The Ministry of Corporate Affairs, via their announcement dated 18th December 2020, has released the Companies (Appointment and Qualification of Directors) Fifth Amendment Rules, 2020. To know all about the changes made, click here.

Section 185 lays down provisions relating to providing loans, guarantee and security to directors and other persons in whom the director is interested. Earlier the section strictly prescribed prohibitions relating to lending of loan and providing guarantee and security to its directors and other interested persons. However, later on, few exemptions and amendments to the law were introduced by the Ministry of Corporate Affairs in order to provide relaxation and improve ease of doing business.

Presently, the Section has been entirely replaced by a new section as per the amendment made via. Companies (Amendment) Act, 2017. The new section has already become applicable w.e.f. 07th May, 2018.

Sub-Section (1) provides that 'No company shall, directly or indirectly, advance any loan, including any loan represented by a book debt to, or give any guarantee or provide any security in connection with any loan taken by, -

(a) any director of company, or of a company which is its holding company or any partner or relative of any such director; or

(b) any firm in which any such director or relative is a partner.'

It implies that a company cannot provide following financial assistance whether directly or indirectly:

a) Advancing a loan;

b) Advancing a loan represented by a book debt to;

c) Give any guarantee; or

d) Provide any security

To the following persons:

i) Any director of the Company;

ii) Any director of its Holding Company;

iii) Any partner or relative of such director; or

iv) Any firm in which such director or relative is a partner.

It means that as per new section also, prohibition on a company, whether directly or indirectly, to make loan, give guarantee or provide security to any of its director, director of its holding company, any partner or relative of such director or any firm in which such director or relative still continues. However, in case of the persons in whom the director is interested, provisions have been amended to make such transactions possible for the sake of ease of doing business.

Sub-Section (2) provide that ' A company may advance any loan including any loan represented by a book debt, or give any guarantee or provide any security in connection with any loan taken by any person in whom any of the director of the company is interested, subject to the condition that -

(a) a special resolution is passed by the company in general meeting:

Provided that the explanatory statement to the notice for the relevant general meeting shall disclose the full particulars of the loans given, or guarantee given or security provided and the purpose for which the loan or guarantee or security is proposed to be utilized by the recipient of the loan or guarantee or security and any other relevant fact; and

(b) the loans are utilized by the borrowing company for its principal business activities.'

It implies that a company may provide any loan, guarantee or security to any person in whom any of the director of the company is interested.

Explanation: - The abovementioned expression ' any person in whom any of the director of the company is interested' means:

(a) any private company of which any such director is a director or member;

(b) any body corporate at a general meeting of which not less than twenty-five per cent. of the total voting power may be exercised or controlled by any such director, or by two or more such directors, together; or

(c) any body corporate, the Board of directors, managing director or manager, whereof is accustomed to act in accordance with the directions or instructions of the Board, or of any director or directors, of the lending company.

Subject to the following conditions:

i) Special Resolution is passed by the company in its General Meeting;

Provided that explanatory statement to the notice for relevant general meeting shall contain full particulars and details of the loan, guarantee or security provided, as the case may be, and the purpose for which the same is proposed to be utilized; and

ii) The loans are utilized by the borrowing company for its principal business activities.

Note: Both the abovementioned conditions are required to be fulfilled for the purpose of this sub-section.

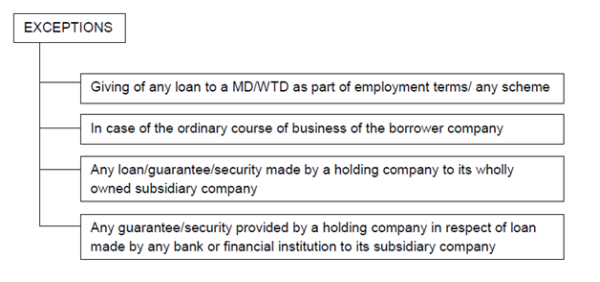

Sub-Section (3) talks about exceptions to the first two sub-sections. It provides that provisions prescribed in sub-section (1) and

(2) shall not apply to:

(a) the giving of any loan to a managing or whole-time director-

(i) as a part of the employment terms between the company and all its employees; or

(ii) pursuant to any scheme approved by the members by a special resolution; or

(b) a company which in the ordinary course of its business provides loans or gives guarantees or securities for the due repayment of any loan and in respect of such loans an interest is charged at a rate not less than the rate of prevailing yield of one year, three years, five years or ten years Government security closest to the tenor of the loan; or

(c) any loan made by a holding company to its wholly owned subsidiary company or any guarantee given or security provided by a holding company in respect of any loan made to its wholly owned subsidiary company; or

(d) any guarantee given or security provided by a holding company in respect of loan made by any bank or financial institution to its subsidiary company:

Provided that the loans made under clauses (c) and (d) are utilized by the subsidiary company for its principal business activities.

Sub-Section (4) prescribes penal provisions. It states that in case of contravention of the provisions of this section:

a) The COMPANY shall be punishable with minimum fine of Rs 5 Lac which may go upto Rs. 25 Lac;

b) Every OFFICER IN DEFAULT shall be punishable with imprisonment upto 6 months or with minimum fine of Rs. 5 lac which may go upto Rs. 25 Lac;

c) The BORROWER shall be punishable with imprisonment upto 6 months or with minimum fine of Rs. 5 Lac which may go upto Rs. 25 Lac or with both.

CONCLUSION:

In view of the latest updated provisions relating to loan to director etc., it can be concluded that a company is not allowed to advance any loan, give guarantee or provide any security in connection with a loan made, to any of its director, director of its holding company, relative or partner of such director or any firm in which such director or relative is a partner.

Further, a company may be allowed to give such financial assistance to any person in whom such director is interested if a special resolution has been duly passed in its general meeting and the loan has been proposed to be utilized for borrower company’s principal business activities.

Exceptions have been mentioned in the third subsection, which do not attract any restrictive provision of this section:

a) loan given by a company to its managing or whole time director pursuant to an employment term or a scheme,

b) loan/guarantee/ security provided by a bank or NBFC etc. in its ordinary course of business,

c) loan/guarantee/ security provided by a holding company to its wholly owned subsidiary company, or

d) guarantee or security provided by a holding company in respect of a loan made by a bank or financial institution to its subsidiary company.

Provided that the loans made under clauses (c) and (d) are utilized by the subsidiary company for its principal business activities.

The author can also be reached at: harnotiapriyanka@gmail.com

DISCLAIMER: THE ENTIRE CONTENTS OF THIS DOCUMENT HAVE BEEN PREPARED ON THE BASIS OF RELEVANT PROVISIONS. THE INFORMATION STATED ABOVE IS NOT A PROFESSIONAL ADVICE OR LEGAL OPINION. IN NO EVENT I SHALL BE LIABLE FOR ANY DIRECT, INDIRECT, SPECIAL OR INCIDENTAL DAMAGE RESULTING FROM THE USE OF THE INFORMATION.

Also read: Loans from Directors under the Companies Act 2013

CAclubindia

CAclubindia