SHORT SUMMARY:

In this Flash editorial, the author begins by referring the Impact of Companies Amendment Act, 2017 on Loan to Director and any other person in whom directors are interested.

The Bill to amend Companies Act, 2013 was passed in Rajya Sabha on 19th December, 2017. This is second Amendment Bill passed by the Parliament after notification of the Companies Act, 2013 i.e. within a span of 40 months. The Companies (Amendment) Bill, 2017 suggests 93 amendments to the Companies Act, 2013. The Bill got the assent of president on 3rd January, 2018 and become Companies Amendment Act, 2017.

New amended Section 185 (1)

• Any director of Company, or of a Company which is its Holding Company or

• Any partner or relative of any such director; or

• Any firm in which any such director or relative is partner.

Subsection 2:

Following loan can be given by company to any person in whom directors are interested after fulfilling the conditions mentioned below:

• Advance any loan, including loan represented by a book debt

• Give any guarantee

• Provide any security in connection with any loan taken

Conditions:

a) Special Resolution passed by the Company in General Meeting

b) The loans are utilized by the borrowing company for its principal business activities.

Things to be mentioned in Explanatory statement while passing of Special Resolution:

i. Full Particular of the loans given; or

ii. Guarantee given or security provided and

iii. The purpose for which the loan or guarantee or

iv. Security is proposed to be utilized by the recipient of the loan or guarantee or security and other relevant facts

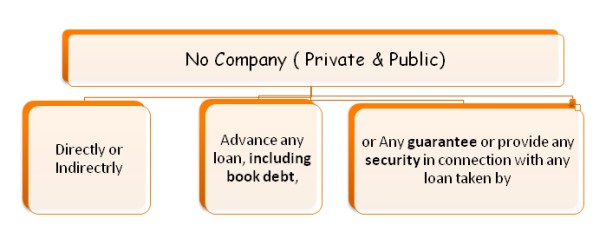

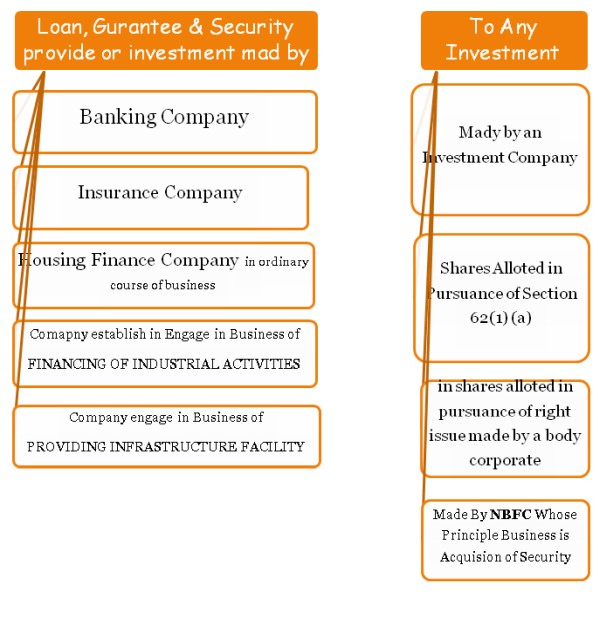

Sub-section 3: Nothing contained in sub-section (1) and (2) shall apply to -

Clause (a): Loan to Managing Director & Whole Time Director:

There are two ways to give Loan to Managing and Whole Time Director. The exception is extended to a particular class of directors, i.e. to the managing or whole-time directors only.

i. Loan can be given to a Managing or Whole-Time Director as a part of the condition of their service.

Condition: Conditions should be available for all the employees of the Company.

ii. Loan can be given to a Managing or Whole-Time Director pursuant to any Scheme.

Condition: Scheme should be approved by Shareholders by passing of Special Resolution.

