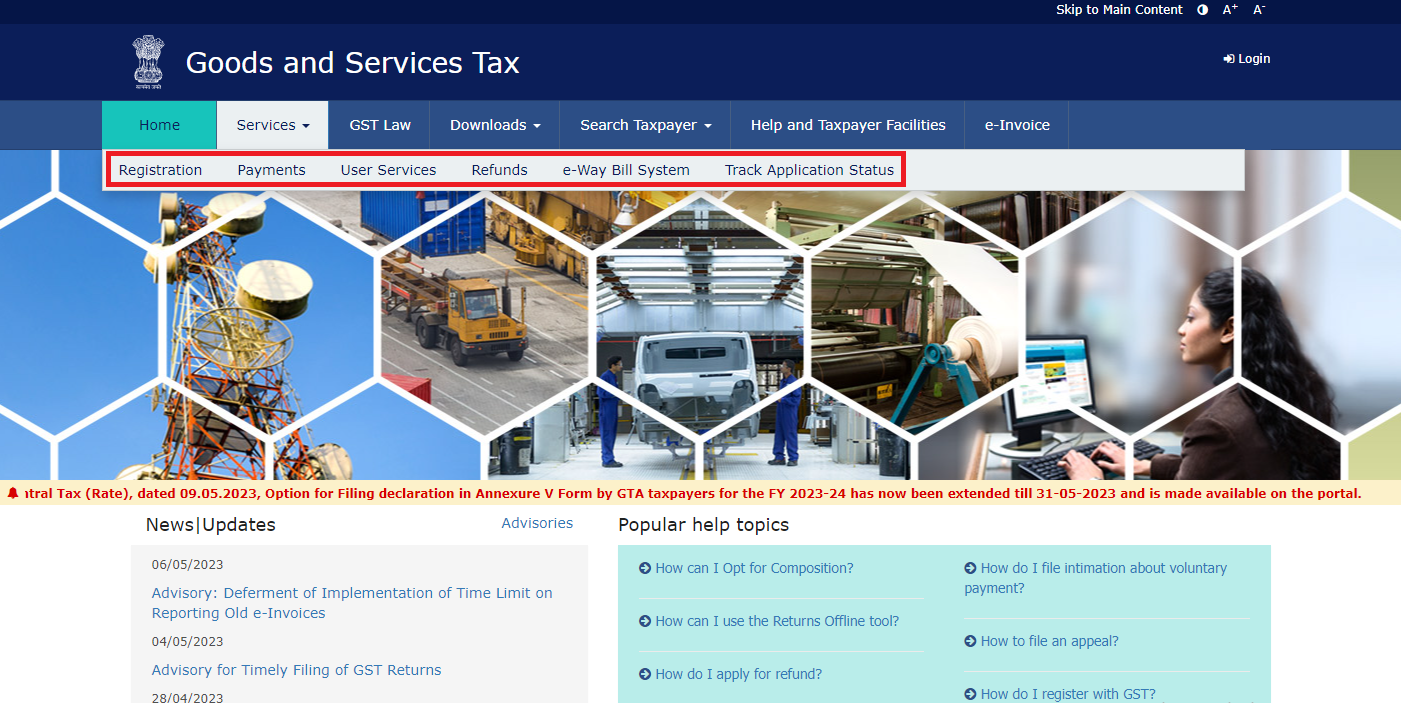

- Services: This section provides access to various services related to GST, such as registration, making payments, application status for refunds, and more. You can explore these services and access the relevant forms and tools.

