EasyOFFICE - The Software for CA's &Tax Professionals

The Need for Income Tax Software for Tax Professionals

Tax professionals, including Chartered Accountants (CAs) and tax consultants, play a critical role in managing the tax compliance and financial planning of individuals and businesses. Given the complexity of the Indian tax system, the demand for efficient, accurate, and reliable tax filing solutions is high. Here's why specialized Income Tax Software is essential for tax professionals:

1. Complex Tax Regulations

2. Efficient Handling of Large Volumes of Data

3. Accuracy &Error Reduction

4. Time Management

5. Comprehensive Client Management

6. Integration and Data Import

7. E-Filing Capabilities

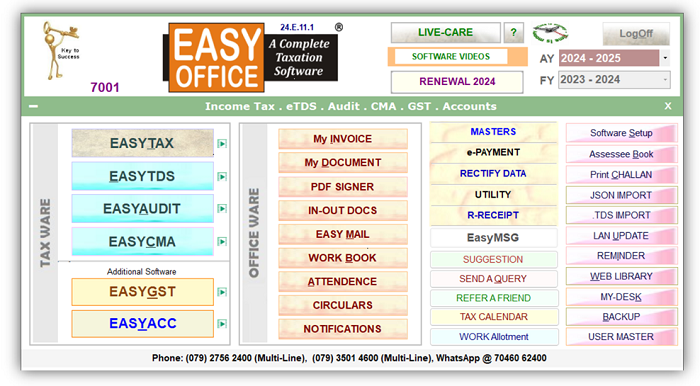

8. Online Data Activities

When it comes to managing the complexities of income tax, Chartered Accountants (CAs) and Tax Professionals need a reliable and efficient software solution. EasyOFFICE Software has emerged as the Best Income Tax Softwarein India, trusted by thousands of CA's, Tax Professionals and Corporates nationwide. Developed by Electrocom Software Pvt. Ltd, EasyOFFICE and its suite of software solutions, including EasyGST, are designed to revolutionize the entire taxation process, offering unmatched accuracy, automation, and user-friendly operations.

Why EasyOFFICE is the Best Income Tax Software for Tax Professionals?

Comprehensive Taxation Management Software: EasyOFFICE Software is not just another Tax software; it's a complete Taxation Software solution that integrates multiple modules including Income Tax, TDS, Audit, CMA Data and Office Management Utilities. This all-in-one approach enables Tax professionals to handle various aspects of taxation from a single platform, streamlining their workflow and improving efficiency.

How EasyOFFICE Software is Useful for Tax Professionals

EasyOFFICE Software, is a comprehensive solution tailored to meet the needs of Chartered Accountants and Tax professionals in India. It offers a range of features designed to modernize the tax preparation process, ensure compliance, and enhance overall productivity.

Here's how EasyOFFICE- Income Tax Software stands outwith following features:

1. Comprehensive Tax Modules

2. Accurate Tax Computation

3. Automatic ITR Form Selection

4. Direct E-Filing and Integration with ITD Portal

5. Data Import and Carry Forward

6. Advanced Pre-Validation Facility

7. Automation of Tax Payments

8. Comprehensive Reporting and Analysis

9. Support for Both Old and New Tax Regimes

10. Excellent Customer Support

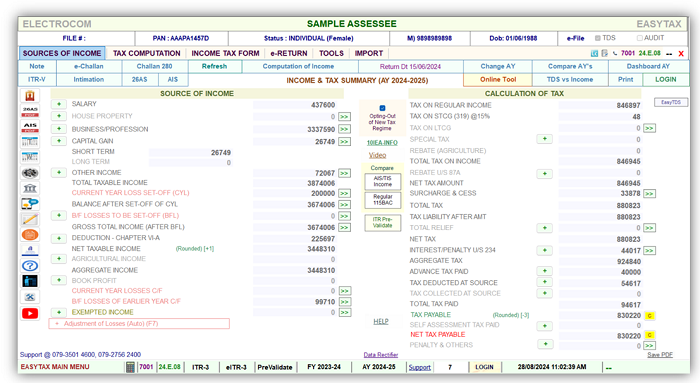

EasyOFFICE - Income Tax Return Filing > Assessee Dashboard

EasyOFFICE: India's Leading Income Tax Software - The EasyTAX module within EasyOFFICE Software is specifically designed to simplify the tax preparation process. It reduces errors, enhances accuracy, and saves valuable time. Key features include:

- Accurate Computation:EasyOffice Software facilitates the accurate computation of income, self-assessment tax, advance tax, and provisions for set-off losses. It also supports the calculation of deductions under Chapter VIA, rebates, and interest under various sections.

