Introduction

With the commencement of new year i.e. 2023, India will still be continuing to attract overseas foreign investors for making their investment in Start-up Indian Companies led by enthusiastic & promising founders, visionaries with their ideas. India shines with hope of safe destination for their investment due to monetary policy tightening in the US and everlasting Russia- Ukraine war.

Further Indian government has taken several initiatives to make India as the preferred destination for foreign investment by rolling out production linked incentives schemes, national logistics policy, liberalization of Foreign Direct Investment Policy, liberalizing taxation policies, global trade relations, considerably reducing compliance burden on companies and rolling out PM Gati Shakti National Master Plan.

It is remarkable to note here that India has registered its highest-ever FDI inflows of approximately $ 84.84 billion during 2021-22.

In this article, we will discuss statutory provisions as to investment by a person resident outside India in unlisted companies and compliances undertaken by an Investee Company or Indian Company.

Statutory Framework governing Foreign Direct Investment in India

- Foreign Exchange Management (Non- Debt Instruments) Rules, 2019 notified on 17th October, 2019

- Foreign Exchange Management Act, 1999 notified on 29th December, 1999

- Foreign Exchange Management ( Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019 notified on 17th October,2019.

- Consolidated Foreign Direct Investment Policy, 2020 effective from 15th October, 2020.

Definitions

Foreign Investment: As per Rule 2(s) of Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 means any investment made by a person resident outside India on a repatriable basis in equity instruments of an Indian company or to the capital of a LLP ;

For example, if a Malaysian Company invests in an Indian Company, it will be a foreign investment.

FDI or Foreign Direct Investment: As per Rule 2(r) of Foreign Exchange Management (Non- Debt Instruments) Rules, 2019 means investment through equity instruments by a person resident outside India in an unlisted Indian company; or in ten per cent or more of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company;

Note:- In case an existing investment by a person resident outside India in equity instruments of a listed Indian company falls to a level below ten percent, of the post issue paid-up equity capital on a fully diluted basis, the investment shall continue to be treated as FDI.

Fully Diluted Basis: means the total number of shares that would be outstanding if all possible sources of conversion are exercised.

Equity Instruments: As per Rule 2(k) of Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 means equity shares, convertible debentures, preference shares and share warrants issued by an Indian Company.

Equity shares: Equity shares are those issued in accordance with the provisions of the Companies Act, 2013 and will include partly paid equity shares issued on or after July 8, 2014.

Share warrants: Share warrants issued on or after July 8, 2014, will be considered as capital instruments.

Debentures: 'Debentures' means fully, compulsorily, and mandatorily convertible debentures.

Preference shares: 'Preference' shares mean fully, compulsorily and mandatorily convertible preference shares.

Indian Company: As per Rule 2(y) of Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 means a company incorporated in India.

Non-Debt Instruments: As per Rule 2(ai) of Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 means the following instruments; namely:-

- all investments in equity instruments in incorporated entities: public, private, listed, and unlisted.

- capital participation in LLP.

- all instruments of investment recognised in the FDI policy notified from time to time.

- investment in units of Alternative Investment Funds (AIFs), Real Estate Investment Trust (REITs) and Infrastructure Investment Trusts (InvIts);

- investment in units of mutual funds or Exchange-Traded Fund (ETFs) which invest more than fifty per cent in equity;

- junior-most layer (i.e., equity tranche) of securitisation structure.

- acquisition, sale or dealing directly in immovable property;

- contribution to trusts; and

- depository receipts issued against equity instruments.

Automatic route: As per Clause 2.1.4 of Consolidated FDI Policy, 2020 means the entry route through which investment by a person resident outside India does not require the prior approval of the Reserve Bank of India or the Central Government.

Government Route: means the entry route through which investment by a person resident outside India requires prior Government approval and foreign investment received under this route shall be in accordance with the conditions stipulated by the Government in its approval.

Government Approval: As per Rule 2(v) of Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 means the approval from the erstwhile Secretariat for Industrial Assistance (SIA), Department of Industrial Policy and Promotion, Government of India and/ or the erstwhile Foreign Investment Promotion Board (FIPB) and/ or any of the ministry/ department of the Government of India, as the case may be.

