Section 35A of Banking Regulation Act, 1949 gives power to RBI to give directions to Banking Companies or Banking Company, as the case may be. The Banking companies or banking company, bound to comply with the directions of RBI issued under section 35A of Banking Regulation Act, 1949.

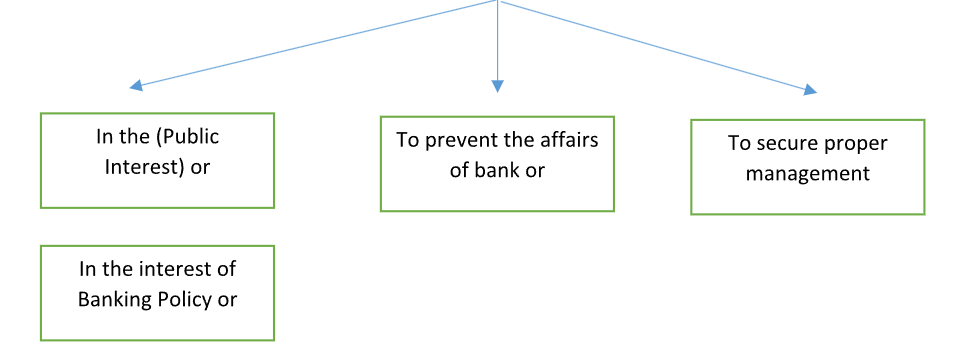

(1) Where the RBI is satisfied on the following it can issue directions:-

Act, gives powers to RBI if it is satisfied on:

(a) It is in the public interest to issue the directions i.e. If as on date RBI will not issue any directions this will surely harm the public interest. In these types of situations Act allows RBI to issue guidelines to any banking companies or banking company, as the case may be or,

(aa) Direction is required to safeguard the interest of the banking policy or,

(b) RBI is satisfied that the way such banking company is handling his business affairs , these are detrimental to the interests of depositors or in a manner prejudicial to the interests of the banking company , Act allows RBI to issue directions or ,

(c) To secure the proper management of any banking company generally.

Time to time RBI issue such directions based upon the reasons as stated above and banking companies or banking company are bound to comply with such directions.

(2) Act also specified, when any representation made to the RBI or RBI on its own motion, can modify or cancel any direction issued under sub-section (1) of section 35A and RBI can impose any conditions while modifying or cancelling any directions and such conditions will be applicable subject to such modification or cancellation of direction.

On 10th October 2023, RBI has issued a direction to the Bank of Baroda (BOB). BOB has a mobile application called as "bob world". Customers use this mobile application for banking services. RBI has noticed some serious supervisory deficiencies on the process of onboarding of customers on the bob world. In this direction, RBI has directed the Bank of Baroda to suspend the onboarding of customers on the bob world application before the removal of deficiencies and strengthening the process of onboarding of customers on bob world to the satisfaction of the RBI. RBI has also directed to the Bank of Baroda that its existing customers who are already on this mobile application don't face any disruption on account of this suspension.

On this direction, BOB has taken corrective actions so that the process of onboarding new customers on bob world could start as soon as possible and assured his existing customers that no one will feel disruptive due to this. There will be no problem in the usage of any banking services or application.

CAclubindia

CAclubindia