The provisions related to Deduction of Tax on Purchase of Property are spread over different places under Income Tax of India. The nature of such transactions are limited in day to day affairs. Due to smaller frequency, in case anything is missed out during the transaction period, it becomes very difficult for buyer to address and resolve the queries from the Income Tax Department which generally comes at very later date, at which many times the seller may not be approachable. Therefore, holistic understanding of these provisions are important for the buyer and it is very important for Buyers to understand clearly his duties, roles and responsibilities while buying the property. This article attempts to compile all relevant information at one place, bundled together in easy Q&A format and to provide SOP for handling the process in step wise step format.

The provisions related to tax deduction on purchase of property are spread over different places under Income Tax Act. Therefore, holistic understanding of these provisions are important for the buyer. The nature of such transactions are limited in day to day affairs. Due to smaller frequency, in case anything is missed out during the transaction period, it becomes very difficult for buyer to address and resolve the queries from the Income Tax Department which generally comes at very later date at which many times, the seller may not be approachable. Therefore, it is very important for Buyers to understand clearly his duties, roles and responsibilities while buying the property.

Filing of Return of TDS on purchase of property under Income Tax Act under Form 26QB can be tricky and at times. It becomes more frustrating when there is some mistake after filing as the correction process may not be friendly for common person.

UNDERSTANDING THE RETURN

First of all let us understand the following aspects about this Return:

- What is this Return?

- When this Return is to be filed?

- Who has to file this Return?

- What if someone does not file the Return?

- Is this one time Return?

- How many times this Return can be filed?

- Can this be corrected, if any mistake happen?

Understanding the Law in common man words

|

Question |

What Law Says |

What does it mean in simple language |

|

Which Income Tax Provision Governsthis return |

Section 194-IA |

Self Explanatory |

|

Who is Required to deduct the tax |

Any person, being a transferee, responsible fo rpaying (other than the person referred to in section 194LA) |

The definition of Person given under the Act is wide. Therefore this section does not only apply to Individuals but also to HUF, Firm, LLP, Companies, Municipal corporation, AOP, BOI etc. The residential status of buyer is not relevant here for the purpose of this section. Therefore, this section will be applicable even on non-resident buyer for dealing any property situated in India. |

|

Who can be seller? |

To a resident transferor |

This section will be applicable only when the seller is resident of India as per Income Tax provision. Therefore, tax shall not be deducted under this section for purchase of property from a non-resident. In that case tax will be deducted under section 195. |

|

What amount has to be considered for deduction of tax? |

Any sum by way of Consideration |

The amount payable as consideration for purchase of property has to be considered for deduction of tax. Therefore, in case of multiple buyers, the tax need to be deducted by each buyer on the value of money paid by him individually. "consideration for transfer of any immovable property" shall include all charges of the nature of club membership fee, car parking fee, electricity or water facility fee, maintenance fee,advance fee or any other charges of similar nature, which are incidental to transfer of the immovable property |

|

Which type of properties or covered under this section for deduction of tax? |

For transfer of any immovable property (other than agricultural land) |

The section will be applied only in case of purchase of immovable property. This can be piece of land, any residential property, commercial property etc. However, agricultural land has been excluded from this section, therefore, where someone buys the agricultural land, in that case he need not to deduct any tax under this section. However, such agricultural land must not situated within 8 km of any municipal area, cantonment area etc..immovable property" means any land (other than agricultural land) or any building or part of a building; In case of multiple buyers, meaning of property should be understood with reference to his individual share in property and not the entire property. |

|

At which time, one need to deduct tax? |

Shall, at the time of credit of such sum to the account of the transferor or at the time of payment of such some in cash or by issue of a check or by any other mode whichever is earlier |

That Tax has to be deducted at the time when payment is made or where the amount has been credited to the account of transfer or, whichever is earlier. Thus, where a company credits the amount to the ledger of seller, the tax need to be deducted under this section, whether or not the amount has actually been paid. However, in case of individual where no books of accounts are maintained by him, the tax need to be deducted at the time of payment. This clarifies the situation where amount is paid by buyer in multiple instalments. As per this section, the buyers need to deduct tax at each such payment of instalment. |

|

What will be the rate of tax deduction? |

Deduct an amount equal to1% |

The buyer need to deduct tax at the rate of 1% on the amount paid by him in each instalment. |

|

What shall be the value considered for deduction? |

Of Such sum or the stamp of such property, whichever is higher |

At times, there is difference between the actual transaction value and the stamp duty value of property. In such cases though amount paid may be less than stamp duty value but the tax needs to be deducted on the highest value. |

|

Whether amount deducted will be available as benefit to seller or it shall be additional cost to him? |