Example: The Companies pass a resolution for appointment of Managing Director and it approves the terms and conditions of its appointment and if as a part of its terms, there is a loan which can be given to that director, then it falls under the exception given in section 185 of the Act.

Clause (b): Loan in Ordinary Course of Business:

A company which in the Ordinary Course of its business provides:

- Loans or

- Gives guarantees or

- Securities for the due repayment of any loan and

- In respect of such loans an interest is charged at a rate not less than the rate of prevailing yield of one year, three year, five year or ten year government security closest to the tenor of the loan; or.

Clause (c): Loan by holding Company to its wholly own subsidiary Company:

Any loan made by a Holding Company to its Wholly own Subsidiary Company or any guarantee given or security provided by a Holding Company in respect of any loan made to its wholly own subsidiary Company.

Clause (d): Guarantee and Security by holding Company to its subsidiary Company:

Any guarantee given or security provided by a Holding Company in respect of Loan made by any Bank or financial institution to its subsidiary Company.

Condition: loan made under this clause utilized by the subsidiary company for its principal business activity only.

Sub-section 4: Punishment for violation: According to sub-section 2 of Section 185 of the Act, if any loan is advanced or a guarantee or security is given or provided in contravention of the provisions of sub-section (1):

(a) The Company shall be punishable with fine which shall not be less than 5 lakh rupees but which may extend to 25 lakh rupees, and

(b) The Director Or The Other Person to whom any loan is advanced or guarantee or security is given or provided in connection with any loan taken by him or the other person, shall be punishable with imprisonment which may extend to 6 months or with fine which shall not be less than 5 lakh rupees but which may extend to 25 lakh rupees, or with both.

EFFECTO OF AMENDMENT IN THE ACT U/S 185:

As per Companies Amendment Act, 2017 following will be effects on Loan to director and person in whom director is interested:

1. Company can give loan, Guarantee, Security to person in whom director are interested after passing of special resolution in General Meeting.

Condition Company will use such money for the principle business activity of the Company.

Like: Private Company in which director is director or member. Exp. If person A is Director in Company XYZ Pvt Limited and PQR Private Limited. In such situation XYZ limited are allowed to give loan and guarantee to PQR limited after passing of special resolution.

2. Companies are still restricted to give loan, guarantee and security to.

• Any director of Company, or of a Company which is its Holding Company or

• Any partner or relative of any such director; or

• Any firm in which any such director or relative is partner.

3. The term 'any person in whom any of the director of the Company is interested' has been changed.

|

Definition as per Companies Act, 2013 |

Definition as per Companies Amendment Act, 2017 |

|

Any other director of the lending company, |

|

|

Any director of the holding company of the lending company |

|

|

Any partner or relative of such director |

|

|

Any private company of which director is a director or member |

Any private company of which director is a director or member |

|

Body Corporate in which 25% or more voting power rests with one or more directors |

Body Corporate in which 25% or more voting power rests with one or more directors |

|

Body Corporate whose Board accustomed to act on directions of BOD or Directors of lending company. |

Body Corporate whose Board accustomed to act on directions of BOD or Directors of lending company. |

New Section 186:

Subsection (1): Shall be omitted

Sub Section (2): In sub-section 2 the word 'Person' does not include any individual who is in the employment of the Company;

Sub Section (3): Where aggregate of any Loan & Guarantee or providing any security or the acquisition exceeds the limit mention in sub section 2 then no investment or loan shall be made or guarantee shall be given or security shall be provided unless previously authorized by a Special Resolution passed in the General Meeting.

Exemption to Sub Section (3):

Proviso: This sub-section 3 will not apply to:

1. Where a Loan or guarantee is given or Where security has been provided by a Company to

- Its wholly owned subsidiary Company or

-

Joint Venture Company; or

2. Where any acquisition is made by a holding Company, by way of subscription, purchase or otherwise of the securities of its wholly owned subsidiary Company,

Sub Section (11): Section 186 not applicable to followings:

CAclubindia

CAclubindia