Under Companies Act, 2013, Company can raise funds via preferential allotment, employee stock option plan, sweat equity shares and right issue. Issue of Shares through preferential basis is the fastest way to raise capital. Section 62 (Allotment of Shares) and Section 42 (Allotment of Securities) of Companies Act, 2013, provides for the Issue of Shares on Preferential Basis.

What is the Preferential Issue of Shares?

The Preference Shares are those shares of the Company which are owned by the persons who have the exclusive right to receive the profits of the Company before the other ordinary shareholders of Company. Furthermore, if the Company has to close down or fails in future, the Preference Shareholders have the right to have their capital repaid. Hence, this significantly reduces the risk of loss.

A Preferential Issue is the Issue of Shares or Securities by Company to a selected group of investors. The Preferential Issue is not a Right Issue or Public Issue. The Preferential Issue of Shares is a unique method of fundraising as compared to the other methods. In Preferential Issue of Shares, the entire Allotment of Shares is made to a pre-identified person, who may be or not the existing shareholders of the Company.

Procedure of Issue of Shares on Preferential Basis

Pre-Board Meeting Requirement

- Take consent from proposed shareholders for proposed preferential issue in prescribed format along with all KYC.

- Closure of Trading Window [SEBI (PIT) Regulation 2015]

- Fix Relevant date and issue price for proposed preferential issue.

Conditions

(Relevant date should be 30 days prior to the date of EGM, if the same is falling on holiday then take one day prior to that day)

If the equity shares of the issuer have been listed on a recognised Stock Exchange for a period of twenty six weeks or more as on the relevant date, the price of the equity shares to be allotted pursuant to the preferential issue shall be not less than higher of the following:

- The average of the weekly high and low of the volume weighted average price of the related equity shares quoted on the recognised Stock Exchange during the twenty six weeks preceding the relevant date; or

- The average of the weekly high and low of the volume weighted average prices of the related equity shares quoted on a recognised stock exchange during the two weeks preceding the relevant date.

4. Conduct Board Meeting (Pre and Post Compliances)

A. Prior intimation to STOCK EXCHANGE under Regulation 29(1)(d) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015.

B. The notice for the Board Meeting should be issued as per Section 173 of the Companies Act, 2013, to all the members 7 days before the Board Meeting. The notice of the Board Meeting should hold the agenda of the Board Meeting. Main agenda's for Board Meeting can be as follows:

- Drafting of notice of EGM (decide date, time and place of EGM)

- Appointment of Scrutinizer for Evoting

- Decide for e-Voting NSDL / CDSL and apply for the same (Generate EVSN number in case of CDSL/ EVEN Number In case of NSDL for E- voting facility and ask RTA to upload Benpos data on depository site)

- Formation of Allotment Committee.

C. Send email to Stock exchange by attaching copy of Notice sent to the shareholders along with a copy of updated MOA & AOA of the company for preliminary scrutiny.

The draft resolution of the Board Meeting should also be attached with the notice.

