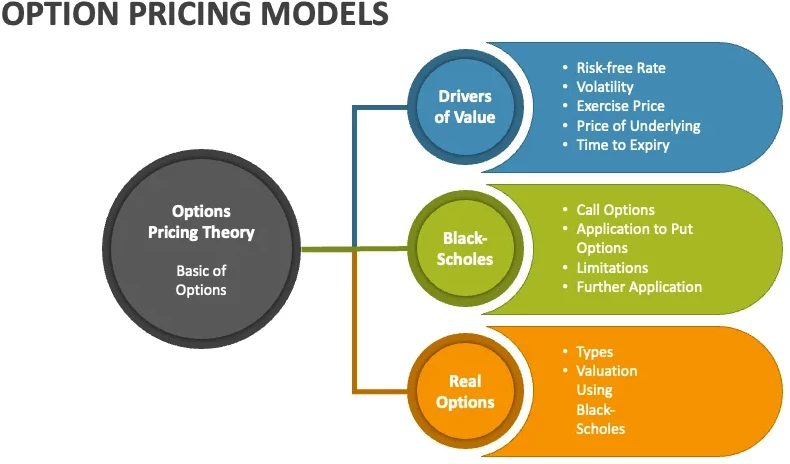

Understanding the Option Pricing Method (OPM)

The option pricing method (OPM) is a widely used approach for allocating equity value to various securities within the intricate capital structures of privately held companies. This method is particularly useful when active markets for privately issued securities are absent. Valuation specialists often face challenges in determining how to allocate value to each security. The OPM is optimal for companies with long-term liquidity event timelines and multiple exit options. It is also effective for valuing option-like payoffs, such as common stock options and warrants.

How OPM Works

The OPM treats each class of security as a call option on the company's total equity value. This approach typically employs the Black-Scholes model to value these call options. The model takes into account parameters like stock price, exercise price, time, volatility, and risk-free rate to determine the price of a European call option. For OPM, the stock price represents the company's total equity value, while the exercise price is the liquidation preference of the security.

Steps to Apply OPM

1. Analyze the Capital Structure

Understand the company's equity interests, including preferred shares, common shares, options, warrants, and other securities. Assess the rights associated with each class of equity.

2. Calculate Each Breakpoint

Determine the points at which each class of equity becomes in-the-money. Breakpoints represent different levels of proceeds from a liquidity event.

3. Determine Black-Scholes Parameters

Estimate the inputs required for the Black-Scholes model, such as the company's total equity value, exercise prices for each breakpoint, expected time to liquidity, volatility, and risk-free rate.

4. Calculate Each Breakpoint Value

Use the Black-Scholes model to determine the value of the call options at each breakpoint.

5. Allocate Incremental Option Values

Allocate the incremental option values to each class of security based on their ownership interests at each breakpoint.

Comprehensive Illustration

Consider Cotopaxi Tech, a venture capital-backed startup. The company's capital structure includes common shares, preferred shares, options, and warrants. The enterprise value is estimated at $40 million using traditional valuation methods. Here's a simplified version of the process:

1. Analyze Capital Structure

Cotopaxi Tech has common shares, Series A and Series B preferred shares, options, and warrants.

2. Calculate Breakpoints

Identify the payoffs to Series B and Series A preferred shares, cumulative dividends, and common shares at different levels of proceeds.

3. Determine Black-Scholes Parameters

Use the estimated equity value, exercise prices, expected time to liquidity, volatility, and risk-free rate to calculate option values.

4. Calculate Each Breakpoint Value

Apply the Black-Scholes model to determine the value of call options at each breakpoint.

5. Allocate Incremental Option Values

Distribute the incremental option values among the securities based on their ownership interests.

Importance of OPM

The OPM provides a structured way to allocate equity value among different classes of securities in a company's capital structure. It ensures that each class is fairly valued based on its economic rights and preferences. This method is crucial for business valuation experts, especially when dealing with startup valuation and the valuation of goodwill in complex capital structures.

CAclubindia

CAclubindia