To make the information more appealing to Chartered Accountants (CAs) and finance professionals, the focus should be on tax trends, financial insights and the significance of high tax payments by celebrities. Here's how the key points can be tailored to engage them:

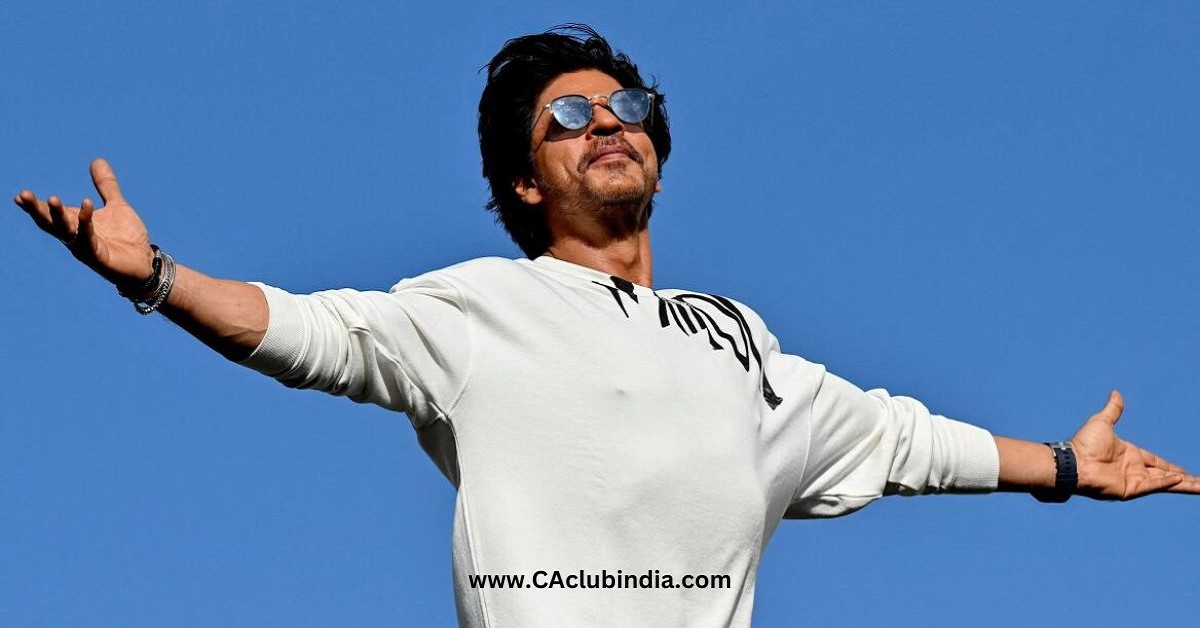

Shah Rukh Khan Tops Taxpayer List

Khan's ₹92 crore tax payment highlights his substantial earnings from multiple revenue streams, including movies, brand endorsements, and business ventures. This could indicate strategic tax planning and financial management.

Rising Tax Payments in the Entertainment Industry

Vijay and Salman Khan's tax payments of ₹80 crore and ₹75 crore, respectively, suggest a strong financial performance by South Indian cinema and Bollywood. Analyzing their earnings could provide insights into the regional and national film markets.

Notable Absence of Akshay Kumar

Akshay Kumar, the highest taxpayer in 2022, did not make it to the list this year, possibly due to a series of underperforming films. This shift shows the direct impact of an individual's professional performance on their tax contributions.

Diversification of Income Sources

Stars like Amitabh Bachchan (₹71 crore) and Virat Kohli (₹66 crore) reflect the diversification of income sources beyond their primary professions. Kohli's endorsements and business ventures demonstrate the growing importance of non-core earnings.

MS Dhoni and Ranbir Kapoor in Top 10

With tax payments of ₹38 crore and ₹36 crore, respectively, Dhoni and Kapoor showcase the relevance of celebrity income from endorsements and strategic investments.

Financial Planning Insights

The presence of multiple celebrities like Hrithik Roshan, Sachin Tendulkar, and Kapil Sharma, paying upwards of ₹26 crore each, underscores the need for effective financial and tax planning among high-net-worth individuals.

Regional Representation

South Indian actors like Mohanlal and Allu Arjun being in the top 20 list indicates a strong financial foothold in regional cinema, showing growth beyond Bollywood.

Impact of Box Office Performance on Tax Contributions

Shah Rukh Khan's successful 2023 films, including "Pathaan" and "Jawan," significantly boosted his earnings and tax contributions, showcasing the direct link between box office success and tax obligations.

Shifting Trends in Celebrity Taxation

The changing positions of celebrities on the taxpayer list highlight the dynamic nature of income trends within the entertainment industry, which CAs can leverage for advisory services.

This approach focuses on financial data and tax trends, making the content highly relevant and insightful for finance professionals.

CAclubindia

CAclubindia