This article is going to help its readers and would assist in the easy filing of the TDS Returns. At the completion of this article, they would be knowing below mentioned steps:

How to file TDS return and without the help of an expert and also without using any software.

In the whole procedure, only the utility available on NSDL website would be used.

This article is a complete guide for filing the TDS return without the help of any expert or any software.

Introduction

There would be two forms for each TDS Return 1) Form 24Q and 2) Form 26Q

Form 24Q is for the details of TDS deducted and deposited on salaries, and

Form 26Q contains the details of TDS under all other heads

Step 1. Firstly, we need to get our data compiled in the prescribed format. The Compilation process is the most crucial and important. As the compilation of the entire data is complete it becomes very easy to file the TDS Returns.

In TDS return utility, basically, two types of information are filled:

1) Details related to challans

2) Details of the deductee for whose dues, a challan is being filed. The taxpayer needs to compile the details challan wise.

Now, let us discuss the points in details:

Firstly, we need to get all the details compiled which would be furnished in the challan. As discussed earlier, we will be having 2 types of challans. Challans for TDS deposit under section 192 is for salary. The First type of challan is used in filing Form 24Q which is for Salary and the other type of challans would be utilized in filing 26Q which is filled with details other than salary.

Below is the information which is required in context to the challan:

|

Amount of challan |

BSR code of bank where challan is deposited |

Date of challan deposited (mentioned on challan itself) |

Amount of challan |

Challan serial number (mentioned on challan itself) |

A minor head of challan will be 200 in most of the cases (400 code will be in case of TDS demand is raised by Income tax department itself) |

Note: Another task after the compilation of data for all the challans, the taxpayer needs to compile the deductee wise details.

The Below fields would be required in the compilation of deductee wise details. Below is provided the format which would be beneficial for filling the form 24Q

And for form 26Q the below format and information under each head would be required for filling the form.

Once the taxpayer gets ready with the data, the next step for him is to download the utility for filing the return.

Here, he would have to download two files. First one, to feed the data and another one, to file the return.

Download One:

Follow the link below and download the 'Return preparation utility’ abbreviated as RPU. https://www.tin-nsdl.com/services/etds-etcs/etds-rpu.html

Download Two:

The second download would be the 'File validation utility’ which also needs to be downloaded, i.e, the FVU file. Click on this link (Highlighted in the image below). https://www.tin-nsdl.com/services/etds-etcs/etds-file-validation-utility.html

Download Three:

With the help of the below link, the 'challan detail file’ could be downloaded from TIN website. https://tin.tin.nsdl.com/oltas/servlet/TanSearch.

One could find this form there. Again, the Tax Deduction and Collection Account Number TAN, the period should be furnished in the form. Now, click on download challan file.

The generated file should be saved in the same folder as it will be used later.

Extract utilities:

Once both the utilities are downloaded, we need to extract them. But Firstly, we would use the RPU file to fill data. The FUV file would be used later while filling data in RPU. After that, the taxpayer needs to click on this exe file and start filling information.

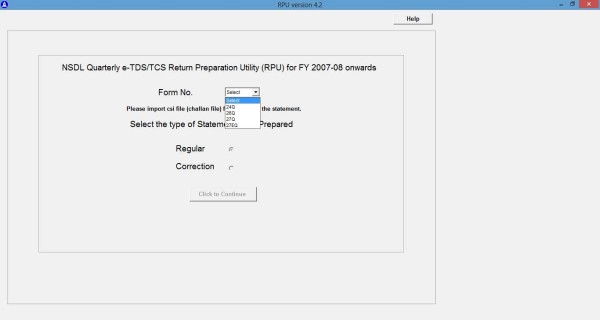

Step-1: This utility belongs to the taxpayer and he is supposed to fill entire data here. Let us start with this. When you will open this utility you will find a window as shown below in the print-shot

Step-2: Now, it is upon the Choice of the Taxpayer to choose for which form he wishes to fill first. We would be dealing with both 24Q and 26Q one by one. Firstly, Form 24Q which is filed for the Salary deductee.

