Business valuation is the process of determining the economic worth or value of a business or company. It is a critical financial assessment that helps stakeholders understand the value of a business for various purposes, such as selling, buying, financing, investing, or making strategic decisions. Business valuation is not an exact science, but rather a combination of financial analysis, market research, and judgment. Several methods and approaches can be used to determine the value of a business, and the choice of method often depends on the specific circumstances and the nature of the business.

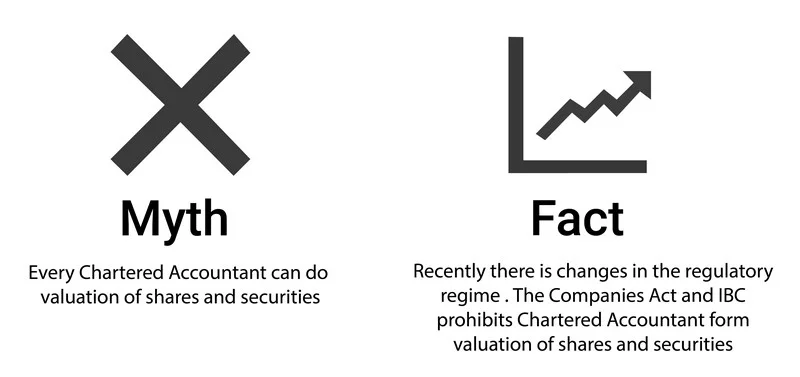

Let's understand myths vs fact

Who Can Do Valuation of securities and financial assets

Valuation Approaches

1. Market Approach

This approach compares the business to similar businesses that have recently been sold or are publicly traded. The most common method in this approach is the Comparable Company Analysis (CCA) and Comparable Transaction Analysis (CTA).

2. Cost Approach

This approach calculates the value of a business based on its tangible and intangible assets, minus its liabilities. It's typically used for asset-heavy businesses, like manufacturing companies.

"It is generally used as the minimum break-up value for the transaction"

3. Income Approach

This approach focuses on the income the business generates. The most common method within this approach is the Discounted Cash Flow (DCF) method, which estimates the present value of future cash flows the business is expected to generate.

When a Valuation Report from a Registered Valuer is Required

- Further issue of capital

- Issue of sweat equity shares

- Valuation of transactions entered between specified related party for a consideration other than cash

- Compromise or arrangements with creditors/members

- Merger and amalgamation of companies

- Purchase of minority shareholding

- Creation of security

- Return of allotment

- Valuation of assets as required by Audit Committee

- Valuation of assets and liability as required by liquidators

- Valuation of securities under various provisions of IBC, 2016

Business Valuation Services

Business valuation services are provided by professional firms specializing in the valuation of businesses. These firms employ experts with extensive knowledge and experience in assessing a business's worth using various methodologies.

At ValuGenius, we are a leading business valuation firm with top-tier credentials and a nationwide presence. Our team of dedicated experts combines years of experience and a deep understanding of business valuation to provide comprehensive and reliable services. We can help you to create valuation report by registered valuer. Contact to learn more about how our business valuation services can assist you in unlocking the true value of your business.

CAclubindia

CAclubindia