BOARD RESOLUTION

TO APPROVE ISSUANCE OF EQUITY SHARES ON PREFERENTIAL BASIS

RESOLVED THAT pursuant to (i) the applicable provisions of Sections 23, 42, 62 and other provisions, if any, of the Companies Act, 2013, read with the Companies (Prospectus and Allotment of Securities) Rules, 2014, the Companies (Share Capital and Debentures) Rules, 2014 and such other applicable rules and regulations made thereunder (including any amendments, modifications and/ or re-enactments thereof for the time being in force) (herein after referred to as the "Companies Act"), (ii) Chapter V and the applicable provisions of the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018 (including any amendments, modifications or re-enactments thereof for the time being in force) ("SEBI ICDR Regulations"), the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (including any amendments, modifications or re-enactments thereof for the time being in force) ("SEBI Listing Regulations"), (iii) the uniform listing agreement in terms of the SEBI Listing Regulations entered into by the Company with STOCK EXCHANGE Limited ("STOCK EXCHANGE") on which the equity shares of the Company are listed, (iv) in accordance with provisions of the Memorandum and Articles of Association of the Company, as amended, and (v) any other applicable rules, regulations, guidelines, notifications, circulars and clarifications issued by the Government of India, the Ministry of Corporate Affairs ("MCA"), the Securities and Exchange Board of India ("SEBI"), or any other statutory or regulatory authority, in each case to the extent applicable and including any amendments, modifications or re-enactments thereof for the time being in force, and subject to such other approvals, permissions, sanctions and consents as may be necessary and on such terms and conditions (including any alterations, modifications, corrections, changes and variations, if any, that may be stipulated while granting such approvals, permissions, sanctions and consents as the case may be) imposed by any other regulatory authorities, and subject to the approval of members of the Company, the consent of the Board be and is hereby accorded to create, offer, issue and allot ____________ (_________-) fully paid-up equity shares of face value of Rs. _____/- (__________) each at a price of Rs. _____/- (________) per equity share, aggregating to Rs. _______/- (____________) ("Subscription Shares") on such terms and conditions as may be determined by the Board in accordance with Chapter V of the SEBI ICDR Regulations, to Mr. _________, and/or M/s. ___________ (the "Proposed Allottees"), who are not a promoter and who does not belong to the promoter(s) and the promoter group of the Company by way of preferential issue, the detailed particulars of the Proposed Allottees is set out below, in accordance with applicable law:

|

Sr. No |

Names of the Proposed Allottees |

Details of the Proposed Allottees |

No. and price of equity shares proposed to be issued and allotted |

RESOLVED FURTHER THAT the Subscription Shares being offered, issued and allotted to the Proposed Allottees by way of a preferential allotment shall inter-alia be subject to the following:

- The Subscription Shares shall be issued and allotted by the Company to the Proposed Allottees in dematerialized form within the timeline prescribed under Regulation 170 of the SEBI (ICDR) Regulations.

- The "Relevant Date" as per the SEBI ICDR Regulations, for determination of floor price of the Subscription Shares shall be ______, _______________-, being the date 30 (thirty) days prior to the date of this meeting on which this special resolution is being passed;

- The Subscription Shares shall be subject to lock-in for such period as specified under Chapter V of the SEBI ICDR Regulations;

- No partly paid-up equity shares shall be issued/ allotted;

- Allotment of equity shares shall only be made in dematerialized form;

- The Subscription Shares so offered, issued and allotted will be listed on the STOCK EXCHANGE Limited, subject to the receipt of necessary regulatory permissions and approvals as the case may be;

- The Subscription Shares allotted to the Proposed Allottees shall rank pari passu with the existing equity shares of the Company in all respects (including with respect to dividend and voting rights);

- The Proposed Allottees shall be required to bring in 100% of the consideration for the Subscription Shares on or before the date of allotment hereof.

Without prejudice to the generality of the above, the issue of the Subscription Shares shall be subject to the terms and conditions as contained in the explanatory statement under Section 102 of the Act annexed hereto, which shall be deemed to form part hereof.

RESOLVED FURTHER THAT subject to the receipt of such approvals as may be required under applicable law, the Board hereby to record the name and details of the Proposed Allottees in Form PAS-5, and issue a private placement offer cum application letter in Form PAS-4, to the Proposed Allottees inviting them to subscribe to the Subscription Shares in accordance with the provisions of the Act.

RESOLVED FURTHER THAT the Managing Director, Chief Financial Officer and Company Secretary of the Company be and is hereby authorized on behalf of the Company to do all such acts, deeds, matters and things as may, in their absolute discretion, deem necessary or desirable for such purpose and for the purpose of giving effect to this resolution, including without limitation

- to vary, modify or alter any of the relevant terms and conditions, attached to the Subscription Shares to be allotted to the Proposed Allottee for effecting any modifications, changes, variations, alterations, additions and/or deletions to the preferential issue as may be required by any regulatory or other authorities or agencies involved in or concerned with the issue of the equity shares;

- making applications to the Stock Exchanges for obtaining in-principle approvals;

- listing of shares;

- filing requisite documents with the Ministry of Corporate Affairs ("MCA") and other regulatory authorities;

- filing of requisite documents with the depositories;

- resolve and settle any questions and difficulties that may arise in the preferential offer;

- issue and allotment of the Subscription Shares; and

- to take all other steps which may be incidental, consequential, relevant or ancillary in relation to the foregoing without being required to seek any further consent or approval of the Board of the Company, and that the Board shall be deemed to have given their approval thereto expressly by the authority of this resolution, and the decision of the Board in relation to the foregoing shall be final and conclusive.