Below are the steps involved:

-

Choose 24Q from the dropdown list

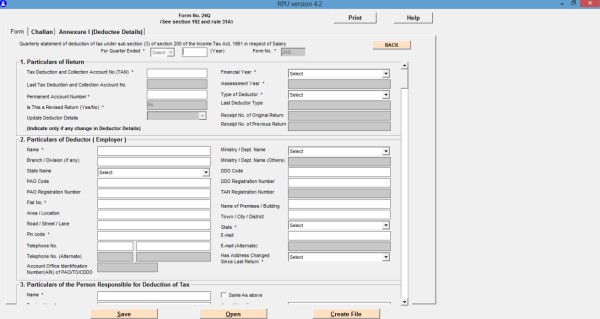

The page would open. Here the deductee could furnish his/her details, viz, name, addresses, TAN, PAN, financial year, quarter, type of entity, Responsible person and his details. After filing this form we need to click on the challan tab.

Step-3: Now, all the data related to the details asked in the challan should be furnished for the quarter for which the taxpayer is filing the return.

1) The fields like Amount, challan no., Bank’s BSR no., date, etc are required to be filled there as shown in the image below.

2) Once the challan details are filled the taxpayer need to fill deductee-wise details against each and every challan. Now, moving to the annexure, the details already compiled should be fed in the fields. Many of the fields could be copy-pasted.

3) Once entire data is fed in the form, we need to check the whole form for the entire form is correctly filled with correct and authentic data. Getting confirmed, we can now click on save to get the file saved. Here a file with the name of form +qtr would get generated, refer to the image below.

This file is editable so if required it could be opened and edited.

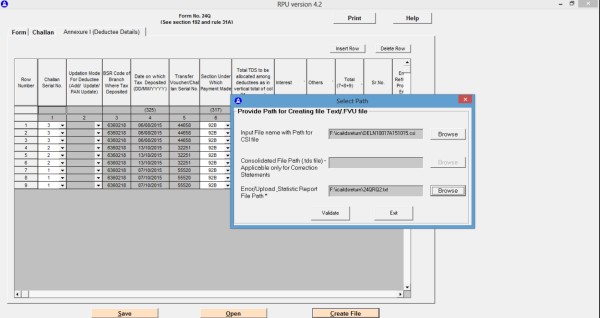

4) Again, for the filing purpose, we need to create a separate file so, we should click on 'create’. A dialogue box will open and would ask for csi file.

5) Click on that file and chose a folder for error file. (you just click it will choose that path itself) and then click on validate.

6) A File validation utility (FUV) file would get created. Now, get the FUV utility extracted and click on the jar file. A small window like this would open.

7) After that, the Challan input file and TDS input file needs to be upload which gives a path to a new error file which needs to be generated. Refer to the print-shot below.

8) Again When you will click on ok, the error file would open in the browser.

9) Get the errors corrected and try again. Once you are done without errors, a new file would be generated in the face of Form 27 A in pdf format which could be uploaded directly or could be sent for filing.

Now the procedure for Form 26Q

In Form 26Q, all the steps would be identical. The basic difference would be that some extra information is required to be filled while filling the deductee wise details.

The process becomes easier as we have already compiled them in our format as shared in this article. Rest all of the processes would be the same for both forms. Every taxpayer must try filing the TDS Return filing on their own. They, for the first time, might face some problems but once the formats are set, it becomes very easy and the steps are jotted down to ease the return filing process. A habit of compiling data hand to hand along with keeping a track of every transaction prevents the last time rush.

Note: Whenever a new payment is made we need to ask for its PAN copy and we need to get it updated. This would ease the filing procedure.

There is a number of TDS software available in the market but most of the taxpayers suggest and Government authorized Gen TDS return filing software in complete TDS e-filing as per TRACES and CPC, India.

CAclubindia

CAclubindia