GST authority had issued various notifications since GST had been introduced in India. Many of the notifications provided much needed relief, clarification etc. Notification 20/2017 (Central Tax Rate) appears to be one such notification vide which GST authority tried to bring more flexibility in GST regime. However, did it bring the flexibility in the GST regime or it made the regime even more complicated? To find out the answer all you need to do is, sit back, relax & enjoy the write-up!

Just before the introduction of GST Law in India, on 28th June 2017, GST authority had issued Notification no. 11/2017 (Central Tax Rate). Relevant entry of the same specifies, rate of GTA service is 2.5% (5% IGST) with condition that, the service provider (GTA) is not allowed to take Input Tax Credit (ITC):-

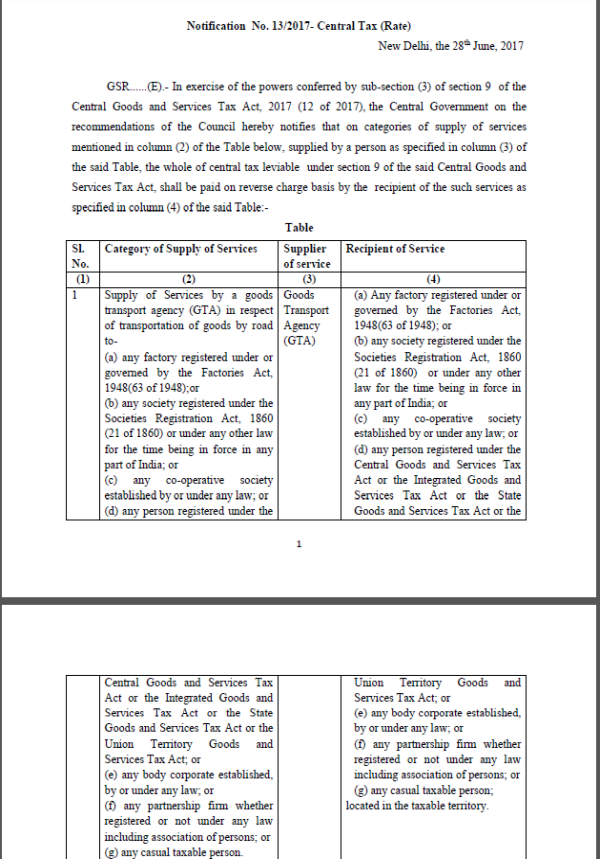

On the same day, notification no. 13/2017(Central Tax Rate) came up with the list of services to be covered u/s 9(3) of CGST Act or services to be covered under Reverse Charge Mechanism (RCM). Relevant entry of the said notification states GTA service provided by the GTAs to business entity etc. to be paid by the recipient as follows:-

However, GTA service provided by the service provider to the individual is not covered under RCM as per the above notification. So GTAs are still required to pay GST on the GTA service extended by them to the individuals and the said tax was required to be paid in cash due to notification number 11/2017 (Central Tax Rate) which does not allow ITC to GTA service providers.

It appears that, to come up with a resolution, GST authority had further issued notification number 20/2017 (central tax rate) on 22nd August 2017 which amends the earlier notification no. 11/2017 (central tax rate) & gives option to the GTAs vide relevant entry to extend the facility of Input Tax Credit scheme to the GTAs, by making the GST rate @6% (12% IGST). However, It is pertinent to note that, notification number 20/2017 (central tax rate) does not amend notification number 13/2017 (Central Tax Rate), which mandates RCM for GTA service at the hand of business entities.

Notification number 20/2017 (central tax rate) states,

'... the Central Government, on the recommendations of the Council, and on being satisfied that it is necessary in the public interest so to do, hereby makes the following amendments in the notification of the Government of India, in the Ministry of Finance (Department of Revenue), No. 11/2017- Central Tax (Rate), dated the 28thJune, 2017…”

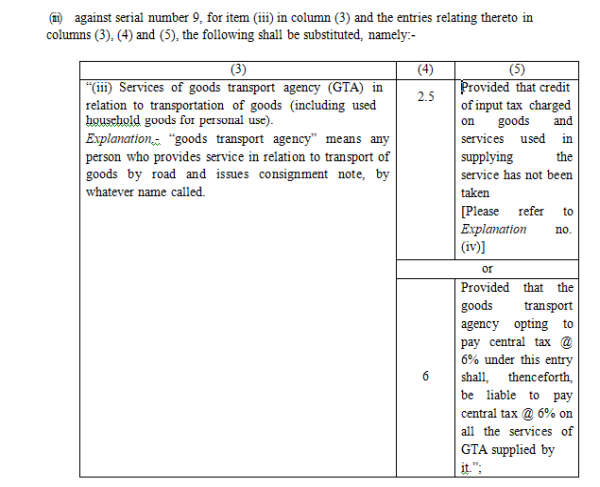

In addition, following entry of the said notification states as follows:-

From the above it appears that, the intention of the notification was to give an option to remove RCM for GTA service& to provide GTAs an option to utilize ITC for the purpose of payment of GST on all the services provided by it by making the rate of GST at 6% (12% IGST) as oppose to 2.5% (5% IGST) earlier. However, this or any other notification does not change the applicability of notification number 13/2017 (Central Tax Rate), which stipulates RCM payment of GST at the hand of business entity on the GTA services received.

