Create Rent Receipt in few steps

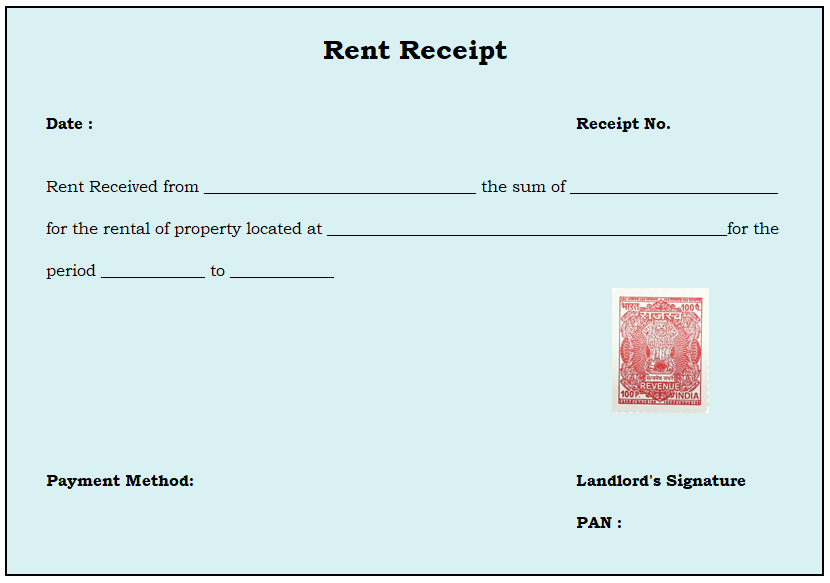

Fill all the necessary details - Name, Monthly rent amount, Address of the rented house, PAN number, period of the rent paid etc.

Then, get the rent receipt stamped & signed by landlord.

Once it been signed submit the rent receipts to your employer to claim exemption on HRA.

Table of Contents

What is a Rent Receipt?

A rent receipt is an important document provided by a landlord to a tenant as proof of payment for rent. Rent receipts serve as a record of financial transactions and are useful for both landlords and tenants to track rent payments, maintain financial records, and fulfill legal or taxation requirements.

Importance of Rent Receipts

- It provides a legally recognized proof of rent payment.

- It serves as a crucial financial record and helps landlords and tenants to maintain accurate records of rent payments.

- It helps tenants to claim rental expenses for tax purposes. These receipts serve as proof of rent payments and are required documentation for employees to avail themselves of tax deductions on HRA as part of their salary package.

- It holds landlords accountable for providing a documented record of rent transactions, promoting transparency in the landlord-tenant relationship.

- It acts as evidence in case of any disagreements or disputes related to rent payments, providing a clear trail of financial transactions.

Details required in rent receipts

The details required in rent receipts:

- The name of the tenant (person paying rent).

- The name of the landlord (property owner or manager).

- PAN of landlord.

- The specific amount paid by the tenant for rent.

- The date on which the rent payment was made.

- The duration for which the rent payment is applicable (e.g., monthly or annually).

- The complete address of the rented property.

- Revenue stamp if required.

- The signature of the landlord or an authorized manager, confirming receipt of the payment.

What is revenue stamp?

A revenue stamp is a small adhesive label serves as evidence that the required taxes or fees have been paid to the government. Revenue stamps are often affixed to documents like agreements, deeds, or receipts to indicate that the necessary financial obligations have been fulfilled.

Is a revenue stamp mandatory for rent receipts?

Affixing the revenue stamp on the rent receipts is totally depends upon the mode of payment :

| Mode of Payment | Amount | Applicability of revenue stamp |

| Cash | Cash payment more than 5000 | Yes |

| Cash | Cash payment less than 5000 | No |

| Online transfer / Cheque |

- |

No |

How tax can be saved through rent receipt?

Individuals can claim HRA exemption by providing rent receipts.

Let's check how it can be saved -

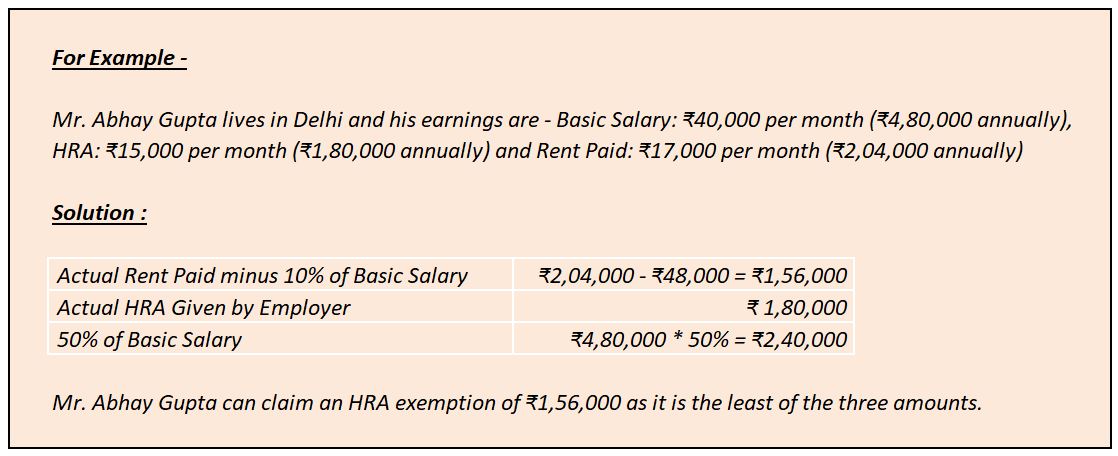

Rent receipts are necessary documents which helps to claim HRA exemptions under Section 10(13A) of the Income Tax Act. The exemption is the least of:

- Actual HRA received from the employer.

- 50% of the salary (Basic salary + DA) for metro cities or 40% of the salary (Basic salary + DA) for non-metro cities.

- Rent paid minus 10% of the salary.

Frequently Asked Questions

What to do if landlord refuses to provide a rent receipt?

If your landlord refuses to provide a rent receipt, communicate with your landlord and explain the importance of having a rent receipt for records and any applicable tax requirements.

What to do if landlord does not have a PAN?

If landlord doesn't have a PAN card and charges an annual rent exceeding Rs 1 lakh, they must furnish a written declaration and then these documents can be submitted to employer when claiming House Rent Allowance (HRA) deductions.

Do I need a rent receipt for claiming HRA benefits?

Yes, a rent receipt is required to claim HRA benefits. It can serves as proof of rent payment for taxation purposes.

CAclubindia

CAclubindia