EXPENDITURE AUDIT (M 99,M 07)(N 01,N 03,N 06)(N 11)

Audit against Rules & Orders(M 08)

Is expenditure = in conformity with statutory provisions and financial rules and regulations

Function of audit to examine various rules, orders and regulations to see that:

≠ inconsistent with any provisions of the constitution or any law made thereunder.

(ii) ≠consistent with requirements of audit and accounts as determined by C&AG.

(iii) ≠ in conflict with the orders/rules made by any higher authority.

(iv) In case they have not been separately approved by competent authority, the issuing authority possesses the necessary rule-making power.

Audit of Sanctions

Is each item of expenditure is covered by a sanction, either general or special, accorded by the competent authority, authorising such expenditure

Audit against provision of funds (N 98)

Is there provision of funds out of which expenditure can be incurred and does it cross the same

Propriety Audit(M 06, N 11)

Check for cases of improper, avoidable, or in fructuous expenditure even though the expenditure has been incurred in conformity with the existing rules and regulations

Look into wisdom, faithfulness and economy of transactions being incurred by employees Are they acting with due care as if it was one s own enterprise

Focus points for Proprietary Audit

(1) Expenditure ≠ more than that justified by occasion. Public money should be spent by the officers as of his own with utmost diligence and care.

(2) No expenditure to be sanctioned that brings pecuniary gains directly or indirectly.

(3) Public moneys ≠utilised for the benefit of a particular person or section of the community unless:

Amount = insignificant; or

(ii) a claim for the amount could be enforced in a Court of law; or

(iii) expenditure = as per a recognised policy or custom; and

(iv) Regulate the quantum of allowances, such as travelling allowances, so that they do not become a source of profit to the recipients.

(4) Ensure that no profiteering by the authority or that the expenditure is in the nature of compensating.

(5)Wastages are avoided in expenditure. Benefits of expenditure > Cost of administering

(6) Ensure that it flows to the intended beneficiary without corruption.

(7) Ensure optimum, enduring benefits instead of mere frittering away the public money on meeting day to day needs repeatedly.

Performance Audit (M 98,M 00)

EEE - Efficiency, economy and effectiveness audit

Efficiency audit Are schemes/projects executed and their operations conducted economically Are we getting the expected results

Economy audit Has the entity has acquired the financial, human and physical resources in an economical manner Has the sanctioning and spending authorities observed economy

Effectiveness audit - Appraisal of the performance of programmes, projects in relation to overall targeted objectives as well as how efficient are the means adopted to attain these

Procedure = Identification of topic, preliminary study, planning and execution of audit, and reporting

Extent of coverage = function (statutory limitations, and the organisational constraints of C & AG)

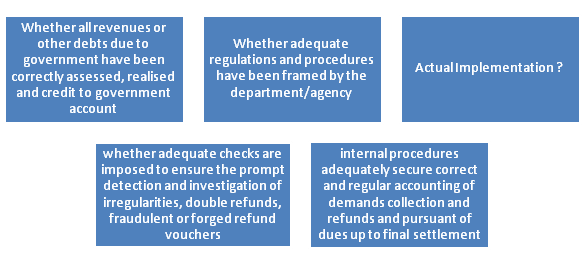

Audit of Receipts

Audit of Stores and Stocks

Whether Regulations governing purchase, receipt, and issue, custody, sale and stock taking of stores are well - devised and properly carried out.Bring to govt s notice any deficiencies in quantities of stores held or any defects in the system of control.

Audit of Commercial Accounts(M 05)

Commercial accounts must maintained by public enterprises

|

Entity |

Mode of Audit |

|

Governmental departmental enterprises engaged in commercial and trading operations (defence factories, mints, etc.) |

same manner as any Government department |

|

Statutory corporations created by specific statues (LIC, Indian Airlines etc.) |

Audit of statutory corporations depends on the nature of the statute governing the corporation. |

|

Government companies, set up under the Companies Act, 1956. (SAIL, Coal India etc) |

Companies Act, 1956 |

CAG has the power u/s 619 of the Companies Act, 1956

i) to appoint the statutory auditor of a Government

ii) to direct the manner in which the company s accounts shall be audited by the auditor, and to give the auditor instructions in this regard

iii) to conduct a supplementary or test audit of the company s accounts by authorising a person and ensuring access to records to such person

The statutory auditor shall submit a copy of his audit report to the CAG, who shall have the right to comment upon or supplement the audit report (if required)

CAG s comments upon or its supplement to the audit report shall be placed before the company, at the same time, and in the same manner, as the audit report.

Audit of a Government company = 2 layered (by the statutory auditors (CAs) and CAG).

CAG audit framework = based on principles of government audit and commercial audit

The concepts of autonomy and accountability of the institution / bodies / corporations / companies have influenced the nature and scope of audit in applying the conventional audit from the angle of economy, efficiency and effectiveness.

Describe the salient features of Financial Administration of Local Bodies.

(i) Budgetary Procedure:

a) Aims at financial accountability, control of expenditure, and to ensure that funds are raised/spent as per rules/regulations and within the limits of sanction and authorisation by law/Council.

b) Focus on how to determine the level of taxation, fees, rates, and laying down the ceiling on expenditure, under revenue and capital heads.

(ii) Expenditure Control:

At the State and Central level, there is a clear demarcation between the legislature and executive.

In the local body, legislative powers are vested in the Council whereas executive powers are delegated to the officers, e.g., Commissioners.

Executive wing handles matters of regular revenue and expenditure while legislative wing handles special situations like, reduction in property taxes, refund of security deposits, etc.

(iii) Accounting System:

Municipal Accounting System is traditionally done under cash system but migrating to accrual system recently

The accounting system is characterized by:

a) subsidiary and statistical registers for taxes, assets, cheques etc.,

b) separate vouchers for each type of transaction,

c) compulsory monthly bank reconciliation,

d) submission of summary reports on periodical basis to different authorities

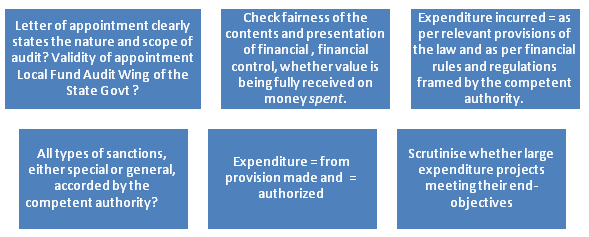

Audit Programme for Local Bodies (M 10)

Audit of Non- Governmental Organisations (NGOs) (N 02, M 04, N 10, N 07, N 05)

CAclubindia

CAclubindia