INTRODUCTION

Start-ups as the name suggest any venture which is going to start or at stage of development or just emerged an innovative idea or technique. Usually start up business need more and more finance at their initial stage for meeting the cost required for developing the product, cost to be incurred for marketing research, for building a technology, for conducting customer survey and many other factors which plays a vital role in building the foundation of any business. Finance need of such start-ups can be met by seeking investment from potential investors who believe in their business ideas/technique, their potential of generating revenue in near future, their comparable business achieving a milestone etc or other relevant factors favoring such type of businesses. For procuring such investment from the investors, valuation of such start-up businesses required which we are going to study in this Article.

VALUATION OF START-UPS

If we are talking about the valuation of start-ups business, it must be understood that there are no well-designed methods and techniques which can be said most suitable for start-ups business, since start-ups businesses are not in revenue generating capacity at its initial stage or in a stage of instability and it is also difficult to find the comparable company data available in the market which resemble with such start-ups business for the purpose of carrying out valuation exercise. While comparing such start-ups valuation with matured listed companies, it is easy to make valuation of such matured companies using various multiples e.g P/E multiple, EBIDTA multiple, Market price method etc and several other factors which is not available for start-up business.

For the purpose of valuation of start-ups business, various methods came into picture depending upon the nature of business, stage of development of such start-ups business, major risk involved in such business, quality of management staff and its strategic relation, prototype, technology, innovative or sound idea etc.

METHODS OF VALUATION OF START-UPS

BERKUS METHOD

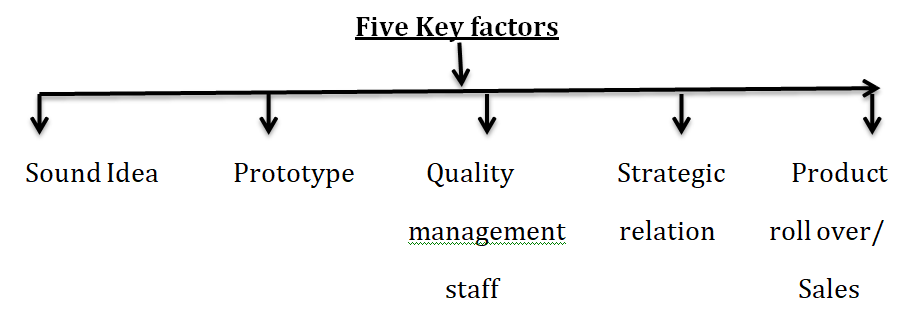

(Valuation based on the assessment of 5 success key factors)

This method is introduced by American venture capitalist and angel Investor Dave Berkus. Under this method, it is assumed that the success and growth of the start-ups business is based on the five key factors which must be examined and observed carefully while adopting this method of valuation.

This method is also referred to as the stage development method or the development stage valuation approach. Under this method, A detailed assessment is carried out evaluating how much monetary value is assigned to the five key success factors. The startup valuation is the summation of those monetary values.

Sound and innovative idea is the USP of the start-ups business which is vital for smooth running and success of such start-ups business.

Prototyping gives you a sense of clarity. As a startup, it is imperative for your team to have a streamlined vision of your project. A prototype can act as a roadmap for everyone involved to bring your vision a step closer to reality.

Quality management staff forms the backbone of any business. The more efficient, talented and compatible team you have, the more successful and sustainable business you can run.

Strategic partnership agreement is best defined as two or more businesses working together to achieve a common goal. Strategic partnerships can provide your startup with many benefits, such as access to new markets, capital, technology, and customers. A strategic partnership can be a win-win situation for both parties involved when done correctly.

Product roll over/sales depends upon the quality of delivering your product and services to the customer to such an extent that it built long term relations and also develop a brand in the market for your product and services and also generate more and more revenue.

RISK FACTOR SUMMATION METHOD

(Valuation based on the assessment of comparable start-ups adjusted with risk factors)

This Method is based on the assessment of various risk factors which the start-ups businesses are exposed to. In this modern era, businessman faces many threats and obstacles which hamper the business activities and delayed the path of achieving goals. It’s imperative to assess all those risk and make effective plans and strategies to mitigate all those risk.

This method is a combination of Berkus Method & comparable transaction method. It uses a base value of comparable start-ups and then adjust it with risk factors.

