PROMPT CORRECTIVE ACTION (PCA) FRAMEWORK FOR NON-BANKING FINANCIAL COMPANIES (NBFCS) (SECURITY EXCHANGE BOARD OF INDIA)

RBI issued the Prompt Corrective Action (PCA) Framework for Non-Banking Financial Companies (NBFCs). This PCA Framework for NBFCs will come into effect from October 1, 2022, based on the financial position of NBFCs on or after March 31, 2022.

A separate circular would be issued in due course with regard to applicability of PCA Framework to Government NBFCs.

In the view of growing nature of the NBFCs and other segment of the financial system, SEBI decided to put in place a PCA Framework for NBFCs to further strengthen the supervisory tools applicable to all NBFCs covering all deposit-taking NBFCs, and middle, upper, and top non-deposit taking NBFCs.

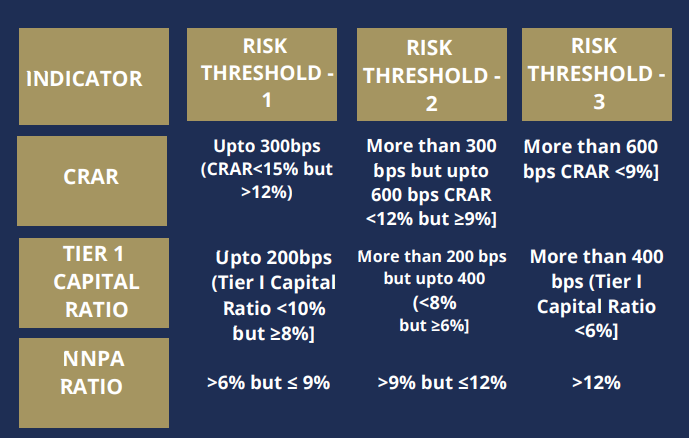

PCA framework will monitor the key areas of capital and asset quality which will be tracked down using certain indicators such as Capital to Risk Weighted Assets Ratio (CRAR), Tier I Capital Ratio and Net NPA Ratio (NNPA).

The indicators are further divided as per different risk thresholds, for instance, risk thresholds 1, 2 and 3 or NBFCs-D and NBFCs-ND (excluding CICs) as follows:

There are certain mandatory corrective actions taken by RBI which differs for each risk threshold as shown below:

Risk Threshold 1

- Restriction on dividend distribution/remittance of profits;

- Promoters/shareholders to infuse equity and reduction in leverage;

Risk Threshold 2

- In addition to mandatory actions of Threshold 1,

- Restriction on branch expansion

Risk Threshold 3

- In addition to mandatory actions of Threshold 1 & 2,

- Appropriate restrictions on capital expenditure, other than for technological upgradation within Board approved limits.

- Restrictions/reduction in variable operating costs.

Along with the mandatory actions few discretionary corrective actions are also taken by RBI. The actions will largely monitor the strategy, governance, credit risk, market risk, profitability and operation related movement as mentioned in the annex.

Once a NBFC is placed under PCA, taking the NBFC out of PCA Framework and/or withdrawal of restrictions imposed under the PCA Framework will be considered only if;

- No breaches in risk thresholds in any of the parameters are observed as per four continuous quarterly financial statements (including annual assessment).

- If an assessment on sustainability of profitability of the NBFC is found supporting from the supervisory of the RBI.

CAclubindia

CAclubindia