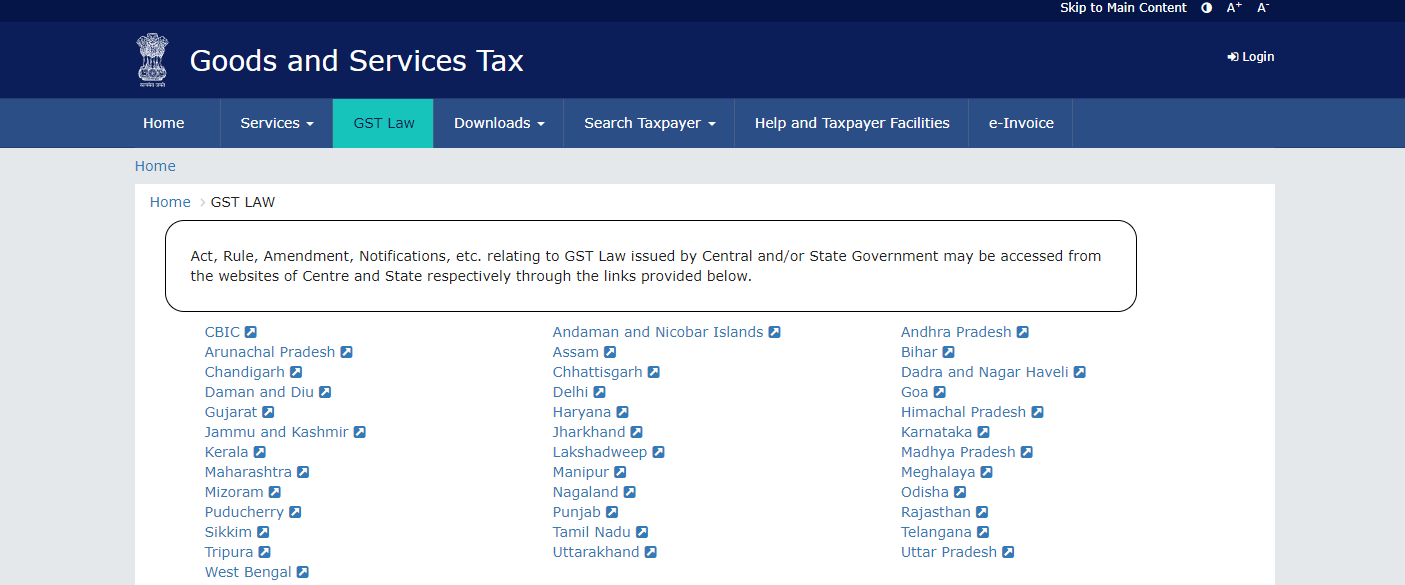

- GST Law: In this section, you can find information about the laws and regulations governing the Goods and Services Tax. It includes GST Acts, rules, notifications, circulars, and other legal documents. You can refer to these resources to understand the GST framework.