Routes through which an Indian Company can receive Foreign Investment

The routes under which foreign investment can be made is as under:

- Automatic Route: Foreign Investment is allowed under the automatic route without prior approval of the Government or the Reserve Bank of India, in all activities/ sectors as specified in the Schedule 1 of Foreign Exchange Management (Non-Debt Instruments) Rules, 2019.

- Government Route: Foreign investment in activities not covered under the automatic route requires prior approval of the Government.

It is pertinent to note here that if the foreign shareholding in the entity remains the same and there is no corporate action pursuant to the sector being brought under approval route, approval is not required.

Sectors in which FDI is Prohibited by Central Government and/or Reserve Bank of India

- Lottery business including Government or private lottery, online lotteries, etc.

- Gambling and betting including casinos, etc.

- Chit funds

- Nidhi company

- Trading in Transferable Development Rights

- Real estate business or construction of farm houses

Explanation: Real Estate Business shall not include development of townships, construction of residential or commercial premises, roads or bridges and Real Estate Investment Trusts (REITs) registered and regulated under the SEBI (REITs) Regulations, 2014.

- Manufacturing of cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes.

- Activities or sectors not open to private sector investment e.g. (I) Atomic energy and (II) Railway operations (other than permitted activities mentioned in paragraph (3) of Schedule I)

- Foreign technology collaborations in any form including licensing for franchise, trademark, brand name, management contract is also prohibited for lottery business and gambling and betting activities.

Statutory Provisions Governing Investments by person resident outside India

As per Rule 6(a) of Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 a person resident outside India can invest by way of subscribing, purchasing, or selling equity instruments of an Indian Company in the manner and subject to the terms and conditions specified in Schedule I.

Provided that an entity of a country, which shares land border with India or the beneficial owner of an investment into India who is situated in or is a citizen of any such country, shall invest only with the Government approval:

Provided further that, a citizen of Pakistan or an entity incorporated in Pakistan shall invest only under the Government route, in sectors or activities other than defence, space, atomic energy and such other sectors or activities prohibited for foreign investment:

Provided also that in the event of the transfer of ownership of any existing or future FDI in an entity in India, directly or indirectly, resulting in the beneficial ownership falling within the restriction or purview of the above provisos, such subsequent change in beneficial ownership shall also require government approval.

Terms and Conditions stipulated in Schedule 1 (1) of Foreign Exchange Management (Non-Debt Instruments) Rules, 2019

- An Indian company may issue equity instruments to a person resident outside India subject to entry routes, sectoral caps and attendant conditionalities prescribed in this Schedule.

- An Indian company may issue, subject to compliance with the conditions prescribed by the Central Government and/or the Reserve Bank from time to time, equity instruments to a person resident outside India, if the Indian investee company is engaged in an automatic route sector, against-

- swap of equity instruments; or

- import of capital goods or machinery or equipment (excluding second-hand machinery); or

- pre-operative or pre-incorporation expenses (including payments of rent etc.).

Provided that the Government approval shall be obtained if the Indian investee company is engaged in a sector under Government route and the applications for approval shall be made in the manner prescribed by the Central Government from time to time.

- An Indian company may issue equity shares against any funds payable by it to a person resident outside India, the remittance of which is permitted under the Act or the rules and regulations framed or directions issued thereunder or does not require prior permission of the Central Government or the Reserve Bank under the Act or the rules and regulations framed or directions issued thereunder or has been permitted by the Reserve Bank under the Act or the rules and regulations framed or directions issued thereunder:

Provided that in case where permission has been granted by the Reserve Bank for making remittance, the Indian company may issue equity shares against such remittance provided all regulatory actions with respect to the delay or contravention under the Act or the rules or the regulations framed thereunder have been completed.

- The mode of payment and other attendant conditions for remittance of sale and maturity proceeds are specified by RBI by promulgation of Foreign Exchange Management (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019.

Manner of determining fair market value of Equity Instruments for FDI purpose

Rule 21(2)(a)(ii) of Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 stipulates the mechanism for determining fair market value of equity instruments issued by an Indian Company to a person resident outside India.

|

Particulars |

Unlisted Indian Company |

|

Issue by an Indian company to person resident outside India - Price should not be less than |

The Fair Market Value (FMV) worked out as per any internationally accepted pricing methodology for valuation on an arm's length basis, duly certified by a Chartered Accountant or a SEBI registered Merchant Banker or a practicing Cost Accountant. |

It is pertinent to note here that the pricing guidelines shall stipulated in Rule 21 shall not be applicable for investment by a person resident outside India on non-repatriation basis.