As Income tax thereon. |

The amount of tax deducted by buyer will not be cost to seller, but it will be available as advance tax deposited by seller and the refund if any, will be available for claim by the seller. |

|

Is there any threshold limit below which tax need not to be deducted? |

No under sub-deduction section shall be made (1)where the consideration for the transfer of an immovable property and the stamp duty value of such property, are both, less than fifty lakh rupees |

Yes, where the purchase price of property as well as the stamp duty value is less than Rs.50 lakhs, in such case, no tax needs to be deducted under this section. |

EXAMPLES FOR APPLICABILITY

|

Status of Buyer |

Resident |

Resident |

Resident |

Resident |

Non-resident |

Resident |

Non-resident |

|

Status of Seller |

Resident |

Resident |

Resident |

Resident |

Resident |

Non-resident |

Non-resident |

|

Value of Sale of Property |

> 50 L |

> 50 L |

< 50 L |

< 50 L |

> 50 L |

> 50 L |

> 50 L |

|

Stamp duty Value of Property |

> 50 L |

< 50 L |

< 50 L |

> 50 L |

> 50 L |

> 50 L |

> 50 L |

|

Applicability of section 194 - IA |

Applicable |

Applicable |

Not Applicable |

Applicable |

Applicable |

Not applicable |

Not applicable |

|

Reason |

All conditions are satisfied |

All conditions are satisfied even when some duty value is less than 50,00,000 |

Both transaction value and stamp duty value is less than Rs.50,00,000 |

All conditions are satisfied even when transaction value is less than 50 lakhs but the stamp duty value is greater than 50,00,000 |

Status of buyer is not to be looked into. All other conditions are satisfied. |

The seller is non-resident. |

Both buyers and sellers or non-resident. |

Where do I find this form on the Income Tax Portal?

Unlike other Income tax forms, which are found under 'Income Tax Forms' tab, you need to navigate to the option of 'E- Pay Tax'. You need to click on 'New Payment' button. Here you will find various forms through which different taxes are paid. Scroll to Form Number 26QB (TDS on Sale of Property) and click on 'Proceed'

Precautions before starting the filing of form

You need to take a few precautions before moving forward filing this form. You need to complete address in your income tax profile. In many cases, it happens that either your residential status, country, pin code, area, locality et cetera or not filled properly. You need to complete the profile first and then move forward for filing of this phone.

Filing of the Form

Excited!! Let's start actual filing of Form. Initial fields are simple and in most of the cases these are pre-filled.

Page-1

The first thing you need to select is your 'Residential Status'. As given in Example-1, the buyer of property can be either Resident or Non-Resident of India. Therefore you need to specify your Residential Status here.

Please Note that the Residential Status has to be checked at the time of filing of form. On the First Page, it shows your information from the profile section which are pre-filled and are freezed. However, do double check before moving forward.

Next, you will see the question "Whether more than one buyer?". This is relevant when there are joint buyers for the C property. Now please understand that each buyer has to fill this form separately for his share of property.

Page-2

We proceed further to the next page of this form which captures/requires the detail of seller of the property.

Please keep all these details handy and it is better to obtain the copy of relevant documents from seller from which the details can be sent. This will help avoiding unnecessary issues of feeding errors.

The form requires PAN twice. If Aadhaar of seller is available, please mention. If you mention the PAN of supplier correctly, the Name and category of Seller is auto populated from the Income Tax database.

Do crosscheck and in case you find any error, please intimate this to seller and ask him to rectify by updating correct information in his profile. The last question it asks on this page is "Whether more than one seller?". Like multiple buyers, there can also be multiple co-owners of the property. You need to file different Form for each co-owner of property. Please select the correct answer. Yes/No.

Page-3

So long so easy. Moving forward to next page. Here the form requires the detail of property. You need to select the Type of Property which is Land or Building. In case, entire building is purchased along with land please don't get confuse and select the Building. From the initial discussion, we know that this form is applicable only to these kind of Immovable property only.

Please mention complete details of the property along with PIN Code. You should be double sure that it is the same address which will be used while making the registration of property. Here it asks some Important dates and value. First is the date of agreement/booking. This is the date when the agreement to sell was first made.

Where the deal contains progressive payments or the instalments, the date of agreement/ booking shall not change in any of the form. This will remain constant till final payment is made. The next column is 'Total value of consideration (Property Value). To understand the value of property, let us discuss following example.

The property being purchased will be equal to the amount that belongs to each buyer. If the value of property is Rs.60 lakhs and there are two buyers buyer A and B paying 60% and 40% respectively. Thus, the value of property purchased by A will be 60% of Rs.60 lakhs i.e. Rs.36 lakhs. Similarly for buyer B, the value of property shall be 40% of total property which will be 40% of 60 lakhs that is 24 lakhs.