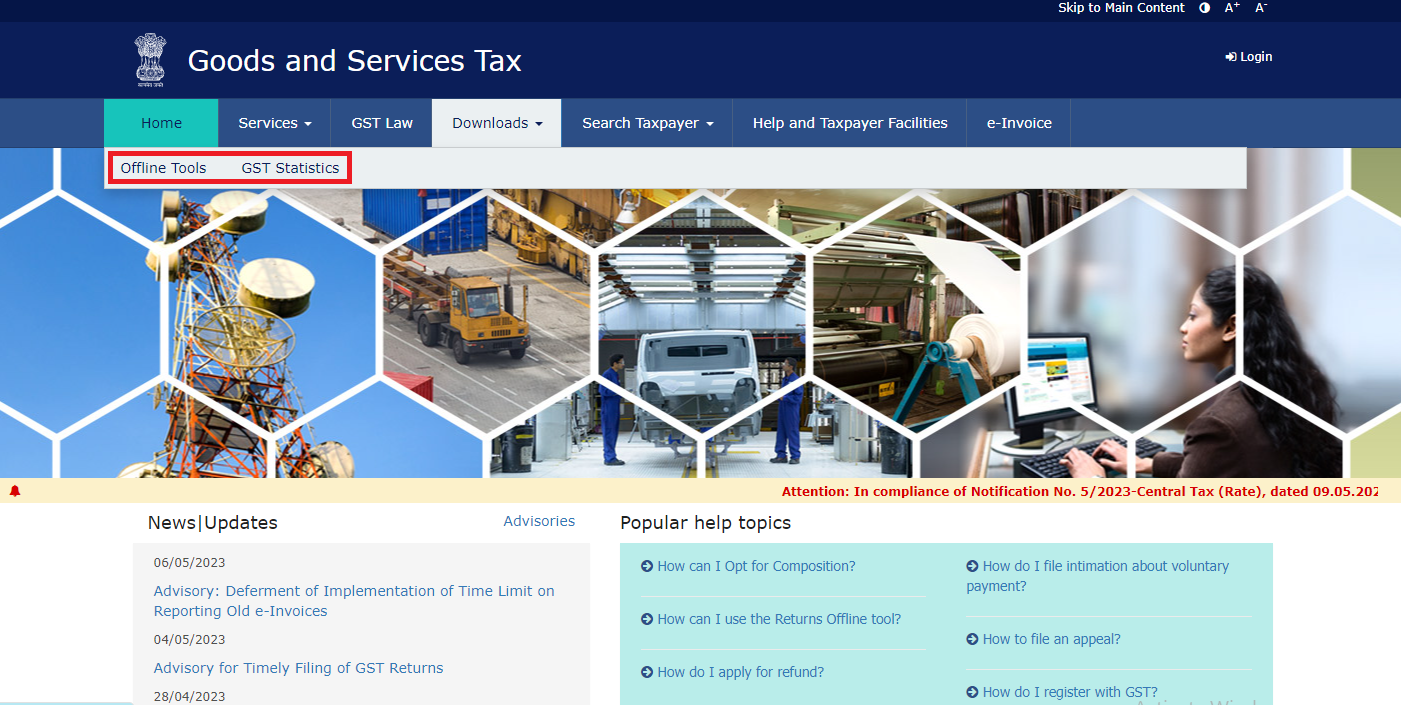

- Download: Under the "Download" option, you can find downloadable files related to GST, including GST Statistics & Offline Tools. These resources can assist you in various aspects of GST compliance.

- Search taxpayer: This feature allows you to search for a specific taxpayer by their GSTIN (Goods and Services Tax Identification Number). By entering the GSTIN, you can retrieve information about the taxpayer, such as their legal name, address, and registration status.

