In the words of Prime Minister Narendra Modi, the Goods and Services Tax (GST) is "a path-breaking legislation for New India". This revolutionary taxation system was rolled out on the midnight of 1 July, 2017 in a ceremony held in the Central Hall of Parliament. GST is not merely a tax reform but a milestone in realising Sardar Vallabhbhai Patel's dream of building 'Ek Bharat - Sreshtha Bharat'.

Need for GST

- Before 1 July 2017, the Indian indirect tax regime was highly fragmented. The Centre and States were separately taxing goods and services. There were many taxes like excise duty, service tax, VAT, CST, purchase tax, entertainment tax etc.

- In addition, there was a multiplicity of rates, laws and procedures. This caused a heavy compliance burden.

- Imposition of tax on tax was another serious problem. For example, VAT was levied on a value that included excise duty.

- Input tax credit chain broke as goods moved from one state to another, resulting in hidden costs for the business.

- There were tax nakas at every inter-state border, creating bottlenecks in inter-state transport of goods.

- Every state was effectively a distinct market for the industry as well as consumer.

- Industry's choice of locating factories or warehouses was heavily influenced by the prevailing tax regime rather than pure business consideration, making the industry uncompetitive.

The Journey to GST - Timeline

- 2000 - PM conceptualised GST and set up a committee to design GST model

- 2003-04 - FRBM Committee formed which recommended introduction of GST

- 2006 - Union Finance Minister, in the 2006-07 Budget Speech, announced the introduction of GST from April 1, 2010.

- 2009 - First discussion paper on GST released

- 2011 - Constitution (115th Amendment) Bill 2011 for incorporating relevant provisions of GST introduced in Parliament

- 2011-13 - GST Bill referred to Standing Committee

- 2014 - Constitution (115th Amendment) Bill lapsed with the dissolution of 15th Lok Sabha, necessitating a fresh Constitutional Amendment Bill

- 2014-15 - The Constitution (122nd Amendment) (GST) Bill, 2014 was introduced and passed in May 2015

- August 2016 - The Constitution (101st Amendment) Act was enacted

- September 2016 - Constitutional changes made vide 101st Amendment come into force. GST Council created, 1st GST Council Meeting held

- May 2017 - GST Council recommended all the rules

- 1st July 2017 - GST Launched

- Post 2014, the Central Government expedited the process, resumed discussions with states and all other stakeholders with new vigour.

- Two significant initiatives of the Government of India - creation of the GST Council and assuring the States of a guaranteed revenue flow to them proved to be decisive in bringing the States on board.

- Government of India assuring each State a minimum growth of 14 per cent per year for five years over their revenues. This commitment of Centre clearly showed its belief in the long-term benefits of GST and helped assuage the concerns of the States.

- Creation of Goods and Service Tax Network (or GSTN), a special purpose vehicle, by the Central Government, for automation of business processes with equal participation of Centre and States, with its adequate resourcing was also a major step taken by the Central Government towards GST.

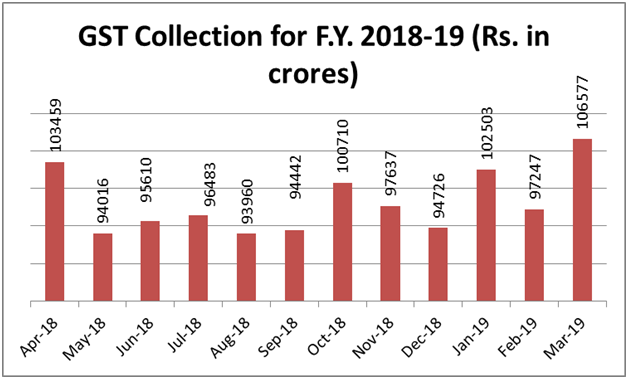

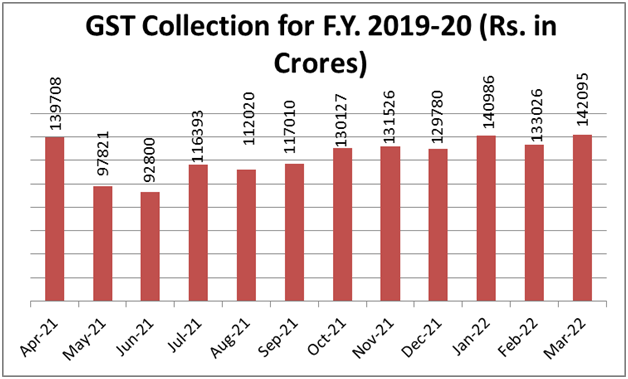

GST collection for the Last Four Years

- There was a record GST collection of Rs 1.42 lakh crore in March, 2022.

- The revenue for the month of March 2022 is 15% higher than the GST revenues in March 2021 and 46% higher than the GST revenues in March 2020.

