Director's Remuneration Meaning

Director's remuneration refers to the compensation or payment that directors of a company receive for their services and responsibilities. Remuneration for directors (including managing or whole-time directors) is decided by the articles of the company or by a resolution in a general meeting.

Table of Contents

Remuneration Modes

- Directors may receive remuneration through fees for each board or committee meeting attended.

- Whole-time directors or managing directors can receive remuneration through a monthly payment or a specified percentage of net profits, not exceeding five percent.

Remuneration for Other Directors

- Directors not in whole-time employment or managing director roles may be paid monthly, quarterly, or annually.

- Alternatively, they may receive remuneration by way of commission, subject to special resolution and certain limits on net profits.

Limits on Remuneration

Public Company

The limits on remuneration for directors in a Public Limited Company having Adequate profits are :

| Category | Limit of Remuneration |

| Single Managerial Person | If a company has only one managerial person (managing director, whole-time director, or manager), the maximum remuneration payable is 5% of the net profits of the company. |

| Multiple Managers | In the case of a company with more than one managing director, whole-time director, or manager, the maximum combined remuneration is 10% of the net profits of the company. |

| Overall Limit | The overall limit on remuneration or salary payable to all managing directors or whole-time directors, collectively, is capped at a maximum of 11% of the net profits of the company. |

The limits on remuneration for directors in a Public Limited Company having inadequate profits or having losses :

| Capital | Limit of remuneration for Managerial Person | Limit of remuneration for other directors |

| Less than 5 crores | 60 Lakhs | 12 Lakhs |

| 5 crores and above but less than 100 crores | 84 Lakhs | 17 Lakhs |

| 100 crores and above but less than 250 crores | 120 Lakhs | 24 Lakhs |

| 250 crores and above | 120 lakhs plus 0.01% of the capital in excess of Rs.250 crores | 24 Lakhs plus 0.01% of the capital in excess of Rs.250 crores |

For Private Company

Director's remuneration structure in private companies are determine through their Articles of Association. Private companies have the flexibility to determine remuneration. The Companies Act does not prescribe specific provisions regarding the remuneration of managerial personnel.

Duration of Special Resolution

- Special resolution authorizing remuneration for directors not in whole-time employment is valid for a maximum of five years.

- Renewal is possible through special resolution for further periods, but not earlier than one year from the previous resolution's effective date.

GST applicability on the Director's remuneration

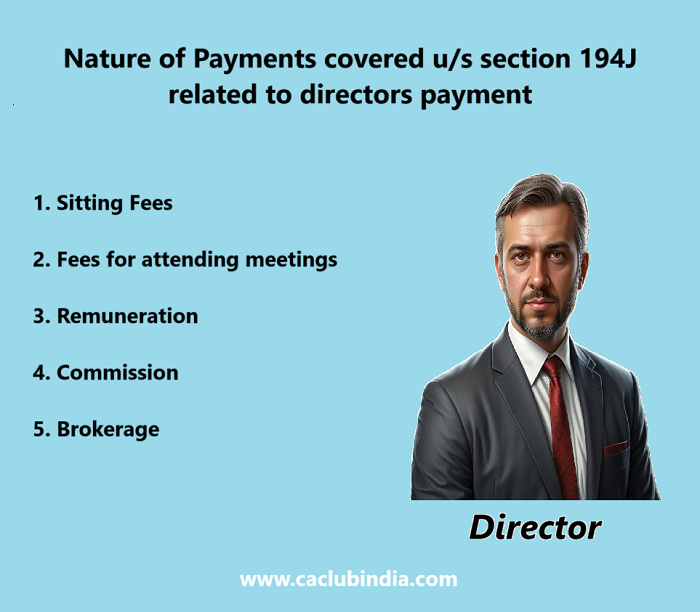

If the whole-time director are part of an employer-employee relationship, and their remuneration is subject to TDS u/s 192 of the Income Tax Act, then GST is not applicable on their remuneration [falls under the scope of Schedule III which means activities neither treated as supply of goods nor supply of services].

If the whole-time director are considered professional services even if they hold a directorial position and their remuneration is subject to TDS u/s 194J of the Income Tax Act, then GST at 18% applies under the reverse charge mechanism [not falls under the scope of Schedule III which means it is a supply].

If directors not involved in the day-to-day operations, and their remuneration is subject to under a "Contract for Service" relationship and TDS is deducted u/s 194J of the Income Tax Act, then GST at 18% applies under the reverse charge mechanism.

CAclubindia

CAclubindia