Risk involved

- Management risk

- Sales & marketing risk

- Manufacturing risk

- Competition risk

- Technology risk

- Funding risk

- Litigation risk

- Political risk

- Country risk

Under the risk factor summation method, an estimated initial value is calculated for the startup using any of the other methods. To this initial value, the effect, whether positive or negative, of different types of business risks are taken into account and an estimate is either deducted or added to the initial value based on the effect of the risk. After taking into consideration all risks and implementing the “risk factor summation” to the initial estimated value of the startup, the final value of the startup is determined.

DISCOUNTED CASH FLOW METHOD

This is the simplest and traditional method for valuation of start-ups businesses. Under this method, future cash flows generated by the business enterprise during a period of time are discounted at the weighted average cost of capital to arrive at the present value. Generally, discounting rate is taken higher for start-up businesses as there is a high risk that the company will inevitably fail to generate sustainable cash flows.

The DCF method relies on an analysis on how much money the startup will probably generate in the future (expected future cash flow) with the assistance of a discount rate. DCF valuation method is considered equally important to valuing a startup based on industry standard.

VENTURE CAPITAL METHOD

The VC Valuation Method was first introduced in 1987 by Harvard Business School Professor Bill Sahlman. It can be used by venture capitalists and angel investors to work out pre-money valuation by first determining post-money valuation, using industry metrics.

This method is specifically adopted from the point of view of investor The investor sets an anticipated exit valuation based on the current state i.e. (if the current business is sold to outsider then what value it would fetch) and the projections then he sets his targeted ROI thus reaching the post-money valuation

Post money valuation = exit value / Rate of investment)

then the pre-money valuation can be easily calculated

Pre-money valuation = Post-money valuation – Initial investment

then this value can be adjusted according to dilution.

Exit Value- Is the anticipated selling price of company at some point in the future – assume 5 to 8 years as the average for early-stage equity. The selling price can be estimated by establishing a reasonable expectation for the revenues in the year of sale and, based on those revenues, estimating earnings in the year of the sale.

ROI-Anticipated ROI is the projected return on investment for company’s investors. All investments must demonstrate the possibility of a 10-40x return (as per industry norms for early-stage investments).

The venture capital method reflects the process of investors, where they are looking for an exit within 3 to 7 years. First an expected exit price for the investment is estimated. From there, one calculates back to the post-money valuation today taking into account the time and the risk the investors takes.

The return on investment can be estimated by determining what return an investor could expect from that investment with the specific level of risk attached.

Uses: The Venture Capital method is an often used in valuations of pre revenue companies where it is easier to estimate a potential exit value once certain milestones are reached.

SCORE CARD VALUATION METHOD

This method is similar to Risk factor Summation Method which uses a base value of comparable start-ups and then adjust it with following factors which are as follows:

- Team Capacity

- Technology/Product

- Market size

- Competition

The scorecard startup valuation method compares your company to similar angel-funded startup ventures and adjusts the average valuation of recently funded companies in the industry to establish a pre-money valuation of your startup. Such comparisons can only be made for companies at the same stage of development.

Example

|

Comparison Factor |

% assigned to each factor of valuing com |

Comparable Target Co |

Product |

|

Team Capacity |

30% |

XXXX |

XXXX |

|

Technology/Product |

15% |

XXXX |

XXXX |

|

Market Size |

20% |

XXXX |

XXXX |

|

Competition |

35% |

XXXX |

XXXX |

MARKET MULTIPLE METHOD

(Valuation on the basis of recent acquisitions or transactions that are similar in nature to the startup)

Basically, the market multiple approach values the company against recent acquisitions of similar companies in the market. In order to value a firm at the infancy stages, extensive forecasts must be determined to assess what the sales or earnings of the business will be once it is in the mature stages of operation. Providers of capital will often provide funds to businesses when they believe in the product and business model of the firm, even before it is generating earnings. While many established corporations are valued based on earnings, the value of startups often has to be determined based on revenue multiples.

Comparable market transactions can be very hard to find. It's not always easy to find companies that are close comparisons, especially in the startup market. Deal terms are often kept under wraps by early-stage, unlisted companies—the ones that probably represent the closest comparisons.

Under this method attempt is made to carry out a valuation based on the market capitalization of comparable listed companies. The market comparables method is a simple calculation using different key ratios like earning, sales, R&D investments, earnings before any taxes, interest, depreciation and amortization (EBITDA) to estimate the value of a company. Common multiples frequently used are EV/EBIT, EV/EBIDTA, EV/SALES, P/E ratio, Price earning to growth ratio, price to book ratio etc.

CAclubindia

CAclubindia