As per Entry No. 49 of List-II of Seventh Schedule 'Taxes on Land and Buildings' is a State subject. Therefore, Sales of Land is subject to State Stamp Duty. Constitution grants concurrent powers to Union & State to levy GST, subject to recommendations by GST Council. In respect to Land & Building, GST Laws have 'deeming provisions' in Schedule-II of the CGST Act. Thus, excluding those 'deemed supply' provisions, GST cannot be imposed on other transactions relating to Land & Building.

Construction of a complex, building, civil structure or a part thereof including a complex or building intended for sale to a buyer, or partly, except where the entire consideration has been received after issuance of completion certificate, where required, by the competent authority or after its first occupation, whichever is earlier. This covers sale of apartments before it is occupied.

Therefore, Matters EXCLUDED from GST Laws are

- Sale of apartment, building or civil structure or part thereof,

- after its completion or first occupation

- will not be subject to GST.

In previous tax structure developers had to bear various taxes like excise duty, vat, service tax etc., and ITC was not available for duties like CST, custom duty, entry tax etc., this would impact the price subsequently and the burden was transferred to buyers.

Under GST, developers’ construction costs are significantly reduced as multiple taxes are subsumed and due to the availability of input tax credit. Also, reduction in cost of logistics will be an added benefit. Hence developers may see improvement in margins.

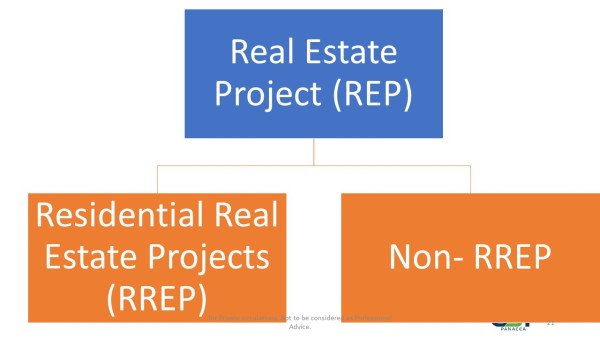

Types of Real Estate Projects

Real Estate Project (REP) are of two types:

RREP (Residential Real Estate Project) means Real Estate Project (REP) of residential apartments with commercial apartments not more than 15% of total carpet area of REP. Other than this all Projects are Non-RREP.

ISSUE OF VALUATION OF LAND IN REAL ESTATE

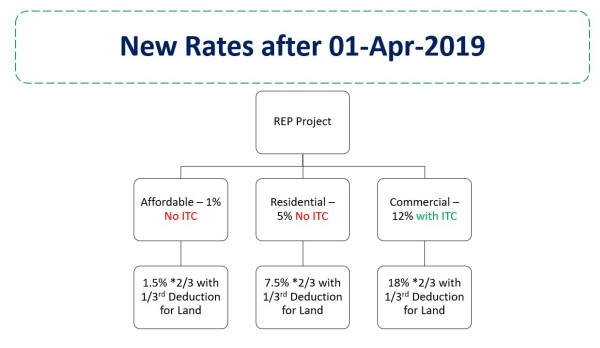

A new tax structure for real estate sector was introduced with effect from 01.04.2019 onwards by amendment of Notification No. 11/2017 Central Tax (Rate) dated 28.06.2017 by Notification No. 03/2019 - Central Tax (Rate) dated 29.03.2019.

The Notification No. 03/2019 - Central Tax (Rate) dated 29.03.2019 substituted the rate for services related to real estate sector with effect from 01.04.2019 and also made provisions for continuing the old rate of tax as it existed up to 31.03.2019 for the ongoing projects. The provisions for continuing the old rate of tax for the ongoing projects were incorporated in Items (ie) and (if) of Sl. No. 3 of the Notification No. 11/2017 CT (Rate) dated 28.06.2017 as amended.

The Item (ie) prescribes the rate of tax on construction of an apartment under the schemes specified in various sub-items of Item (iv), (v) and (vi) as enumerated therein and Item at (if) prescribes the rate of tax on the construction of residential apartments other than affordable residential apartments in an ongoing project in respect of which the promoter has exercised option to pay tax at the rates as specified under the respective items (ie) and (if).

VALUE OF SUPPLY INVOLVING TRANSFER OF LAND

Notification No-11/2017-Central Tax (Rate), dated 28th June 2017, provides for the valuation of supply of construction services involving transfer of land or undivided share of land, as the case may be.

The value of such supply shall be equivalent to the total amount charged for such supply less the value of transfer of land or undivided share of land. This supply shall be deemed to be one third of the total amount charged for such supply.

Here, "total amount" means the sum total of,

(a) consideration charged for construction service; and

(b) amount charged for transfer of land or undivided share of land, as the case may be including by way of lease or sub-lease.

The provisions of Para 2 of Notification No. 11/2017 Central Tax (Rate) dated 28.06.2017 is extracted below;

"2. In case of supply of service specified in column (3) of the entry at item (i) against serial no. 3 of the Table above, involving transfer of property in land or undivided share of land, as the case may be, the value of supply of service and goods portion in such supply shall be equivalent to the total amount charged for such supply less the value of land or undivided share of land, as the case may be, and the value of land or undivided share of land, as the case may be, in such supply shall be deemed to be one third of the total amount charged for such supply.

Explanation- For the purposes of paragraph 2, "total amount" means the sum total of-

(a) consideration charged for aforesaid service; and

(b) amount charged for transfer of land or undivided share of land, as the case may be."

The CBIC has issued FAQ's on Real Estate Sector under F. No. 354/32/2019 - TRU dated 07.05.2019 wherein it is clarified as follows;

"Question No. 36: Can a developer take deduction of actual value of land involved in sale of unit instead of taking deduction of deemed value of land as per Paragraph 2 to Notification No. 11/2017 - CTR?

Ans: No. Valuation mechanism prescribed in paragraph 2 of the notification No. 11/2017 - CTR dated 28.06.2017 clearly prescribes one-third abatement towards value of land."

DECISION IN CASE OF M/S VKL BUILDERS INDIA PRIVATE LIMITED (KERALA – AAR)

ADVANCE RULING No. KER/119/2021, Dated: 30-05-2021

The combined effect of the various amendments to Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017 were that the composite supplies of works contract under the specified schemes was extended a concessional rate of GST of 12% and in cases where the supply involved transfer of land or undivided share of land the provisions of Para 2 of the notification applied for valuation of the service.

The taxable value of service specified at item (i) of the said notification is the total amount charged for the supply less the value of land or undivided share of land and the value of land or undivided share of land shall be deemed to be one third of the total amount charged for the supply - the value of land or undivided share of land is deemed to be one-third of the total amount charged for the supply irrespective of the actual value of land and accordingly the applicant is eligible to avail deduction of one-third of the total amount charged for the supply in arriving at the taxable value of the supply.

CONCLUSION

One-Third is the maximum deduction allowed for value of Land in current legislation. A Suitable amendment should be brought in for allowing the actual value of Land as in absence of it, through deeming fiction value of Land is taxable which is not as per sprit of Constitution as taxing Land is State matter.

CAclubindia

CAclubindia