- Total number of e-way bills generated in the month of February 2022 is 6.91 crore as compared to e-way bills generated in the month of January 2022 (6.88 crore) despite being a shorter month, which indicates recovery of business activity at faster pace.

Recent GST Updates

2022 GST Updates

24th June 2022

The 47th GST Council meeting is being held on the 28th and 29th of June 2022 in Chandigarh. Union FM Nirmala Sitharaman is chairing this meeting and may make key recommendations to revise rates for 14 goods and 22 services. Further, the GST exemption list could be trimmed down and modifications to the GSTR-3B format are expected.

26th May 2022

As per the CGST Notification no.7/2022 dated 26th May 2022, the late fee has been waived for the delay in filing GSTR-4 for FY 2021-22, if it is filed between 1st May and 30th June 2022.

24th February 2022

- The e-Invoicing system will get extended to those annual aggregate turnover ranging from Rs.20 crore up to Rs.50 crore starting from 1st April 2022, vide notification no. 1/2022.

- Composition taxable persons and those interested to opt into the scheme for FY 2022-23 must submit declaration on the GST portal in Form CMP-02 by 31st March 2022.

1st Feb 2022

The Union Budget 2022 introduced key changes to the GST law-

- Additional Condition has been imposed for availment of ITC u/s 16(2)- ITC can be availed only if the same is not restricted under Section 38 - as per the details communicated to the purchaser in GSTR-2B.

- ITC availment: Now ITC Credit will be available till 30th November for the following financial year. (Time-limit to avail ITC u/s 16(4) extended till 30th November of next year from 30th September.)

- Composition dealer registration cancellation dependent on non- filing of GST returns Section 10 Composition Taxpayers Registration can be cancelled suo-moto if they have not filed their GSTR-4 return beyond 3 months from the due date.

- Non-composition tax payer registration cancellation on non-filing of GST returns Registration of a person, other than those paying tax under section 10, can be cancelled if has not furnished returns for such continuous tax period as may be prescribed.

- Extension in time limit to issue of Credit Notes in respect of supply made in a financial year can be issued by 30th November of next financial year (currently allowed till 30th September).

- GSTR 1/ GSTR-3B rectification allowed till 30th November Any rectification of error in GSTR-1/ GSTR-3B is now permitted till 30th November of next financial year (currently allowed till 30th September).

- GST Outward Supply process to be amended

- Sub Section 2 of Section 37 of CGST omitted by giving away with two way communication process in Return filing. Now filing of details of outward supplies for a tax period on a sequential basis. Now, you cannot file GSTR-1 for Current period if no GSTR-1 for the earlier period is not filed. Rectification of error in GSTR-1 is now permitted till 30th November of next financial year (currently allowed till 30th September).

- Section 38 of the CGST Act is being substituted for prescribing the manner as well as conditions and restrictions for communication of details of inward supplies and input tax credit to the recipient by means of an auto-generated statement and to do away with two-way communication process in return filing.

- The due date for filing return under Section 39 (5), by a non-resident taxable person is prescribed as the 13th day of next month.

- Section 41 of the CGST Act is being substituted so as to do away with the concept of "claim" of ITC on a "provisional" basis and to provide for availment of self-assessed input tax credit. No ITC in case the supplier does not pay GST.

- Sections 42, 43 and 43A of the CGST Act are being omitted so as to do away with two-way communication process in return filing.

- Section 47 of the CGST Act is being amended so as to provide for levy of late fee for delayed filing of TCS returns under section 52.

- ITC availment on self-assessment basis

- Section 49 of the CGST Act is being amended so as to provide for prescribing restrictions for utilising the amount available in the electronic credit ledger.

- Section 49 of the CGST Act is being amended so as to allow transfer of amount available in electronic cash ledger under the CGST Act of a registered person to the electronic cash ledger under the said Act or the IGST Act of a distinct person.

- Section 49 of the CGST Act is being amended so as to prescribe the maximum proportion of output tax liability which may be discharged through the electronic credit ledger.

- Interest to be levied on ITC wrongly availed and utilised. If ITC is not utilised, then interest will not be levied. Section 50(3) substituted retrospectively w.e.f. 01.07.2017. (Clause 110)

- Section 54 dealing with refund is being amended

- Explicit refund claim of any balance lying in Electronic Cash ledger under Section 54.

- Time limit of 2 years provided for claiming tax refund on inward supplies of both goods or services u/s 55, from the last day of the quarter in which said supply was received.

- GST portal www.gst.gov.in notified

- Notified Retrospectively as the common portal for all the functions provided under CGST Rules 2017 except for E-way bill generation and for generation of invoices under Rule 48(4), (E- Invoicing) of CGST Rules.