So, basically the RCM on GTA services received by business entity is still effective, even after notification number 20/2017 (Central Tax Rate), as the said notification states to pay Tax @6% (12% IGST) by the GTA, whereas it doesn't state that, if the business recipient still needs to pay the tax or not.

Due to this anomaly, on a same GTA service:-

- Business entity will bound to pay tax on GTA service by virtue of notification number 13/2017 (Central Tax Rate)and take ITC on the basis of Self invoice u/s 31(3)(f) of CGST Act.

- On the other hand, GTA service provider will be forced to pay @ 6% (if opted so), as notification number, 20/2017 (Central Tax Rate) stipulates the condition to pay CGST @6% (12% IGST) on all the services. It is relevant to note that, the same will be uploaded in GSTR 1 of the GTAs, and credit of the same will automatically flow to the GSTR-2 of the recipients (business entities), by which they can avail the credit (ITC).

This essentially crates ambiguity as follows,

- The business recipient & GTA both are forced to pay tax on a single transaction. Double taxation on a single service!

- If so, whether the business entities are allowed to take both the ITC? One on the basis of the self-invoice u/s 31(3)(f) [point (a) above] and another on the basis of supplier's invoice? [point (b) above]

- If one of the above credit/ITC is denied then how far it is fair to collect double tax on a single transaction but restricting credit or ITC up to a single tax?

- Can it be challenged under article 301 of the Indian constitution or any other articles for that matter?

- The problem is more serious, if the supplier of GTA service is from other state. There might be a possibility that on a same supply, supplier will charge IGST (as inter state), whereas on the self-invoice it has to be CGST & SGST by the logic of GSTIN of the invoicing party & the recipient party comes under the same state.

Due to this, it appears that, GTAs who had opted to pay @6% started facing the problem as business entities are having reservation on the same. Large business entities may consider payment to the extent of value of GTA service to the GTAs and pay GST on the same directly to GST authority based on self-invoice & take credit. Whereas, GTAs are claiming reimbursement of the 6% GST (or 12% IGST) as it is a statutory payment which GST law mandates to pay.

To make it interesting let's take an example of Mr. Ram who is a GTA entity & Mr. Sham who is business entity. Earlier Ram was raising invoice value of Rs 1,00,000 for the GTA service provided by him to Sham & Sham was paying 2.5% (5% IGST) on it for Rs 5,000/- and was taking credit based on self-invoice raised by him. Also Sham was reimbursing the value of the service to the extent of Rs 1,00,000 to Mr. Ram as below:-

|

Particular |

Rs |

|

Value of Service |

1,00,000 |

|

GST(to be paid under RCM) |

5,000 |

|

Total reimbursement/payment |

1,00,000 |

After notification number, 20/2017 (Central Tax Rate), Mr. Ram had opted for paying 6% (12% IGST), and raised invoice for the supply made by him to Sham as below:-

|

Particular |

Rs |

|

Value of Service |

1,00,000 |

|

GST |

12,000 |

|

Total |

1,12,000 |

Here is what may happen,

- Sham(GTA) pays tax @ 12% = 12,000

- Ram (Business Entity) also pays tax @12% (RCM) = 12,000

- Ram takes credit of the tax paid as mentioned in point (2)

- Sham therefore not likely to pay tax amount once again to Ram (as it causes double payment)

- Ram may not get reimbursement of the amount, which is statutory in nature.

- Due to this Ram may incur loss of Rs 12,000/-

It is very surprising that, even after 8 months after this notification GST authority is yet to issue any further clarification, notification etc. to put an end to this anomaly. Is it high time GST authority should issue such clarification?

The author can also be reached at cp171185@gmail.com

Disclaimer: The contents of this document are solely for informational purpose & personal view. It does not constitute professional advice or a formal recommendation. It is also not meant to portray anything against the GST law or any other law of the land for that matter. While due care has been taken in preparing the document, the existence of mistakes & omissions herein are not ruled out. The author does not accept any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied without express written permission of the author.

CAclubindia

CAclubindia