- ITR Generation: EasyOFFICE Software automatically selects the applicable ITR forms (1 to 7 and ITR-U) based on the user's sources of income and generates them in both paper and electronic formats. Software completes the ITR e-filingwith a click.

- Data Import & Integration: It allows the import of pre-filled JSON data directly from the Income Tax portal and facilitates seamless data integration for return preparation.

- New & Old Tax Regimes: The software supports computations for both the new and old tax regimes under section 115BAC, providing a comparative income statement for better financial planning.

· Automation & Efficiency: Automation is at the heart of EasyOFFICE's functionality. It auto-adjusts losses as per income tax provisions, auto-calculates interest under sections 234A, 234B, 234C, and 234F, and even auto-utilizes MAT/AMT credits. The software also offers the facility to prepare and e-pay tax challans (like 280, 281, 282) directly, making it a highly efficient tool for tax professionals.

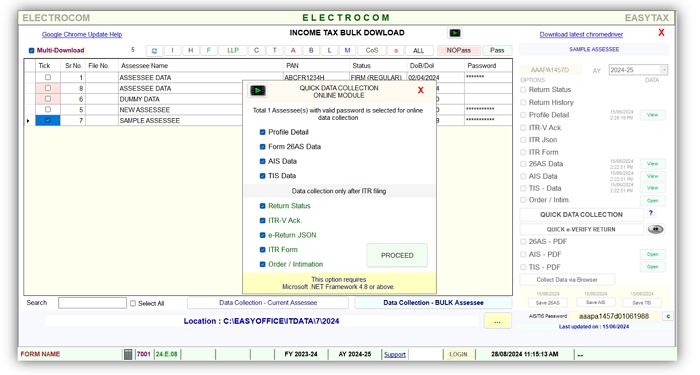

Multiple Clients bulk data download Dashboard

· Comprehensive Online Data Management: EasyOFFICE Software enables the collection and management of extensive data for multiple Assessee. This includes details like Return status, Return history, ITR form, ITR JSON, ITR-V acknowledgment, 26AS, AIS, TIS, and more. This consolidated view allows for better client management and accurate tax filing.

· Analysis & Reporting: The software is equipped with robust reporting tools that generate insightful analysis reports. These include pending returns, filed returns with dates, refund status, tax register, advance tax register, assessment book, and more. Such reports are invaluable for professionals managing multiple clients and assessment years.

· Error Identification & E-Filing: Before filing, EasyOFFICE thoroughly checks for errors, ensuring that returns are accurate and compliant with tax regulations. It also supports direct e-filing of returns on the Income Tax Department's portal, further simplifying the filing process.

What Makes EasyOFFICE the Preferred Choice for CAs and Tax Practitioners?

1. User-Friendly Operations: EasyOFFICE Software is designed with the user in mind. Its intuitive interface makes it easy for even non-tech-savvy users to navigate and utilize its features effectively. This ease of use has contributed significantly to its popularity among tax professionals.

2. Trusted by Thousands of users: With a strong reputation across India, EasyOFFICE Software has gained the trust of thousands of CAs, Tax professionals, and Corporates. Its commitment to accuracy, automation, and excellent after-sales support has made it a market leader.

3. Compliance with Regulations: Developed in accordance with the guidelines set by the Income Tax Department, Protean, and TRACES, EasyOFFICE Software ensures that all computations and filings are compliant with the latest tax regulations, reducing the risk of errors and penalties.

4. Comprehensive Support: Electrocom, the developer of EasyOFFICE Software, provides excellent after-sales support, ensuring that users have access to assistance whenever they need it. This level of support is crucial for tax professionals who need to resolve issues quickly during the busy tax filing season.

Special Price Benefit Offer for Practicing Chartered Accountants

Recognizing the critical role that Chartered Accountants play in financial compliance and advisory, EasyOFFICE Software is available at a Special Discounted Pricing benefit exclusively for Practicing CA. This offer ensures that you have access to the best Income Tax Return Filing Software without straining your budget.

Conclusion

For Chartered Accountants and Tax Professionals in India, EasyOFFICE Software is the ultimate solution for managing Income Tax computation, return filing and other taxation needs. Its comprehensive features, user-friendly design, and robust support make it the best choice for anyone looking to streamline their tax preparation process. Whether you are managing individual returns or handling complex corporate filings, EasyOFFICE Software has the tools and features you need to succeed. The Company has Special Offer for Practicing Chartered Accountants on EasyOffice Software also.

Experience the efficiency and accuracy of EasyOFFICE Software today by downloading a free trial demo.

Let EasyOFFICE - India's Leading Taxation Software; transform your Tax practice into a simplified, automated, and error-free operation.

CAclubindia

CAclubindia