For FY 2023-24 (AY 2024-25), the original ITR filing deadline is July 31, 2024, with no late fee.

If the return is filed after the due date, you may be liable to pay interest under Section 234A.

In addition to interest, there's a penalty under Section 234F for late filing. Section 234F imposes a late fee of Rs.5,000, reduced to Rs.1,000 if income is below Rs.5 lakh.

Table of Contents

- What are Financial Year (FY) and Assessment Year (AY)?

- Income Tax Filling Due dates for FY 2023-24 (AY 2024-25)

- Important of Filing Income Tax Returns on Time

- Due date to submit a tax audit report

- Due date to file ITR-U

- Additional tax for filing ITR-U

- Consequences if you missed to file ITR on time

- Advance Tax Due Dates for FY 2024-25

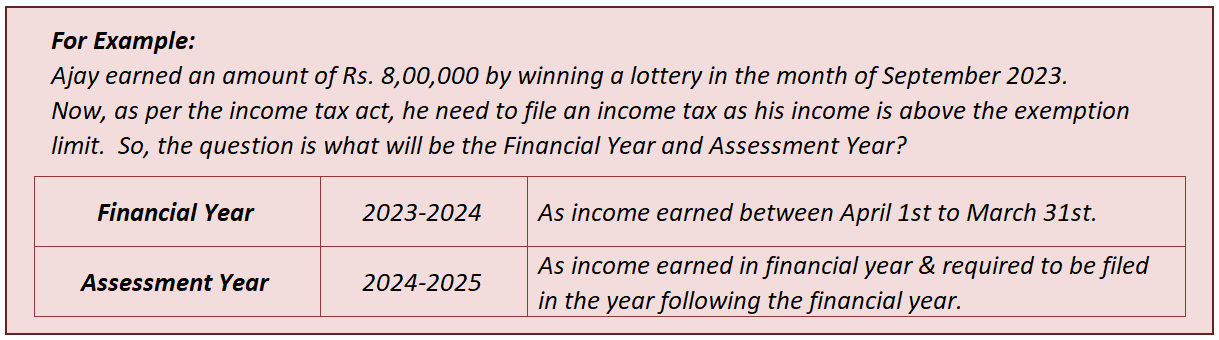

What are Financial Year (FY) and Assessment Year (AY)?

Financial Year (FY) - It's a 12-month period when a person earns income from April 1st to March 31st.

Assessment Year (AY) - It's the year immediately following the financial year, during which a person assess and pay taxes for the previous financial year.

Income Tax Filling Due dates for FY 2023-24 (AY 2024-25)

| Category of Taxpayer | Due Date |

| Individuals, HUFs, AOPs, BOIs (not subject to audit) | 31st July 2024 |

| Companies, other entities subject to tax audit, and partners in applicable firms | 31st October 2024 |

| Assesses under Section 92E requiring audit returns | 30th November 2024 |

| Revised return/Belated/late return | 31st December 2024 |

Importance of Filing Income Tax Returns on Time

Filing return timely allows individuals and entities to accurately report their income, deductions, and exemptions, ensuring compliance with tax laws.

Filing return late can result in penalties and interest charges, which increases the financial burden on taxpayers.

Due date to submit a tax audit report

The last date to submit a tax audit report for a taxpayer is September 30th of the relevant assessment year. The individual should get the book of accounts audited and obtain the audit report by this deadline.

Due date to file ITR-U

The deadline for submitting ITR-U as of any revisions or amendments to their previously filed returns are:

| Year | Due Date |

| FY 21-22 (AY 2022-23) | 31st March 2025 |

| FY 22-23 (AY 2023-24) | 31st March 2026 |

If you filed your ITR for AY 2023-24 and missed the revised/belated filing, you have until March 31, 2026, to file a belated return (ITR-U).

Additional tax for filing ITR-U

If you file the updated Income Tax Return (ITR-U):

| If filed within | Additional Tax |

| 12 months from the end of the relevant assessment year (AY) | Additional tax of 25% on the tax amount, along with interest and a late filing fee. |

| 24 months from the end of the relevant AY | Additional tax increases to 50%, along with interest and the late filing fee. |

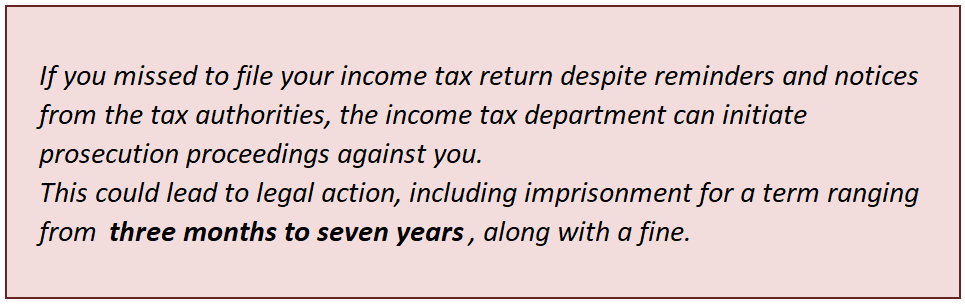

Consequences if you missed to file ITR on time

- Penalty: Depending on income, you will be required to pay a penalty under Section 234F. Section 234F imposes a late fee of Rs.5,000 for income more than 5 lakh and Rs.1,000 if income is below Rs.5 lakh.

- Interest: As per Section 234A, you will be liable to pay interest of 1% per month or part month on the unpaid tax amount.

- Delay in Refunds: If you don't file your return on time you will not receive a refund you're owed.

- Difficulty to get Loan: If return not filed financial institutions may not process loan.

- Difficulty in Loss Adjustment: One the most important consequence of missing the deadline is that if you've incurred losses like the stock market, mutual funds, businesses, etc you won't be able to offset them against your income in the subsequent year if you file a belated return.

Advance Tax Due Dates for FY 2024-25

| Due date | Compliance Type | Tax to be paid |

| 15th June 2024 | First Installment | 15% |

| 15th September 2024 | Second Installment | 45% |

| 15th December 2024 | Third Installment | 75% |

| 15th March 2025 | Fourth Installment/ For presumptive taxation scheme | 100% |

CAclubindia

CAclubindia