- Rate of Interest under Section 50(3) (Reversal of Excess ITC wrongly availed and utilized) prescribed as 18% in all cases.

- GST Rates

- unintended waste generated during the production of fish meal (falling under heading 2301), except fish oil, is being exempted during the period commencing from the 1st day of July, 2017, and ending with the 30th day of September, 2019 (both days inclusive), subject to the condition that if said tax has been collected, the same would not be eligible for refund.

- Service by way of grant of alcoholic liquor license, against consideration in the form of license fee or application fee or by whatever name it is called by the State Governments, has been declared as an activity or transaction which shall be treated neither as a supply of goods nor a supply of service. Retrospectively w.e.f. 01.07.2017. However, no refund shall be made of tax which has been collected, but which would not have been so collected, had the said notifications been in force at all material times.

2021 GST Updates

29th Dec 2021

- The 46th GST Council meeting was held on 31st December 2021 in New Delhi. Union FM Nirmala Sitharaman led meeting has decided to defer the GST rate hike to 12% for textiles.

- CGST Rule 36(4) is amended to remove 5% additional ITC over and above ITC appearing in GSTR-2B. From 1st January 2022, businesses can avail ITC only if it is reported by supplier in GSTR-1/ IFF and it appears in their GSTR-2B.

- The due date to file GSTR-9 & self-certified GSTR-9C for the FY 2020-21 has been extended up to 28th February 2022.

- Further amendments are carried out to seizure and detention rules, penalties related to the same, and certain forms such as DRC-10, DRC-22, DRC-23 and APL-01 stands amended with the addition of new form DRC-22A as per Central Tax notification no. 40/2021.

21st Dec 2021

Following are the changes with effect from 1st January 2022-

- ITC claims will be allowed only if it appears in GSTR-2B as per Section 16(2)(aa). So, the taxpayers can no longer claim 5% provisional ITC under the CGST Rule 36(4) and ensure every ITC value claimed was reflected in GSTR-2B.

- The officer can issue notice under Section 74 to multiple persons for tax short paid or excess ITC claims by fraud. Now, it is amended that the officer can confiscate and seize goods or vehicles even after concluding proceedings against all persons liable to pay specific or general penalties.

- The taxpayers cannot file GSTR-1 if the previous period's GSTR-3B was not filed.

- The GST officers can initiate recovery proceedings without any show-cause notice against taxpayers who under-report sales in GSTR-3B compared to GSTR-1, under Section 75(12).

- All the e-commerce aggregators into food delivery services or cloud kitchens under Section 9(5) will be liable to pay tax on services provided through them. However, restaurants with accommodation with a tariff per unit of more than Rs.7,500 per day are kept out of the scope.

- The scope of passenger transport motor vehicles is expanded to include service rendered through omnibus and any other motor vehicle, but not just radio taxi or cab under Section 9(5).

- Following facilities will henceforth require taxpayers' aadhaar authentication- - To apply for a refund under the CGST Rules 89 (Excess tax, interest, penalty, fees paid) and 96 (IGST paid on goods or services exported out of India) in RFD-01. - To apply for revocation of cancelled GST registration under the CGST Rule 23 in REG-21.

24th Sept 2021

With effect from 1st October 2021, the frequency of filing the ITC-04 form has been revised through the Central Tax notification number 35/2021 dated 24th September 2021, as follows-

- Those with AATO more than Rs.5 crore - Half-yearly from April-September- due on 25th October and October-March due on 25th April.

- Those with AATO up to Rs.5 crore - Yearly from FY 2021-22 due on 25th April.

1st September 2021

45th GST Council meeting will be held on 17th September 2021. Tax concessions on COVID-19 essentials may be extended, Matter on GST compensation to states may be taken up, correction of inverted tax structure, etc are on the agenda.

29th August 2021

- Time limit to avail GST Amnesty Scheme extended up to 30th November 2021. It continues to apply for GSTR-3B from July 2017 up to April 2021 via CGST notification number 33/2021 dated 29th August 2021.

- Taxpayers can get extended time up to 30th September 2021 to revoke cancelled GST registration if the last date for the same falls between 1st March 2020 and 31st August 2021. It applies if the GST registration is cancelled under Section 29(2) clause (b) or (c) of the CGST Act via CGST notification number 34/2021 dated 29th August 2021.

- Company taxpayers can continue filing GSTR-1 and GSTR-3B using EVC or DSC up to 31st October 2021 via the CGST notification number 32/2021 dated 29th August 2021.

26th August 2021

From 1st September 2021, taxpayers will not be able to file GSTR-1 or use the IFF for August 2021 on the GST portal if they have pending GSTR-3B filings. It applies if GSTR-3B is pending for the past two months till July 2021 (monthly filer) or for the last quarter ending 30th June 2021 (quarterly filer), as per CGST Rule 59(6).

