Input tax credit is the amount of tax paid by the dealer on purchases for which the dealer is entitled to claim a credit. The input tax credit has to be claimed by a dealer against tax invoice which can be adjusted against tax liability of the dealer. As we know that the current framework of tax structure allows limited inter-levy credits between excise duty (tax on manufacture) and service tax However, no cross credits are available across the sales tax paid (on input) or payable (on output) and these taxes. The GST will facilitate seamless credit across the entire supply chain and across all States under a common tax base.

Introduction of GST should thus rationalize tax content in product price, enhance the ability of companies to compete globally, and possibly trickle down to benefit the ultimate consumer. However, it is learnt that under the proposed GST regime, the Centre will give input tax credit (set off) only for Central GST and the States will give input tax credit only for State GST. Crossutilisation of credit between Central GST and State GST will not be allowed. Nevertheless, the dealers could claim set-off within the respective heads.

Presently, input tax credit is available under the Excise Duty and Service Tax on payment basis. However, under the State VAT, it is allowable on the basis of tax invoice, irrespective of date of payment. It is probable that tax credit under GST would be available on the payment basis. The dealers, who are presently registered under the VAT only, will have to accordingly adjust their business norms to avoid unnecessary blockage of working capital for payment of tax.

The Centre would levy and collect the Integrated Goods and Services Tax (IGST) on al inter- State supply of goods and services. There will be seamless flow of input tax credit from one State to another. Proceeds of IGST will be apportioned among the States. IGST model permits cross-utilization of credit of IGST, CGST & SGST for paying IGST unlike intra –State supply where the CGST/SGST credit can be utilized only for paying CGST/SGST respectively.IGST credit can be utilized for payment of IGST, CGST and SGST in sequence by importing dealer for supplies made by him.

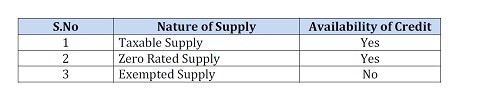

In GST, Nature of Sale/Service (i.e. taxable supplies) also determines the availability of input tax credit, which may be as under:

Any one of the following documents for availing input tax credit may be prescribed as eligible document for claiming ITC:

• The Invoice

• Payment of Tax

• Hybrid System

However to avoid leakage of GST, input tax credit might be allowed based upon e-return filed by the seller, so that the amount of tax paid by the seller is reflected in the account of the purchaser electronically.

CA MOHIT SINGHAL

CAclubindia

CAclubindia