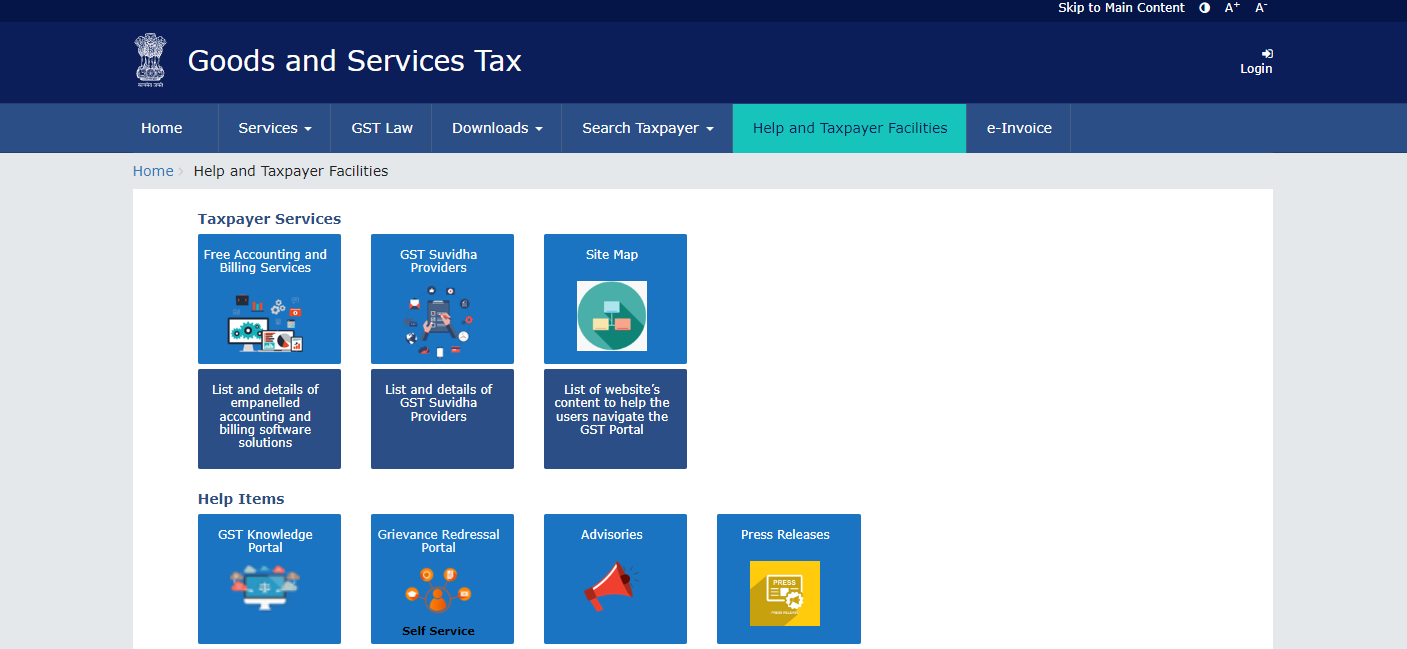

- Help and taxpayer facilities: This section provides assistance and support for taxpayers. It includes FAQs, user manuals, video tutorials, and other resources to help users navigate the GST portal and understand various procedures.

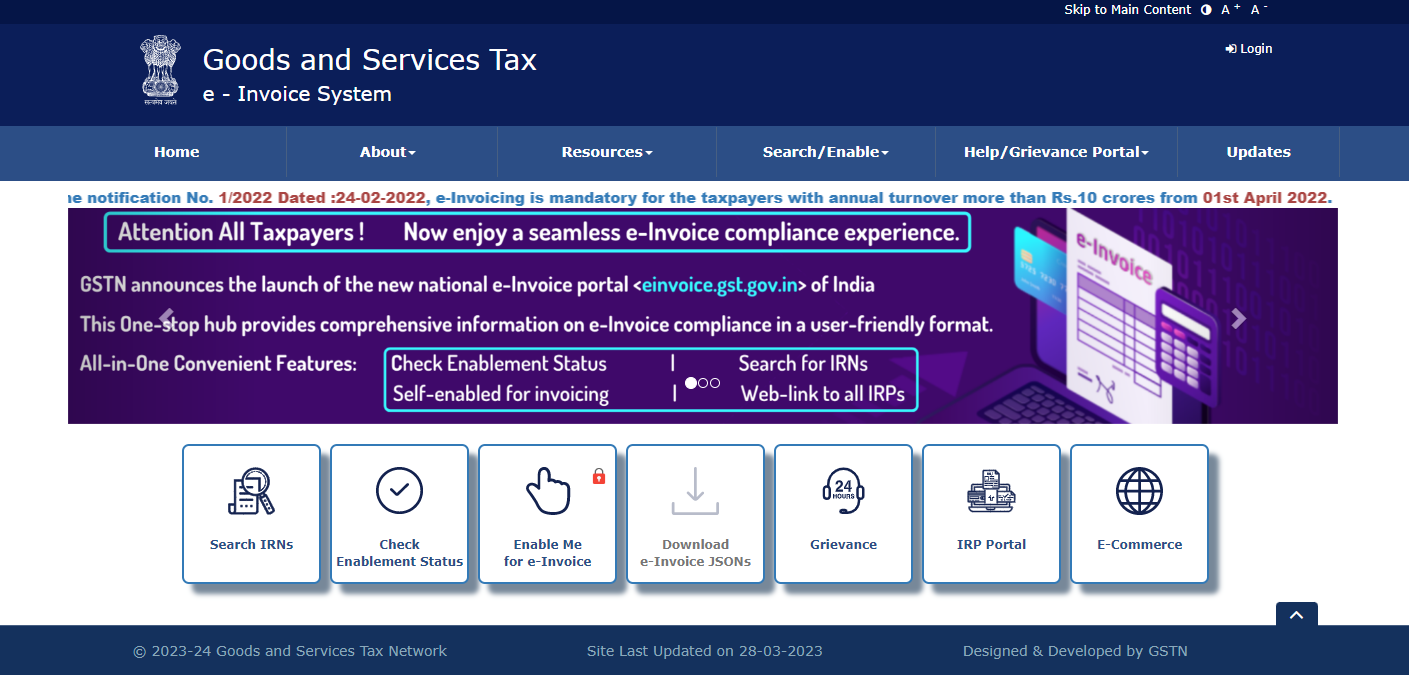

- e-invoice: The e-invoice option enables businesses to generate electronic invoices in a standardized format. It facilitates the automated exchange and validation of invoices between businesses and the GST portal. This feature helps streamline the invoicing process and enhances compliance.

Authored by Adv Shivam Kumar

CAclubindia

CAclubindia