RESOLVED FURTHER THAT the Board be and is hereby authorised to delegate all or any of its powers conferred upon it by these resolutions, to Managing Director, Chief Financial Officer and Company Secretary of the Company for execution of any documents on behalf of the Company and to represent the Company before any governmental or regulatory authorities, and to appoint any professional advisors, bankers, consultants and advocates to give effect to this resolution and further to take all others steps which may be incidental, consequential, relevant or ancillary in this regard.

RESOLVED FURTHER THAT the Managing Director, Chief Financial Officer and Company Secretary of the Company be and are hereby severally authorized to do all such acts, deeds, matters and things, as they may consider necessary, expedient or desirable for giving effect to this resolution.

D. File Intimate Stock Exchange regarding outcome of the Board Meeting within 30 minutes of the closure of meeting. [Regulation 30 of SEBI (LODR) 2015]. (With Covering Letter along with following format)

|

Sr. No. |

Details |

Particulars |

|||||||||||||||||||||||||

|

a) |

Type of securities proposed to be issued |

Equity Shares |

|||||||||||||||||||||||||

|

b) |

Type of issuance |

Preferential Allotment / Preferential Issue |

|||||||||||||||||||||||||

|

c) |

Total number of securities proposed to be issued or the total amount for which the securities will be issued (approximately) |

Upto ___________ equity shares of face value of __________ at an issue price of ______________ each. Total subscription amount aggregates to approximately Rs. ________________________ |

|||||||||||||||||||||||||

|

d) |

In case of preferential issue, the listed entity shall disclose the following additional details to the Stock Exchange |

||||||||||||||||||||||||||

|

i) |

Names of the investors |

||||||||||||||||||||||||||

|

ii) |

Post allotment of securities - outcome of the subscription, issue price / allotted price, number of investors |

Outcome of the Allotment:

Issue Price: Rs______ per equity shares. The price at which the equity shares shall be issued is not lower than the floor price calculated in accordance with Regulation 164 of the ICDR Regulations. Number of lnvestors: There are Three investors who are being issued equity shares pursuant to Preferential Allotment. |

|||||||||||||||||||||||||

|

iii) |

In case of convertibles - intimation on conversion of securities or on lapse of the tenure of the instrument |

Not Applicable |

|||||||||||||||||||||||||

|

e) |

Any cancellation or termination of proposal for issuance of securities including reasons thereof |

Not Applicable |

|||||||||||||||||||||||||

E. Above stock Exchange intimation shall also be published on Website of the Company [Regulation 46of the SEBI (LODR) 2015].

F. File MGT-14 with ROC with Copy of Board Resolution. [Section 117 read with 179(3) and Companies (Prospectus and Allotment of Securities Rules) 2014]. (Point B)

G. Lock-in pre-shareholding of all proposed allottees with CDSL and/NSDL by paying their fees via companies RTA.The entire pre-preferential allotment shareholding of the allottees, if any, shall be locked-in from the relevant date up to a period of six months.

H. Following are the three steps for preferential allotment.

- In-Principle approval (Pre issue)

- Post-preferential allotment process for Listing Approval

- Trading Approval

*login on Listing Center> Listing operations> Listing Module> Select Issue type as Preferential>Sub Process> Prior/Listing/Trading.

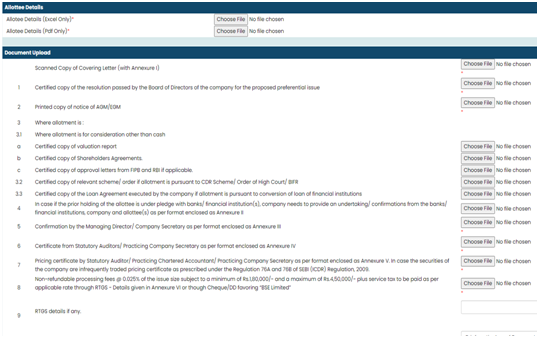

5. Application for In-Principle approval (Pre issue) with Stock Exchange

Download the checklist and formats from STOCK EXCHANGE under the download section link is mentioned below:

https://www.Stock Exchangeindia.com/static/about/downloads.aspx

Apply with all the signed documents mentioned in checklist along with following list of documents (Formats are mentioned in STOCK EXCHANGE checklist)

6. Dispatch EGM notice to shareholders via emails Approx. 25 days prior (as per Companies Act, 21 clear days plus 4 days before EGM date) – before sending emails ask RTA to upload Benposdata on NSDL/CDSL site and approve email draft and confirm to NSDL/CDSL for sending mails to all shareholders.