Manner of Payment and Reporting Requirements for Schedule I of Foreign Exchange Management (Non-Debt Instruments) Rules, 2019

a) Mode of Payment and Remittance of Sale Proceeds is stipulated in Regulation 3.1 of Foreign Exchange Management (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019 as under

1. The amount of consideration shall be paid as:

- Inward Remittance from abroad through banking channels; or

- Funds held in NRE/FCNR(B)/ Escrow Account

It is pertinent to mention here that amount of consideration shall include issue of equity shares by an Indian Company against funds payable by it to the investor.

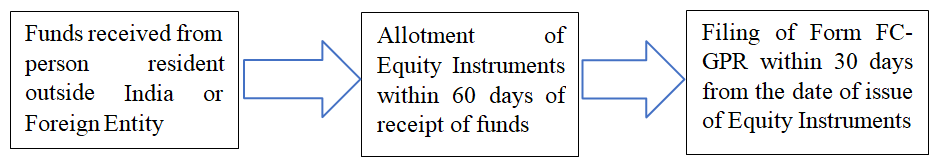

2. Equity instruments needs to be issued to a person resident outside India within 60 (sixty) days from the of receipt of consideration.

Provided that where such equity instruments are not issued within 60 (sixty) days from the date of receipt of the consideration the same shall be refunded to the person concerned by outward remittance through banking channels or by credit to his NRE/ FCNR (B) accounts, within 15 (fifteen) days from the date of completion of 60 (sixty) days.

3. Indian Company issuing equity instruments under Schedule I must open a foreign currency account with an Authorised Dealer in India in accordance with Foreign Exchange Management (Foreign currency accounts by a person resident in India) Regulations, 2016.

4. The sale proceeds (net of taxes) of the equity instruments may be remitted outside India or may be credited to the NRE/ FCNR (B) of the person concerned. (Remittance of Sale Proceeds)

b. Reporting Requirements

Regulation 4.1 of Foreign Exchange Management (Mode of Payment and Reporting of Non- Debt Instruments) Regulations, 2019 stipulates that where an Indian Company issues equity instruments to a person resident outside India and where such an issue is considered as FDI, Indian Company or Investee Company shall report such issue in Form Foreign Currency-Gross Provisional Return (FC-GPR) within 30 (thirty) days from the date of issue of equity instruments.

c. Documents to be attached with Form FC-GPR

- CS Certificate;

- Valuation Report from CA or SEBI Registered Merchant Banker;

- Board Resolution evidencing allotment of Equity Instruments;

- Press Note 3 Declaration or Land Border Declaration;

- Foreign Inward Remittance Certificate;

- KYC

- Conversion declaration (if required)

- Pre and Post Shareholding Pattern;

- Declaration by Authorised Representative of Indian Company;

- Clarification Letter, in event form gets rejected due to some reasons.

d. Penalty for Delayed Filing

Regulation 5 of Foreign Exchange Management (Mode of Payment and Reporting of Non- Debt Instruments) Regulations, 2019 stipulates that the person / entity responsible for filing the form provided above shall be liable for payment of Late Submission Fee (LSF), as may be decided by the Reserve Bank, in consultation with the Central Government, for any delays in reporting.

- RBI with a view of bringing uniformity in imposition of LSF has issued a circular having Circular No. 16 dated 30th September 2022 wherein imposition of LSF has been clearly outlined.

- Any delay in filing of FC-GPR shall result in imposition of penalty of Rs. 7,500 + (0.25%

*A*n) Where,

"n" is the number of years of delay in submission rounded-upwards to the nearest month and expressed up to 2 decimal points.

"A" is the amount involved in the delayed reporting.

- LSF amount is per return.

- Maximum LSF amount will be limited to 100 per cent of 'A' and will be rounded upwards to the nearest hundred.

- The facility for opting for LSF shall be available up to three years from the due date of reporting/ submission. The option of LSF shall also be available for delayed reporting/submissions under the Notification No. FEMA 120/2004-RB and earlier corresponding regulations, up to three years from the date of notification of Foreign Investment Management (Overseas Investment) Regulations, 2022.

The author of this article can be reached out at harsh@sarvaankassociates.com

CAclubindia

CAclubindia