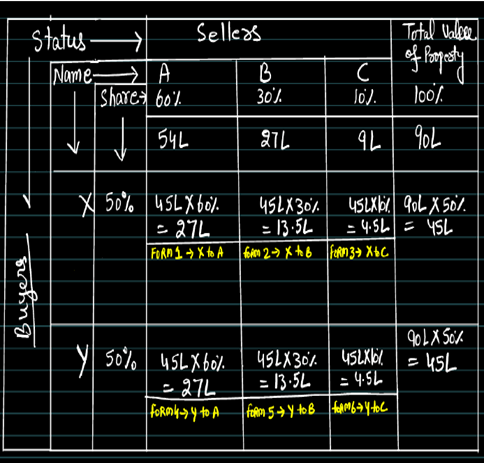

Now the question comes when there are multiple buyers and multiple seller. In this case each buyer is buying the property from each seller to the extent of his share. This can be understood easily from following example

In this example, there are three sellers A (60%), B (30%) and C (10%) co-ownership of Property. The total value of property is Rs. 90 Lakhs. also, there are Two Buyers X (50%) and Y (50%) co-ownership for buying the property.

There are Six segments of transactions

(1) X buys 27L of Property from A,

(2) X buys 13.5 Lakhs of Property from B, (3) X buys 4.5L of Property from C

and similarly for Y.

Therefore, each Buyer need to submit three different form of TDS deduction. The number of forms required to be submitted will multiply for each instalment.

You should be very careful while declaring the value of property. This can be tricky and many times becomes problematic when incorrect value of property is mentioned by buyer.

Next field is date of payment/credit made to seller. This will be the date of actual payment payment for which the Form is being filed.

Next field is date of deduction. Generally the date of deduction is the same as date of payment.

Next field is the 'Payment Type'. You need to select from any of two options i.e. Instalment or Lump-sum. Where you select Lump-sum, next question becomes irrelevant and thus is automatically freezed. However, if you select the type of payment as Instalment, you need to answer next question which is 'Whether it is last instalment?'.

Next question is whether "Stamp Duty value is higher than sale consideration?". You need to select any of two i.e. Yes/No. We understand from the initial discussion that we need to pay tax on highest of two values i.e. Value of property or the Stamp Duty value. Here it is important to note that the stamp duty value of the property will be only for the same portion of property which is being bought by the co-owner from the co-seller.

In case of subsequent instalments, the next question is to be answered, which asks about "Total amount paid/ credited in previous instalments (A)". Here you need to mention the total amount which has been paid already created till last instalment.

Please note that if you have deducted tax in last instalments also it is considered as part of payment to seller. Therefore, if in previous instalments, amount of Rs.20 lakhs was payable but you have deposited 1% of 20 lakhs as TDS which is Rs. 20,000 and have made actual payment of 19,80,000 to the seller, you need to mention Rs.20 lakhs in this field.

The next field is pretty simple which asks about the 'Amount paid/credited currently (B). Here you need to mention the amount that is being currently Paid (including the TDS).

Next field is total stamp value of the property (C). As we have discussed the stamp duty value shall be for the portion of property being purchased by co-buyer from the co-seller where there are multiple buyers and multiple sellers.

Next you need to understand that how the tax to be deducted is computed.

- Where it is the Instalment payment which is not the last instalment, the TDS shall be deducted on the amount paid till previous instalments (A) plus amount paid in current instalment (B).

- Where it is the last instalment, the amount of tax is to be deducted on higher of two.

a. Total amount paid till last instalment (A) plus payment in Current instalment (B) or

b. the Stamp duty value of the property (C).

3. Where it is the lump-sum payment, the tax will be deducted on higher of the lump-sum payment or stamp duty value for the property.

The system automatically calculate the amount on which TDS is to be deducted as per this formula. Please double check the amount calculated by system and once you are satisfied click on Next.

Here you will find different ways for payment of tax which includes net banking, debit card, pay at bank counter, which is off-line, RTGS/NEFT and through payment gateway.

Congratulations, you have successfully completed the deduction of Tax on Property!!

FAQs from Practical Work

Q. Do I need to apply for any Registration for filing of this return?

A. No, Your PAN is sufficient to file this.

Q. When do I file this Return?

A. By end of next month in which deduction was made. If payment is done on 5th July, you can submit this by 31sst Aug.

Q. What if I could not file it within time or forget?

A. You can still file this after due date with interest @ 1.5% per month or part thereof.

Q. How may times do I need to file this return?

A. For each payment made till final installment is paid.

Q. What if I make any mistake in filing this Return?

A. There are many details which can be rectified in the return online like PAN of seller, Address of Property, Transaction Value of Property etc.

CAclubindia

CAclubindia