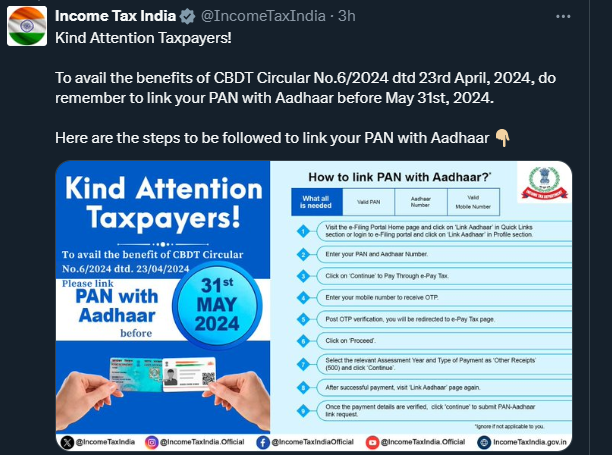

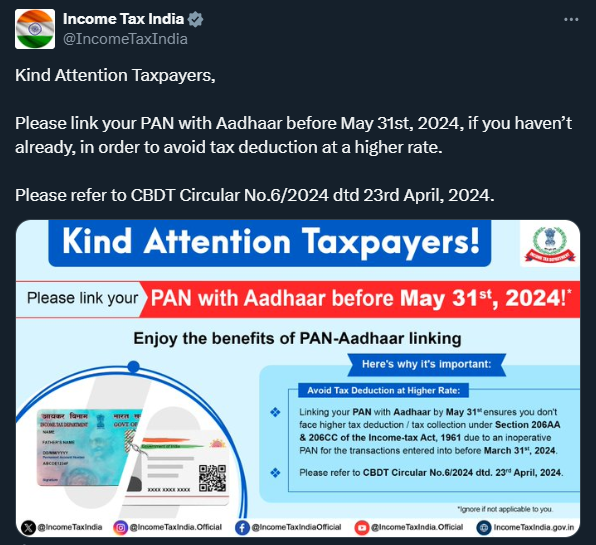

The Income Tax Department has recently issued reminder for taxpayers to link their Permanent Account Number (PAN) with Aadhaar by May 31, 2024.

IT Department shared this reminder on X (formerly Twitter)

According to the CBDT circular, for transactions done up to March 31, 2024, if the PAN becomes operative (linked with Aadhaar) by May 31, 2024, normal TDS will be applicable. This means the deductor/collector will not be liable for a penalty under sections 206AA/206CC for not deducting/collecting higher TDS.

Consequences of Not Linking Aadhaar with PAN

- PAN will become invalid if it is not linked with Aadhaar.

- If any tax refunds are due under the Income Tax Act, it will be not received.

- No interest will be paid on your refund for the period, if PAN becomes inoperative.

- Tax will be deducted at a higher rate on income where TDS is applicable.

- Tax will be collected at a higher rate on transactions where TCS is applicable.

What is PAN-Aadhaar Linking?

PAN is a ten-digit alphanumeric code issued by the Income Tax Department for tax-related identification, while Aadhaar is a twelve-digit unique identification number provided by the UIDAI to residents of India.

- Linking PAN with Aadhaar helps to prevents individuals from holding multiple PAN cards by ensuring that each PAN card is linked to a unique Aadhaar number.

- It simplifies tax filing process by pre-filling personal details and thus, reducing errors.

- It helps in creating a unified database for financial transactions and tax filings, thereby reducing tax evasion.

What was the initial deadline for linking PAN with Aadhaar?

The initial deadline for linking PAN with Aadhaar was March 31, 2022.

How many times the deadline for linking PAN with Aadhaar has been extended?

The deadline has been extended multiple times, the dates are June 30, 2022, June 30, 2023, and most recently to May 31, 2024.

What was the penalty imposed for not linking PAN with Aadhaar?

The penalty for not linking PAN with Aadhaar :

- Between July 1, 2022, and June 30, 2022, was Rs. 500.

- Between July 1, 2022, and June 30, 2023, is Rs. 1,000.

- After 30th June 2023, if PAN is not linked with Aadhaar, the PAN becomes inoperative, and the individual faces higher TDS and TCS rates, along with other financial consequences.

Click here to know how to Link PAN Card with Aadhaar Number?

CAclubindia

CAclubindia