7. Upload the EGM Notice on STOCK EXCHANGE website along with covering letter and shall also be published on Website of the Company [Regulation 46of the SEBI (LODR) 2015].

8. Prepare draft notice of EGM for newspaper advertisementand publish the same in one English and one Vernacular newspaper and upload on STOCK EXCHANGE with covering letter and on Companies Website.

9. Opening of Separate Bank Account for every preferential allotment.

10. Decide cut-off date for E-voting in EGM notice which should be at least 7 days before EGM.

11. Receipt of In-principle prior approval before EGM.

12. Preparation for EGM - Complete the e-voting one day before EGM, Preparation of speech for EGM and conduct the EGM. Upload the proceeding of EGM within 24 hours of conclusion of EGM.

13. After EGM within 2 working days upload the E-voting result and scrutinizers report on Stock Exchange. Preparation for PAS-4 and mail the signed PAS-4 to proposed shareholders along with application letter and take signed application letter from proposed shareholders for companies record. And Prepare PAS-5 and keep it for Companies record.

14. File MGT-14 for Special resolution passed at EGM and prepare PAS-3 by entering SRN no of MGT-14 and attaching PAS-4 and PAS-5 within 15 days of EGM (Subject to receipt of In-principle approval of SEs).

15. Preferential Issue - Post Issue/ Listing Application

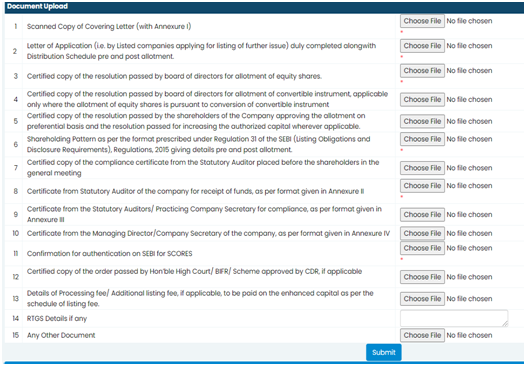

Company can use funds only after uploading PAS-3. Now start the process of Post-preferential allotment process for Listing Approval. Formats are available at https://www.Stock Exchangeindia.com/static/about/downloads.aspx - Preferential Issue - Post Issue and Listing Application form (By Listed Companies For New Original Or Further Issues). Download both the formats and submit signed copies on BSE.

16. Upload on Stock Exchange Announcement under Regulation 30 (LODR)-Allotment.

17. Upload Capital restructuring shareholding pattern on Stock Exchange. (within 10 days of capital restructuring) as per regulation 31 (1) (c) of SEBI LODR Regulations, 2015.

18. On receipt of Listing approval from Stock Exchanges end Corporate Action forms along with all the required enclosures to CDSL/NSDL through RTA.

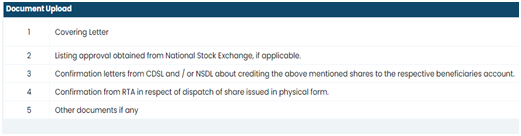

19. Trading Application

Apply for trading Approval with following attachments.

20. The specified securities allotted on a preferential basis to persons other than the promoters and promoter group and the equity shares allotted pursuant to exercise of options attached to warrants issued on preferential basis to such persons shall be locked-in for a period of one year from the date of trading approval as per Part V: Lock-In and Restrictions on Transferability, Regulation 167 of SEBI (ICDR) Regulations,2018.

Disclaimer: This article is written merely for informational purposes and it should not be taken as a legal advice. The readers are advised to consult competent professionals before acting on the basis of any information provided here.

CAclubindia

CAclubindia