Section 40A(2)(b) of the Income Tax Act pertains to the disallowance of certain expenses in case the taxpayer has failed to deduct tax at source as required by law. An "assessee" in this context refers to any entity or person that is subject to taxation under the Income Tax Act in India. This encompasses individuals, Hindu Undivided Families (HUFs), partnership firms, Limited Liability Partnerships (LLPs), companies, and other taxable entities. If the assessee is supposed to deduct tax at source from certain payments but fails to do so, the section disallows the related expenses while calculating their taxable income. This ensures that tax is appropriately deducted and paid to the government in accordance with tax regulations.

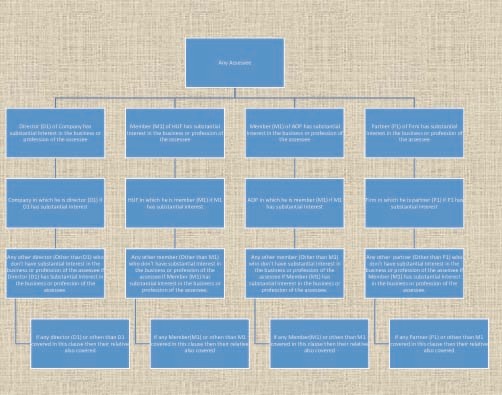

Persons Covered under 40(A)(2)(b)

- Here Only Company/AOP/HUF/Firm have substantial Interest in the assessee business or profession.

- If Company/AOP/HUF/Firm have substantial interest in the business or profession of the assessee then only Directors/Members/Partners or relatives of Directors/Members/Partners covered under this clause.

- If Assessee Incurring any transaction of expenditure nature with company 2 covered in this clause only if Company 1 has substantial Interest in the business or profession of company 2 & as well as in the assessee business or profession.

- Here Only Director/Member/Partner have substantial Interest in the assessee business or profession

- If Director/Member/Partner have substantial interest in the business or profession of the assessee then automatically Company/HUF/AOP/Firm covered under this clause.

- If Director/Member/Partner have substantial interest in the business or profession of the assessee then automatically other directors or other members or other partners covered under this clause.

- If D1/M1/P1 Don’t have substantial interest in Assessee business or profession then the Company/HUF/AOP/Firm not covered in this clause and other directors or other members or other partners also not covered under this clause.

- If Any director/partner/member mentioned cover under this clause then automatically their relatives also covered under this clause

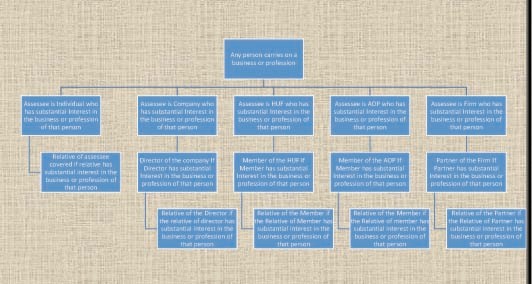

- Here Assessee as a Company/AOP/Firm/HUF has substantial interest in the business or profession of person.

- *Here Assessee as a Director/Member/Partner has substantial interest in the business or profession of person.

- Here Assessee as a Director relative/Member relative/Partner relative has substantial interest in the business or profession of person.

*For the purposes of this sub-section, a person shall be deemed to have a substantial interest in a business or profession, if,—

(a) in a case where the business or profession is carried on by a company, such person is, at any time during the previous year, the beneficial owner of shares (not being shares entitled to a fixed rate of dividend whether with or without a right to participate in profits) carrying not less than twenty per cent of the voting power; and

(b) in any other case, such person is, at any time during the previous year, beneficially entitled to not less than twenty per cent of the profits of such business or profession.

*"relative", in relation to an individual, means the husband, wife, brother or sister or any lineal ascendant or descendant of that individual

CAclubindia

CAclubindia