Are you investing in mutual funds, but don't know where these contributions will lead you? Don't be financially ignorant! It could lead to missed opportunities and even financial losses. To set realistic goals and easily achieve your dreams, start using a SIP calculator.

It is an online tool that estimates how much money you can accumulate over your investment tenure. All you need is to enter these three basic details:

- How much money do you plan to invest every month?

- For how many years do you want to invest?

- What percentage of returns do you hope to earn?

Post-entry, the calculator instantly calculates the approximate value of your total investment and returns. Due to its popularity and versatility, many leading banks and NBFCs have introduced various versions to serve investors' diverse needs.

They even offer several additional insights that significantly enhance your decision-making. Wish to know them? In this article, let's check out the top five SIP calculators for smart investors.

1. Basic SIP calculator

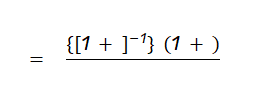

A basic SIP calculator gives a rough estimate of how much your SIP investments will grow over your investment period. Generally, such calculators are based on the following formula:

Where,

- M = The amount you will receive at the end of tenure

- P = The amount of money you plan to invest at regular intervals

- n = The number of times you have invested

- i = The expected rate of return

While making calculations, this calculator assumes that all your returns are reinvested and there is no redemption of units. The approximate value generated by the calculator also does not account for charges like exit loads or expense ratios.

2. SIP with inflation calculator

This calculator adjusts your investment returns by accounting for inflation. While a Basic SIP Calculator shows growth in absolute terms, this tool helps you understand the real value of your investments after inflation is factored in.

Let's understand through an example how it works:

- Say you want to invest in a mutual fund scheme that offers 12% annual returns.

- However, as per recent estimates, the inflation rate is 5%.

- Now, while estimating the future value of your investments, this calculator considers only net returns of 7% (12% - 5%)

In this way, this tool reveals the actual purchasing power of your investment at maturity. It is ideal for long-term planners and shows whether their investments grow faster than the inflation rate.

3. SIP step-up calculator

This calculator estimates the returns when you increase your SIP contributions annually. For example,

- Let's assume that you start with Rs. 5,000/ month

- You want to increase your SIP by 10% yearly.

- Now, the calculator adapts accordingly and shows the impact of these gradual increments.

This SIP calculator is ideal for those with growing incomes. It clearly shows how a gradual increase in investments lets you build a significantly higher corpus over the years.

4. SIP goal calculator

This SIP calculator works in reverse. Instead of showing the corpus at maturity, it calculates how much you need to invest monthly to reach a specific goal. For example,

- Say you want to save Rs. 50 lakhs for buying a home.

- You input this financial goal in the calculator along with the expected return rate and the tenure.

- Now, the calculator determines the monthly SIP required to achieve this goal.

This tool is perfect for goal-oriented planning, such as retirement, saving for a child's education or buying a house. Sometimes, such calculators also have an additional feature of EMI estimation. This allows you to instantly calculate EMIs for purchases made from online marketplaces or offline stores.

5. Lumpsum and SIP combination calculator

This tool combines both one-time (lumpsum) investments and regular SIPs to estimate the total corpus. Here you enter the following details:

- The lump sum amount

- SIP contributions

- Tenure

- Expected return rate

The calculator shows your combined growth after factoring in compounding. This SIP calculator is beneficial for those who prefer to invest a larger amount upfront and supplement it with SIPs.

Conclusion

By using SIP calculators, smart investors can easily set realistic financial goals and build a sizeable corpus. They come in different varieties and offer several advanced options like:

- Inflation adjustments

- Step-up contributions

- Goal-based planning

Ideally, you should identify your real need and choose a SIP calculator that maximises your returns. Lastly, since such calculators provide a rough estimate, you must keep reviewing your investments periodically.

CAclubindia

CAclubindia