In today's fast-evolving tax environment, the Goods and Services Tax (GST) has revolutionized how businesses manage their taxes. The complexities of GST compliance have made it essential for tax professionals to adopt reliable GST Return filing and ITC reconciliation software. However, with numerous options available, choosing the right software can be a challenge. This guide will walk you through the key features to consider when selecting the best GST software and provide an in-depth review of EasyGST, a leading GST software Solution for Chartered Accountants and tax professionalsin India; developed by Electrocom Software Pvt. Ltd.

Why GST Software is Essential for Your Practice

GST software plays a critical role in simplifying tax compliance. It ensures accurate tax calculations, facilitates return filing, automates data reconciliation, and helps maintain compliance with the latest GST regulations. By automating these complex tasks, the right software saves time, minimizes errors, and ensures that businesses remain compliant with tax laws.

Key Features to Look for in GST Software

When evaluating GST software, keep an eye on below features to ensure you choose the best solution for your practice, EasyGST - The Complete GST Return filing & Re-conciliation software have all these features for Professionals in GST practice.

1. Single-Click GST Return Filing

Efficient return filing is a must for any GST software. EasyGST software offers a comprehensive dashboard where you can file all types of returns-GSTR-1, 3B, 4, CMP-08, 9, and 9C-without navigating multiple menus. This centralized filing system simplifies the process, saving your time and boosting productivity.

2. Seamless Data Import and Export

EasyGSTsoftware streamlines data entry by allowing users to import data from Excel sheets or JSON files. You can also export reports in various formats, such as Excel, making the software flexible and convenient. This feature reduces manual data entry errors and increases the speed of your operations.

3. User-Friendly Interface

The software's interface should be intuitive and easy to navigate, enabling professionals to complete tasks quickly. EasyGSTsoftware excels in this area, offering a clean and simple user interface that even first-time users can master with ease.

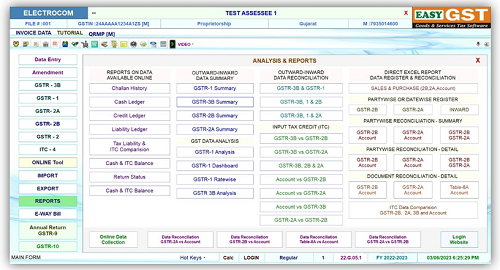

4. Comprehensive Dashboard

A well-designed dashboard that offers a bird's-eye view of all GST-related tasks ensures you can easily monitor your operations. EasyGST software provides a holistic view of all GST-related activities simplifying monitoring and management, enhancing overall efficiency.

5. Accurate Tax Calculations

Accuracy is key in tax management. EasyGST software automatically calculates taxes according to the latest GST laws, helping you avoid mistakes and maintaining a clean compliance record for your clients.

6. Intelligent GST Reconciliation

One of the most challenging aspects of GST compliance is reconciling data. EasyGSTsoftware simplifies this process by matching data from GSTR-2A and GSTR-2B with your accounting books. This feature ensures that all transactions are accurate and fully compliant with tax regulations.

7. Data Pre-Validation for Error-Free Filing

To prevent filing mistakes, EasyGSTsoftware provides multiple data validation checks before submission. This helps to catch errors early, ensuring accurate and timely return filings and reducing the risk of non-compliance.

8. Reliable Customer Support

No software is complete without robust customer support. EasyGSTsoftware offers dedicated technical and functional support to assist users whenever issues arise, guaranteeing a smooth and hassle-free experience.

EasyGST Dashboard

Why EasyGST is the Best Choice for Chartered Accountants & Tax Professionals

Among the many GST software options available, EasyGST stands out as a top contender for its rich feature set, affordability, and ease of use. Here's why:

- Time-Saving Automation: From return filing to reconciliation, EasyGST automates time-consuming tasks, allowing tax professionals to focus on more critical aspects of their business.

- Advance user Interface: Designed with tax professionals in mind, EasyGST offers a simple, intuitive interface that requires minimal training.

- Advanced Security and Privacy: Data privacy is paramount. With EasyGST, your data remains stored locally, giving you complete control and ensuring the highest level of privacy.

- Competitive Pricing: Compared to its competitors, EasyGST offers a comprehensive suite of features at a competitive price, making it an ideal choice for tax professionals looking for value without compromising quality.

Conclusion: Elevate Your Tax Practice with India's leading GST Software - EASYGST

Choosing the right GST software can drastically improve your practice's efficiency, accuracy, and compliance. EasyGST Software stands out as the Best software solution for Chartered Accountants and Tax Professionals in India, thanks to its powerful features, user-friendly interface, and unmatched customer support.

Ready to streamline your GST processes? Try EasyGST Software today and see how it can transform your tax practice.

CAclubindia

CAclubindia