Union Finance Minister Smt Nirmala Sitharaman on July 23rd, 2024 under new tax regime, hiked the standard deduction to Rs. 75,000 from the current Rs. 50,000.

Salaried employees will now stand to save Rs. 17500 in income tax.

Applicability

Standard Deductions is a fixed deduction allowed under the Act to reduce the tax burden under the hands of the Taxpayers.

The standard deduction is subtracted from an individual’s gross salary or pension income, for lowering the taxable income under the head “Income from Salaries.”

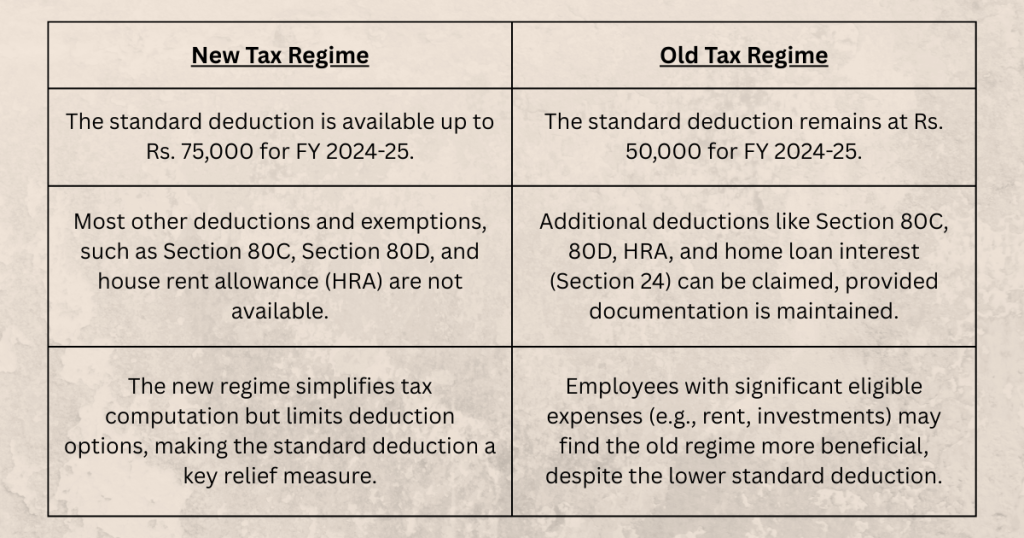

The standard deduction is independent of other deductions and exemptions, but its applicability depends on the tax regime chosen:

Tax Slabs for New Regime for FY 2024-25

| Tax Slab (in Rs. ) | Rate of Tax (in %) |

| 0-7,00,000 | NIL |

| 3,00,000-7,00,000 | 5% |

| 7,00,000-10,00,000 | 10% |

| 10,00,000-12,00,000 | 15% |

| 12,00,000-15,00,000 | 20% |

| Above 15,00,000 | 30% |

How to Claim the Standard Deduction?

Taxpayers do not need to submit any proof for the expenses to claim this deduction.

No Documents Required

The deduction gets automatically applied based on the salary reported in the Income Tax Return without requiring any proof of expenses, making it distinct from other deductions that need documentation.

Impact of Standard Deduction under various Salary Levels

Annual Income: Rs 7.75 lakh

| Standard Deduction | Rs 75,000 |

| Taxable Income | Rs 7 lakh |

| Tax Calculation | Tax on income up to Rs 3 lakh: Nil Tax on income Rs 3-7 lakh: 5% or Rs 20,000 Rebate under Section 87A: Rs 25,000 |

| Total Tax | Nil |

Annual Income: Rs 10 lakh

| Standard Deduction | Rs 75,000 |

| Taxable Income | Rs 9.25 lakh |

| Tax Calculation | Tax on Rs 3 lakh: Nil Tax on income Rs 3-7 lakh: 5% or Rs 20,000 Tax on Rs 7-9.25 lakh: 10% or Rs 22,500 |

| Total Tax | Rs 42,500 |

Annual Income: Rs 12 lakh

| Standard Deduction | Rs 75,000 |

| Taxable Income | Rs 11.25 lakh |

| Tax Calculation | Tax on Rs 3 lakh: Nil Tax on income Rs 3-7 lakh: 5% or Rs 20,000 Tax on Rs 7-10 lakh: 10% or Rs 30,000 Tax on Rs 10-11.25 lakh: 15% or Rs 18,750 |

| Total Tax | Rs 68,750 |

Annual Income: Rs 20 lakh

| Standard Deduction | Rs 75,000 |

| Taxable Income | Rs 19.25 lakh |

| Tax Calculation | Tax on Rs 3 lakh: Nil Tax on income Rs 3-7 lakh: 5% or Rs 20,000 Tax on Rs 7-10 lakh: 10% or Rs 30,000 Tax on Rs 10-12 lakh: 15% or Rs 30,000 Tax on Rs 12-15 lakh: 20% or Rs 60,000 Tax on Rs 15-19.25 lakh: 30% or Rs 1,27,500 |

| Total Tax | Rs 2,67,500 |

Who can Claim a Standard Deduction?

The standard deduction can be claimed by individuals receiving salary and pension, excluding business owners. For the following cases, the standard deduction will not be applicable:-

- Freelancers, business owners, and professionals cannot claim this deduction.

- Family pension (received by legal heirs of a deceased pensioner) is taxed under the head “Income from Other Sources“, not “Salaries.”

- If a person has income only from rental income, capital gains, interest, or business, they cannot claim the standard deduction.

Reflection in ITR Forms

ITR-1 (Sahaj)

This Form is used by individuals with income from salaries, one house property, or other sources (e.g., interest) up to Rs. 50 lakh. In ITR-1, the gross salary is reported, and the standard deduction of Rs. 75,000 (new regime) or Rs. 50,000 (old regime) is subtracted to compute taxable salary.

ITR-2

The Form ITR-2 is applicable for Individual and Hindu Undivided Family (HUF) with more complex income sources (e.g., capital gains, multiple properties) or no business income. Similar to ITR-1, the standard deduction is entered under “Income from Salaries” by reducing the gross salary by Rs. 75,000 under new regime or Rs. 50,000 under old regime.

FAQs

- Is Standard Deduction available on other Heads of Income?

No, Standard deduction is only available from salary & pension income and not from Income from other sources.

- Does Standard deduction apply for Payments of annuity from Insurance Companies?

No, it does not apply to Payments of annuity from Insurance Companies, since they are taxed under the head Income from Other sources.

- What if I switch jobs mid-year?

The standard deduction under new regime Rs. 75,000 or Rs. 50,000 under old regime applies for the year, regardless of job changes.

Employers can adjust TDS based on the salary paid during employment.

If the total deduction is not fully accounted for by employers, you can claim the balance while filing ITR using Form 16 from all employers. - What is rebate under Section 87A?

Rebate is a tax relief provided to the Tax Payers whose Annual Income is up to Rs. 7 lakh under the new tax regime and up to Rs. 5 lakh under the old regime for FY 2024-2025.

- How is Rebate different from Standard Deduction?

Standard Deduction is a deduction on income earned. On the other hand Tax rebate is claimed from the total amount of tax payable.

- Does the standard deduction apply to part-year employment?

Yes, the deduction is not prorated. Even for part-year employment, the full standard deduction can be claimed under new regime or under old regime.