30th July 2021

- A GST registered person whose aggregate turnover in the financial year 2020-21 is up to Rs.2 crore has been given exemption from filing Form GSTR-9 (annual return) for the FY 20202-21.

- The section 35(5) is omitted and section 44 is amended, so that the taxpayer can submit the reconciliation statement on a self-certification basis instead of being furnished after audit and certification by CA/CMA.

- The taxpayers having aggregate turnover up to Rs.5 crore are not required to file self-certified GSTR-9C . Further, changes are notified to the format of Form GSTR-9C from FY 2020-21 onwards.

30th June 2021

Any late fee, otherwise chargeable for non-compliance with the dynamic QR code requirement from 1st December 2020 to 30th September 2021, is waived.

01st June 2021

The summary of CBIC notifications is as follows:

- The amendment of Section 50 through the Finance Act 2021 has been notified to come into effect from 1st July 2017, retrospectively. Now, interest shall be computed on the net tax liability after reducing eligible ITC from the total liability. It is to be noted that the interest shall be debited from the electronic cash ledger.

- The reduced late fee has been notified for GSTR-1 and GSTR-3B returns from June 2021 onwards.

- The maximum late fee for GSTR-4 that can be charged will be restricted to Rs.500 per return for nil filing and Rs. 2,000 for other than nil filing.

- The late fee chargeable for GSTR-7, i.e. TDS filing under GST, shall be a maximum of Rs. 2,000 while late fee per day charged is reduced from Rs.200 to Rs.50 per day of delay per return.

- CGST notification no. 13/2020 amended for fresh exclusions from the need to issue e-invoices. Now, the e-invoicing system shall not apply to a government department and local authority.

28th May 2021

43rd GST Council meeting took place on 28th May 2021 (Friday) at 11 A.M. via video conferencing and was chaired by Union FM Nirmala Sitharaman. The Council approved the GST amnesty scheme to be re-introduced, the late fee was rationalised for all taxpayers, especially for small taxpayers and IGST is exempted on import of COVID treating equipment and relief materials up to 31st August 2021.

Budget 2021: Updates as on 1st February 2021

- Section 16 amended to allow taxpayers' claim of input tax credit based on GSTR-2A and 2B. Henceforth, ITC on invoices and debit notes may be availed only when the details of such invoice or debit note have been furnished by the supplier in the statement of outward supplies, and such details have been communicated to the recipient of such invoice or debit note.

- Section 50 of the CGST Act is being amended to provide for a retrospective charge of interest on net cash liability, with effect from 1st July 2017.

- With respect to orders received on detention and seizure of goods and conveyance, 25% of penalty needs to be paid for making an application for appeals under section 107 of the CGST Act. Date of applicability is yet to be notified.

- GST audit requirement by specific professionals such as CAs and CMAs has been removed from the GST law. Section 35 and 44 have been amended in this regard. As per the amendment, only GSTR-9 annual returns on a self-certification basis need to be filed on the GST portal by taxpayers, completely removing the requirement for GSTR-9C, i.e. the reconciliation statement. However, the financial year and date of applicability are yet to be clarified by the government.

- section 7 of the CGST Act was amended to include a new clause under the definition of supply. Activities or transactions involving the supply of goods or services by any person, other than an individual, to its members or constituents or vice-versa, for cash, deferred payment or other valuable consideration falls under supply and will be liable to tax. Earlier, this supply would have been considered as only supply of goods under schedule II. So, the scope is expanded now for levy.

- Seizure and confiscation of goods and conveyances in transit are now made a separate proceeding from the recovery of tax from Section 74.

- Self-assessed tax referred to under section 75 of the CGST Act shall also cover the outward supplies/sales as reported in the GSTR-1 under Section 37 of the CGST Act, but which has been missed out while reporting in the GSTR-3B under Section 39.

- The provisional attachment shall remain valid for the entire period starting from the initiation of any proceeding till the expiry of a period of one year from the date of order made thereunder.

- Section 129 is delinked from Section 130. Accordingly, proceedings relating to detention, seizure and release of goods and conveyances in transit will be separate from the levy of penalty for the confiscation of goods and conveyance.

- The Jurisdictional Commissioner can now call for information from any person relating to any matter dealt with in connection with the Act under Section 151, together with section 168. Further, section 152 is amended to provide an opportunity of being heard before using information obtained under Sections 150 or 151 of the Act

- The IGST Act was also amended in Section 16, that defines a zero-rated supply. Three amendments were made - (1) To state that supply to SEZ units /developers will be zero-rated only if it is authorised operations. (2) Only notified persons or supplies of goods/services can avail the status of zero-rated when IGST is paid. (3) Foreign exchange remittance will be linked in case of export of goods with the refund.

CAclubindia

CAclubindia